- Accueil

- Interventions des sous-gouverneurs

- Rethinking central bank money in the dig...

Rethinking central bank money in the digital age

Intervenant

Denis Beau, First Deputy Governor of the Banque de France

Mise en ligne le 30 Septembre 2025

Meiji University of Tokyo

Tuesday 30 September 2025

Speech by Denis Beau, First Deputy Governor

Dear faculty members, doctoral researchers, ladies and gentlemen,

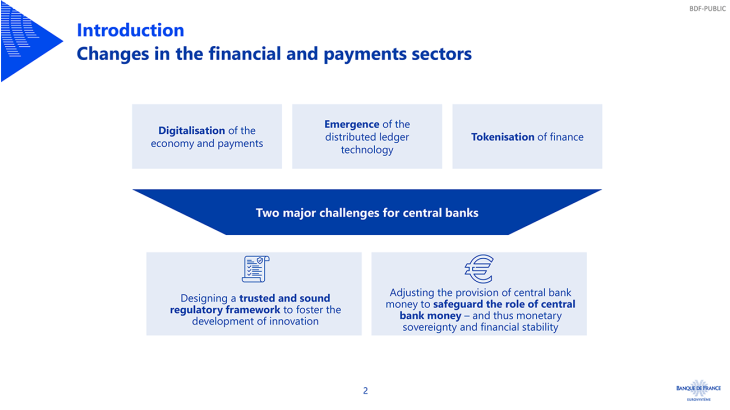

I am very pleased to be with you today to talk about the changes taking place in our payment system and the wider financial system, driven by the advancing digitalisation of financial services.

- They have already transformed payment habits, brought about the rise of crypto-assets and decentralised finance (DeFi), and opened the door to the tokenisation of finance.

These innovations open up new horizons for the functioning of our financial system. For market participants and citizens alike, they hold the promise of greater simplicity, transparency, and speed, while reducing transaction costs.

But these innovations also raise important challenges — particularly from the perspective of an institution like the Banque de France, whose core mandate includes safeguarding financial stability.

- First, if appropriate safeguards are not in place, these innovations could potentially reduce security and efficiency and affect our sovereignty over the payment ecosystem and our financial system; < /li>

- Second, they could jeopardise the role of central bank money (CeBM) as the stability anchor of our payment and financial system.

At the Banque de France, we are taking action in two key areas to address these challenges: (i) by contributing to developing a regulatory framework and to oversee its implementation so that innovation can expand within a framework of trust, and (ii) by adapting the provision of our CeBM services to safeguard its core role within the payment and financial system.

I will now outline the Banque de France’s work in these two areas to support first the ongoing tokenisation of finance and second the digitalisation of payment services.

I- Supporting the tokenisation of finance

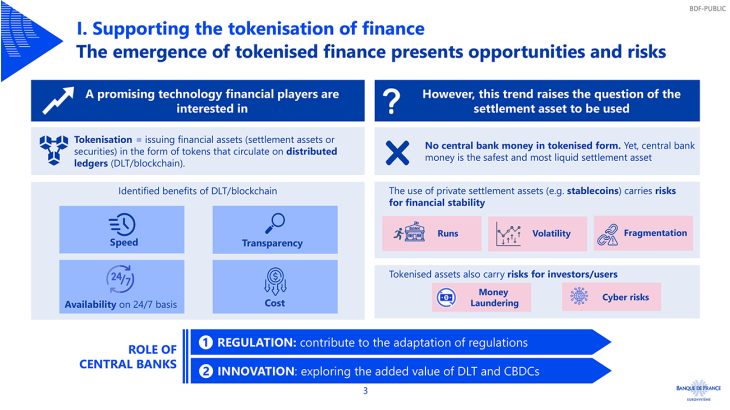

Digital technologies are significantly transforming the financial system by supporting the emergence of a wave of new participants at the interface of IT and finance, a new form of tokenised investment and settlement assets, commonly called crypto-assets and stablecoins, and new decentralised market infrastructures based on DLT, particularly blockchain.

As a result, new activities and services have emerged first in the payments sector and have been expanding since to the broader financial sphere. One of the clearest illustrations is what is commonly known as decentralised finance, or DeFi, which presents itself as an alternative to conventional finance.

These changes could have ambivalent effects on the efficiency and stability of our financial system:

- From an efficiency standpoint, they can improve transparency, ease data reconciliation, reduce costs and inefficiencies by optimising processing along the whole settlement chain thanks to smart contracts, and could shorten transaction time with 24/7 availability.

But processes could also become fragmented if blockchains are non-interoperable and unable to interact smoothly with existing central clearing, settlement and payment systems.

- From a stability perspective, despite its distributed architecture which might offer resilience benefits, the crypto ecosystem inherits many vulnerabilities from the traditional financial system — notably credit, liquidity, and market risks. In addition, unregulated stablecoin-type of crypto-assets carry their own particular dangers, starting with questions about their reliability and transparency.

At the Banque de France, we are working to help mitigate these risks while ensuring that the full benefits of tokenisation are harnessed. To that end, we are guided by two convictions:

- Confidence requires a regulatory framework that is adequate, clear, sufficiently demanding and fair;

- Central bank money must remain at the heart of settlements between intermediaries, which are the most sensitive from a systemic risk perspective.

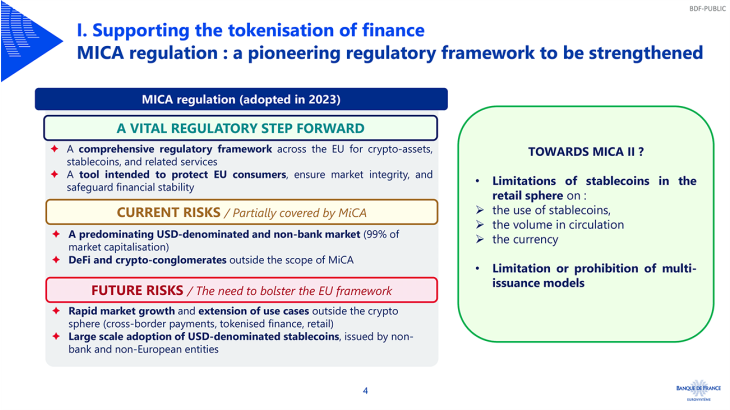

France has been a pioneer in the definition of a regulatory framework for crypto-assets with the establishment in 2019 of one of the first comprehensive regulatory frameworks for digital asset service providers (DASP) and coin offerings in Europe.

This framework has largely inspired the EU’s lawmakers. In 2023, the EU adopted its Markets in Crypto-Assets (MiCA) Regulation, a specific regulatory framework covering the issuance of crypto-assets and stablecoins and the provision of related services. MiCA’s goal is to address the major risks and provide protection to users.

While MiCA represents a vital regulatory step forward, it will need to be built on in the coming years as it does not comprehensively address all current and foreseeable risks, like those related to the concertation of services within conglomerates, the development of the DeFi-ecosystem and the large-scale adoption of USD-denominated stablecoins, which are primarily issued by non-bank and non-European entities.

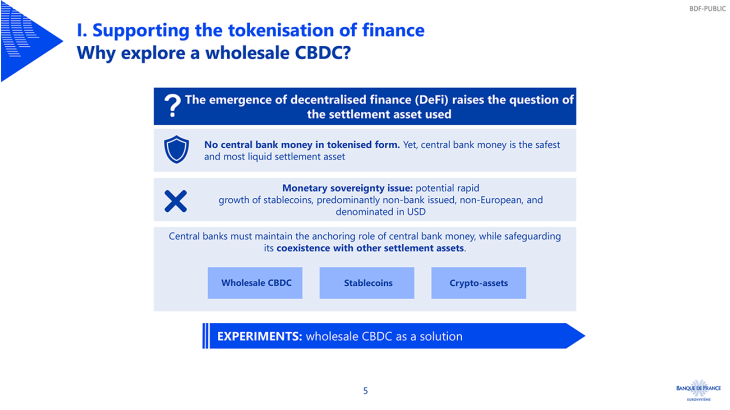

Our second conviction is that, in order to have a framework that inspires trust in the development of the tokenisation of finance, central bank money needs to be maintained as the primary settlement asset between intermediaries, which are the most sensitive in terms of systemic consequences in the event of problems.

For the time being, stablecoins are the only available settlement assets in the digital assets’ ecosystem. This is why we’ve proactively made efforts towards the provision of tokenised EUR central bank money to meet demand for safe tokenised settlement assets, building on an ambitious experimental programme on wholesale central bank digital currency (CBDC) launched in 2020. The Eurosystem also conducted exploratory work in 2024 to test three solutions for the settlement of tokenised assets in central bank money, including the DLT solution developed by the Banque de France for its own experiments, DL3S.

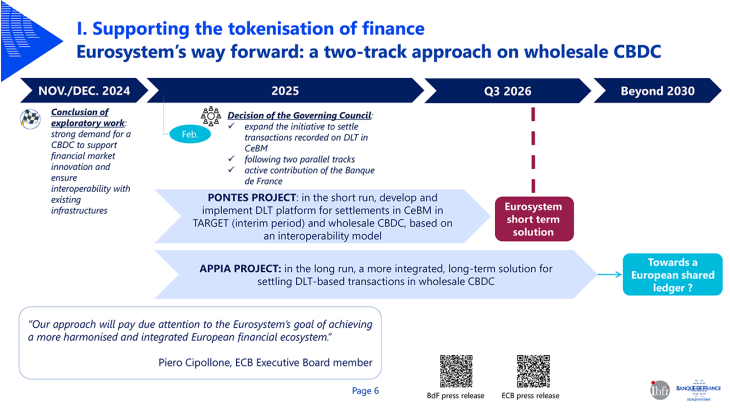

The successful outcome of those experiments led a few months ago to the Eurosystem’s decision to implement a dual-track strategy:

- Through the Pontes project, the Eurosystem will provide a wholesale CBDC by the end of 2026, offering a secure, efficient, and interoperable platform with Target services.

- Through the Appia project, the Eurosystem will explore the potential of DLT to deliver in the medium run an integrated solution for settlement, in the form of a European Shared Ledger – a single platform integrating CBDC, tokenised CoBM and tokenised financial instruments. This platform could contribute to the EU Savings and Investment Union project and the deepening of EU capital markets.

II. Supporting the digitalisation of retail payments with a digital euro

I will now move on to retail payments, also an area undergoing rapid change—and more specifically the work of the central banks of the Eurosystem, led by the ECB, on the possible introduction of a digital euro.

As our economies move further into the digital age, cash is being used less and less for everyday payments, a trend observed both in Europe and Japan. In the euro area for example, cash accounted for 52% of transactions in 2024, compared with 79% back in 2016. The rise of cashless payment instruments, such as mobile and card payments, has of course brought many benefits: payments have become simpler, faster, more convenient, and safer.

But cash has unique qualities that could be useful to everyone — and absolutely essential for some, in the digital space.

That is why the Eurosystem is preparing the launch of a digital euro which is to be, first and foremost, a “digital banknote” to preserve the availability of key characteristics of cash in the digital space. The digital euro will be a new form of central bank money, accessible and free for everyone, usable in all contexts across the entire euro area, including by those who do not own a smartphone, thanks to its legal tender status and offering strong privacy protection. Thanks to its offline functionality, the digital euro will also allow for enhanced resilience of our payment systems in the event of service disruptions (e.g. Iberian Peninsula blackout in April 2025) or natural disasters. The objective is therefore to complement the existing supply of private payment solutions for the digital economy with a public one which replicates the attributes of cash in the real, face to face, economy.

Another motivation for introducing a digital euro is related to two other major challenges for payments in Europe raised by the digitalisation of our economies:

- First, as we increasingly rely on digital payments, we are becoming more and more dependent on non-European players, such as international card networks or, more recently, Big Tech companies. These actors benefit from strong network effects that hamper competition and encourage the emergence of oligopolies.

- Second, despite harmonisation efforts, European payment solutions are still significantly fragmented and have so far struggled to challenge international players.

In this context, the digital euro should contribute to strengthening European sovereignty and foster greater integration in payments. It will do so, beyond making a public payment solution available to every citizen anywhere in the euro area, by building on the existing public-private partnership at the foundation of our monetary system. Just like cash, the digital euro will be issued by the national central banks of the Eurosystem and distributed through private intermediaries, who will continue playing their central role with users, managing accounts, providing payment instruments, and overseeing customer relationships more broadly.

In turn, these players will be able to leverage the digital euro standards and architecture to facilitate the deployment of their payment solutions and innovative services at a pan-European scale, thus overcoming the fragmentation of the European payment landscape.

In this sense, the digital euro should serve as a “platform for innovation” for private players. To that end, the ECB launched an innovation partnership with the private sector in January 2025 to (i) test innovative use cases like conditional payments and (ii) conduct research on new digital euro use cases and how they could help address societal challenges. The results of this work have just been published.

To make sure the digital euro can be easily used by all stakeholders if they so wish, we are seeking to ensure its smooth integration into the existing payment landscape.

- To this end, the Eurosystem has been engaging in close dialogue with consumer associations, merchant associations, commercial banks, and other private intermediaries — both at the European and national levels.

- And through its design, we will ensure that the digital euro poses no risk to financial stability. A holding limit will be set so that it is used strictly as a means of payment, not as an investment asset. The Eurosystem has been conducting extensive work on this topic, in partnership with market players.

While this initiative is moving forward at a steady pace, there is still a significant road ahead before people could start paying with a digital euro with the current project plan. It is unlikely to be before 2028 but the past two years have been instrumental in finalising the digital euro’s design, testing its functionalities with potential users, and selecting the service providers to develop its technical architecture. By the end of the month, the Governing Council of the ECB will decide whether to move on to a next preparatory phase of the project.

Let me stress however that no decision has yet been taken to issue a digital euro. Such a decision can only be taken once a final regulation is adopted by the European Parliament and the Member States, hopefully next year.

Conclusion

As you can see, the Banque de France and the national central banks of the Eurosystem are firmly resolved to support innovation, not only by helping to establish an appropriate regulatory framework, but also by innovating in their own right. However, the private sector has a leading role to play in bringing to the market innovations and providing safe payment solutions assets alongside the central banks’ provision of CBDC.

Our common goal should be to expand the current monetary system based on the coexistence and complementarity of central bank and commercial bank money to the digital economy, in order to ensure financial stability, security, and trust. Thus, we very much welcome the discussions and initiatives of European financial intermediaries, like those led by the EPI with its WERO service and those consisting in developing “tokenised deposits” or stablecoins in euro issued by European financial intermediaries, to maintain a broad “layer of commercial bank money-based payment solutions” for the digital space. This is essential to provide to our digital economy with a strong and efficient monetary system.

Thank you for your attention. I would be delighted to answer any questions.

Download the full publication

Mise à jour le 6 Octobre 2025