ECB publishes supervisory banking statistics on significant institutions for the third quarter of 2024

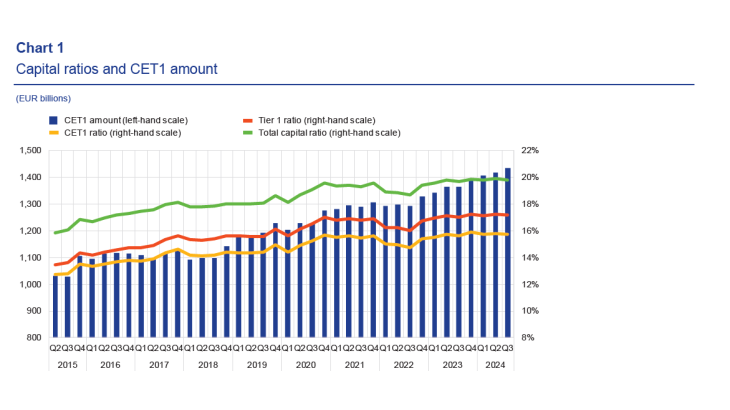

- Aggregate Common Equity Tier 1 ratio at 15.72% in third quarter of 2024, down from 15.81% in previous quarter but up from 15.61% one year ago

- Aggregated annualised return on equity at 10.22% in third quarter of 2024, up from 10.11% in previous quarter, representing second consecutive highest reported value since start of time series (second quarter of 2015)

- Aggregate non-performing loans ratio (excluding cash balances) stable at 2.31% compared with 2.30% in previous quarter and 2.27% in third quarter of 2023

- Share of loans showing significant increase in credit risk (stage 2 loans) at 9.67%, up from 9.45% in previous quarter and from 9.29% one year ago

Mise en ligne le 20 Décembre 2024