- Accueil

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of May 2...

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 28 April and 6 May), activity in April grew considerably in industry and construction, and more moderately in market services. In May, business leaders expect activity to decline in industry, market services and construction, mainly due to holidays and closures associated with the number and timing of public holidays. Order books continued to be deemed weak across all industrial sectors, with the exception of aeronautics.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 28 April and 6 May), activity in April grew considerably in industry and construction, and more moderately in market services. In May, business leaders expect activity to decline in industry, market services and construction, mainly due to holidays and closures associated with the number and timing of public holidays. Order books continued to be deemed weak across all industrial sectors, with the exception of aeronautics.

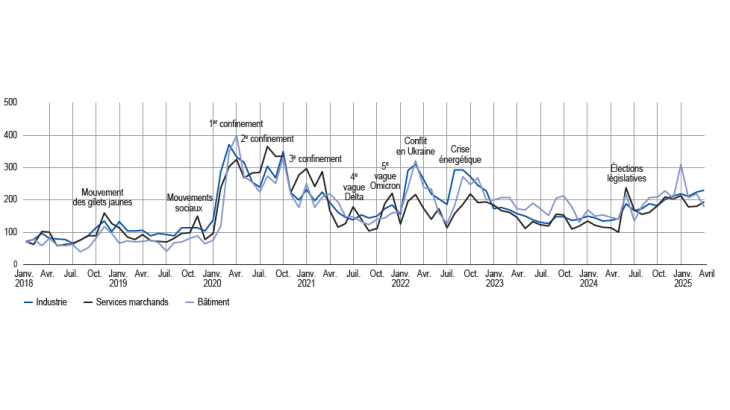

Our uncertainty indicator based on comments by surveyed companies has risen slightly in industry and market services this month but declined in construction. The significantly higher level of our indicator in industry compared with the two other major, more domestically‑focused sectors probably reflects the fact that international developments now outweigh domestic factors in terms of uncertainty.

Indeed, the business leaders surveyed specifically refer to the possible effects of increases in customs tariffs by the United States, but generally consider that their businesses are not significantly affected at this stage (with the exception of the wine sector).

Increases in raw materials prices are considered very moderate in industry and supply difficulties remained low overall, except in aeronautics. Selling prices were deemed to be stable overall in industry, slightly higher in services and lower in construction. Recruitment difficulties were broadly stable at 19%.

Based on the survey results, together with other indicators, we estimate that activity should increase slightly during the second quarter of 2025 after a 0.1% increase in the first quarter.

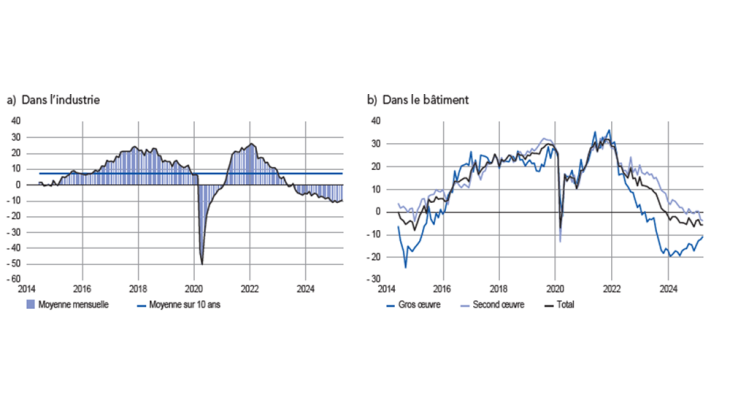

1. In April, activity grew more than expected in industry and construction, but more moderately in market services

In April, activity actually grew faster than the long‑term average for the fourth consecutive month, even though last month business leaders in industry had expected it to slow down. This growth was mainly driven by the agri‑food sector (Easter Sunday fell in April this year, whereas it fell in March in 2024), capital goods (particularly computer, electronic and optical products), pharmaceuticals and the automotive industry. Activity in the wearing apparel‑textiles‑footwear sector was down slightly. Aeronautics was almost stable in April following several months of strong growth, due mainly to the fall in the dollar, which is impacting sales to the United States, and supply chain difficulties.

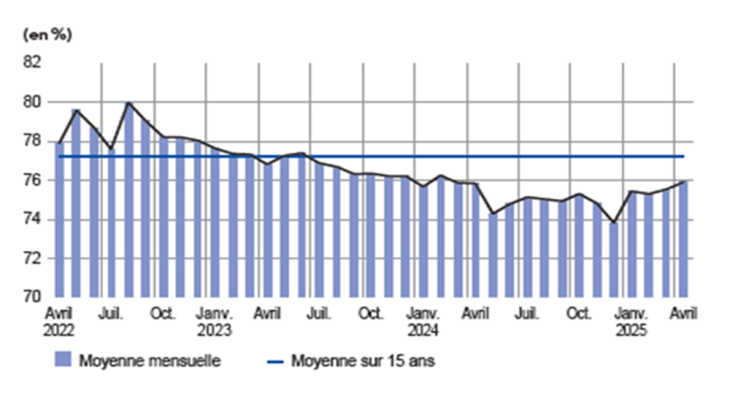

The capacity utilisation rate (CUR) for industry as a whole increased to 75.9% in April (compared with 75.6% in March), well below its long‑term average (77.2%). It grew in the automotive sector (up 2 percentage points), computer, electronic and optical products, electrical equipment and other industrial products (up 1 percentage point), but declined in aeronautics (down 1 percentage point), albeit from a relatively high level.

Capacity utilisation rate (en %)

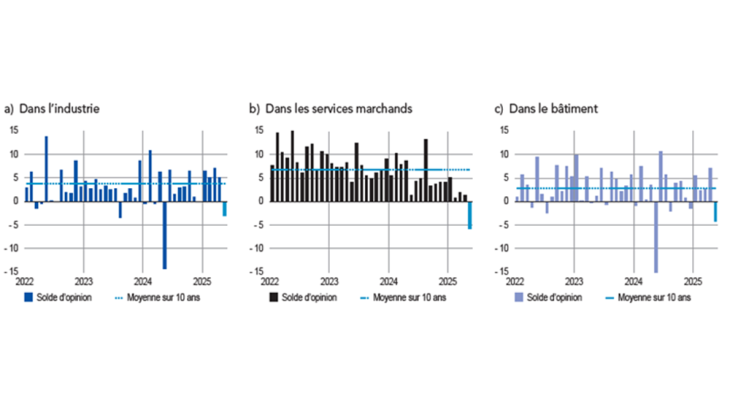

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working-day variations; forecast for May)

Inventories of finished goods were deemed stable when

compared with March. Decreases identified in the automotive,

pharmaceutical and electrical equipment sectors were offset by

increases in aeronautics and computer, electronic and optical

products. In most sectors, the balance of opinion on inventories

was above the long‑term average, with the exception of

wearing apparel‑textiles‑footwear and the automotive industry.

There was a slight increase in activity in market services as

forecast by business leaders last month. It continued to increase

in household services (accommodation and food services,

recreation activities and personal services), which benefited

from favourable weather during the Easter holidays; it also

grew in certain business services (publishing, engineering

activities and technical analyses). However, it declined in the

temporary work sector (a wait‑and‑see attitude on the part

of customers), in car rentals (low demand for commercial

vehicles), and in the programming and IT consultancy sector.

In construction, activity grew significantly, whereas business

leaders had forecast it to remain stable. It picked up in the

finishing works sector, driven by energy renovation work.

It is also grew in the structural works sector, driven mainly

by the construction of industrial buildings (aviation, energy,

defence). Projects that had been postponed this winter due

to unfavourable weather conditions were completed in April.

Business leaders in structural works also reported more

favourable credit conditions, thanks to lower interest rates.

The balance of opinion on cash positions remained slightly

negative in industry. It deteriorated chiefly in rubber and

plastic products and in the agri‑food sector but improved

in the automotive and aeronautics sectors.

In all industrial sectors, the balance of opinion remained below

its long‑term average, particularly in electrical equipment,

chemicals and in the rubber and plastic products sector.

Inventories of finished goods in industry (balance of opinion, adjusted for seasonal and working day variations)

Situation de trésorerie (solde d’opinion CVS‑CJO)

Dans les services marchands, le solde d’opinion sur la situation de trésorerie se maintient à un niveau proche de zéro, avec une forte hétérogénéité entre les sous‑secteurs. La situation de trésorerie est jugée satisfaisante dans l’édition et, dans une moindre mesure, dans la location automobile. En revanche, elle est jugée dégradée dans la publicité, l’hébergement‑restauration, la réparation automobile et le nettoyage.

2. In May, business leaders expect activity to decline across all three major sectors, mainly due to the number and timing of public holidays

In May, business leaders in industry expect activity to decline, mainly due to holidays and closures related to the timing of public holidays. It is expected to fall in wearing apparel‑textiles‑footwear, the automotive industry, wood‑paper‑printing, rubber and plastic products, metal and metal products manufacturing and the machinery and equipment sectors. However, it is forecast to increase in the agri‑food and aeronautics sectors.

Activity is also expected to decline in market services, again due to the impact of long weekends in May. It is forecast to decline once again in the motor vehicle rental segment, programming and consulting and temporary work sectors, and to trend downwards in management consulting.

In the construction sector, after a brisk month of April, activity is expected to decline in May in both structural and finishing works. Here too, holidays and closures are cited as factors impacting the forecast level of activity.

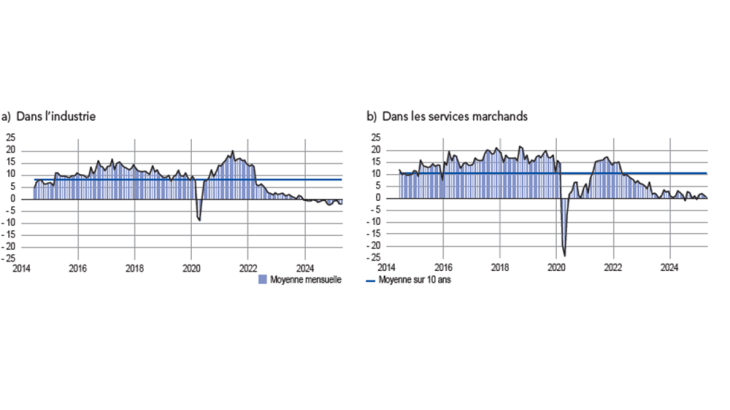

At the end of April, industrial order books were still considered weak (well below their medium‑ to long‑term averages) across all sectors apart from aerospace, where they grew considerably last month. They were especially weak in rubber and plastic products, machinery and equipment and the automotive industry. New orders fell sharply in the wearing apparel‑textiles‑footwear sector in April due to uncertainty over US customs duties, resulting in a wait‑and‑see attitude and the postponement of decisions, especially among companies in the luxury products sector.

In construction, the balance of opinion on order books deteriorated slightly in the finishing works sector but continued to recover in the structural works sector, while remaining at a very negative level.

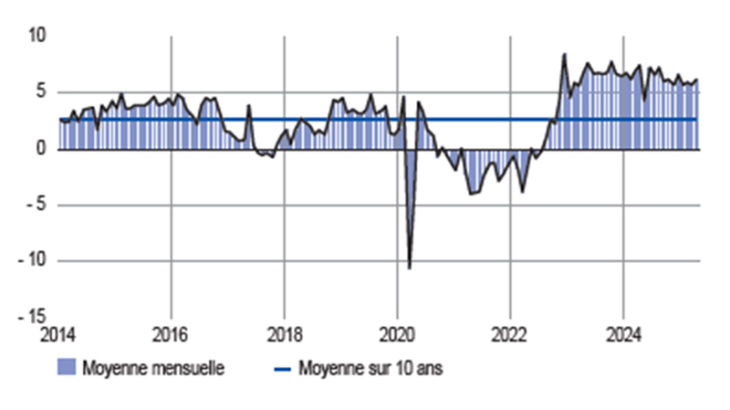

Our monthly uncertainty indicator, which is constructed from

a textual analysis of comments by surveyed companies, rose

slightly in industry and services while it continued to trend

downwards in construction. Business leaders cited customs

duties as a source of uncertainty, although they do not believe these will lead to a significant decline in their activity for the

time being, with the exception of the agri‑food industry

(wine sector). The considerably higher level of our indicator

in industry compared with services and construction probably

reflects the fact that international considerations now outweigh

domestic factors in terms of uncertainty.

Level of order (solde d’opinion CVS‑CJO)

Indicator of uncertainty in the comments section of the monthly business survey (MBS)

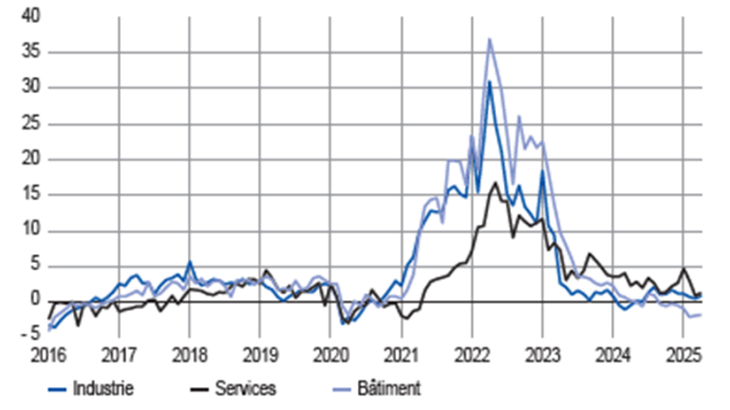

3. Selling prices – deemed stable overall in industry – rose slightly in services but fell in construction

In April, supply difficulties were generally stable compared to the previous month (10% of companies reported them, which was the same as in March). In transport equipment, the most affected sector, they rose again in aeronautics due to supply chain problems (41%, after 33% last month) and were considered stable in the automotive industry (11%). Supply difficulties continued to be rare in the construction sector (3%).

In industry, business leaders reported that raw materials prices rose very slightly; increases were reported in the agri‑food and wood‑paper‑printing sectors. Customs tariffs raised concerns about steel supplies.. The balance of opinion on finished goods prices1 remained generally close to zero: price increases in certain sectors (agri‑food, aeronautics and pharmaceuticals) were offset by decreases in others (chemicals, rubber and plastic and metal and metal products).

Change in prices of finished goods by major sector (balance of opinion, adjusted for seasonal and working day variations)

More specifically, 8% of business leaders in industry reported that they had raised their selling prices in April, close to pre‑Covid April figures and below those of 2021‑23 for the same month. Price increases were most widespread in the agri‑food sector (17%). Conversely, 5% of business leaders in industry reported cutting their selling prices, a higher proportion than in the month of April before Covid. In chemicals and metal and metal products, price decreases more than offset price increases.

In construction, the balance of opinion on price movements remained negative in April, in both structural and finishing works. 2% of business leaders reported increasing their quote prices, which was a lower proportion than that observed in April of previous years. Conversely, 18% of business leaders (8% in March 2024) said they had reduced their quote prices, a much higher proportion than in April of previous years.

In services, the balance of opinion remained very slightly positive. The proportion of companies reporting an increase in prices was 9%, well down on April figures for the last three years, and similar to pre‑Covid April figures. At the same time, the proportion of companies reporting a reduction in their prices was 4%, on a par with figures reported in April of previous years, including during the Covid period. Price rises mainly concerned accommodation, advertising, transport‑storage and vehicle repairs.

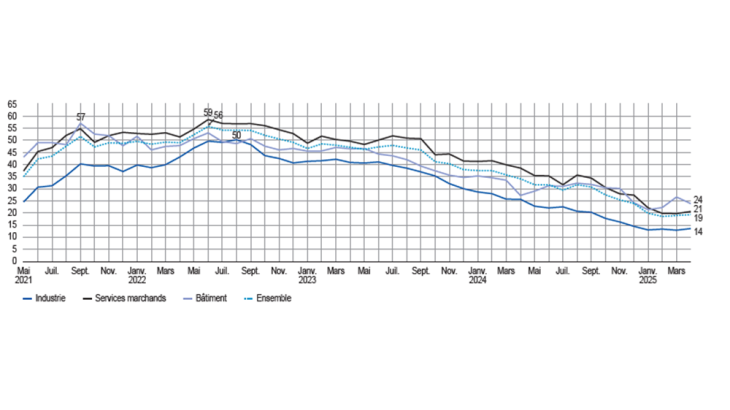

In April, 19% of business leaders reported recruitment difficulties, the same proportion as in March.

Share of businesses reporting recruitment difficulties (%, unadjusted data)

4. Our estimates suggest that GDP will edge up slightly in the second quarter

According to quarterly account first estimates published by INSEE at the end of April, GDP growth stood at 0.1% for the first quarter of 2025, slightly below our estimates in our last update on business conditions, reflecting a rebound in the manufacturing sector and more moderate growth in market and non‑market services. Activity declined in the energy and construction sectors.

Based on the results of the Banque de France monthly business survey (MBS), rounded out by other available data (INSEE production indices and surveys and high‑frequency data), we estimate that GDP should increase slightly during the second quarter of 2025. Activity should mainly be underpinned by moderate growth in value added in market services and manufacturing. Value added is expected to decline again in the construction and energy sectors.

However, this forecast is still very preliminary, due to the effect of the May public holiday dates this year and uncertainty over customs duties.

Télécharger l'intégralité de la publication

Mise à jour le 27 Mai 2025