Non-Technical Summary

Financial asset holdings vary substantially across countries and over time. However, most existing research analyses these patterns at the aggregate country level. As a result, less is known about sectoral characteristics and heterogeneity in asset holdings, and even less attention has been paid to the household sector. This leaves a relevant gap, as household decisions affect the macroeconomy and households hold a non-negligible share of total financial assets.

A key reason behind the persistence of this gap in the literature is the limited availability of detailed data on household financial investments. Outside a few countries, administrative data are generally not widely accessible in the euro area, preventing cross country comparisons. This paper contributes to the literature by developing a methodology that links two rich yet underused datasets available for euro area countries. The Security Holdings Statistics (SHS) provide detailed information on domestic and cross-border financial investments at the aggregate level, capturing how and how much the household sector invests, while the Household Finance and Consumption Survey (HFCS) collects granular information on individual household characteristics. We match country-level valuation and risk measures computed from the SHS to household portfolios in the HFCS to construct household specific return and risk figures.

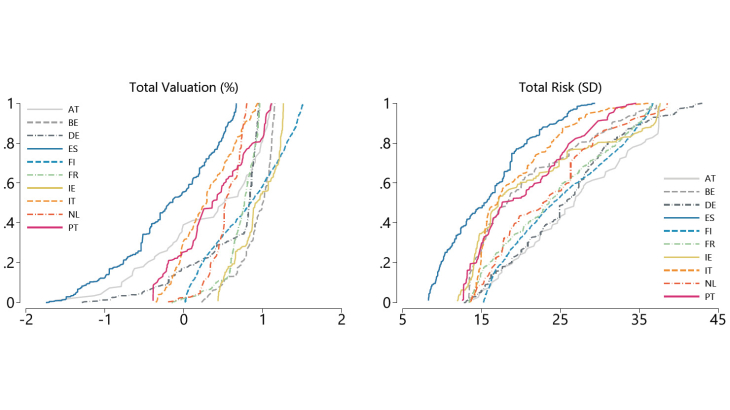

This augmented dataset allows us to study how households’ investment returns and risk exposures vary both between and within countries. To visualise the derived household-level return and risk metrics, the figure below plots the cumulative distributions of total valuation effects and risk for a sample of euro area countries. Household return-risk profiles differ substantially between countries, with some (e.g., Spain) showing low return and low risk, while others (e.g., Ireland, Finland) show both high return and high risk. Within each country, the dispersion of household outcomes also varies substantially, as highlighted by the width and shape of the CDFs. Since our analysis focuses on households holding at least two out of the three financial instruments, the results effectively describe the diversification patterns of households that participate in risky asset markets.

To illustrate the framework’s potential, we examine how education relates to investment outcomes for a panel of euro area countries between 2019 and 2022. Using descriptive comparisons between groups and panel regressions, we show that more educated households are not only more likely to experience positive investment returns but also exhibit a higher tolerance for risk. Because education is correlated with financial wealth, part of this relationship operates through wealthier households having more scope to diversify into risky assets. This aligns with established evidence that risk tolerance rises with wealth (e.g., Calvet and Sodini, 2014; Liu, Yang, Cai, 2016). These patterns may also reflect other factors, such as the presence of illiquid business wealth among some households. Interestingly, we find that differences in return and risk primarily come from portfolio composition and market price movements, rather than from exchange rate fluctuations.

The broader implications extend beyond this single example. Disaggregated information on household financial asset holdings enables researchers and policymakers to detect emerging risks, understand how shocks propagate across household types, and design policies that support both welfare and financial stability. The insights of our paper are directly relevant for current European policy debates. Because European households hold markedly less risky portfolios than those in the United States, the Savings and Investments Union (SIU) initiative aims to foster greater participation in capital markets by broadening investment options and improving financial literacy. Indeed, financial education is one lever to increase participation, illustrating why detailed household level data such as the one we use is essential for effective policy design and evaluation.

Keywords: Household Finance, International Macroeconomics, Portfolio Return, Investment Risk

Codes JEL : G50, G11, E22, F21