The major changes in the payment universe

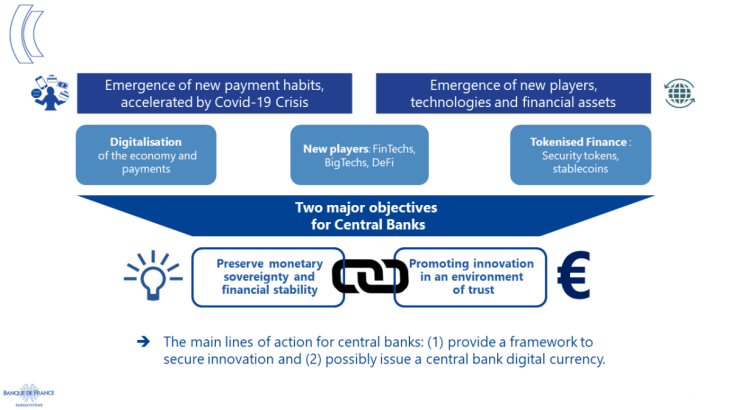

Over the past few decades, a number of major trends have transformed the financial ecosystem and payments landscape:

- the digitalisation of economies, with the development of e-commerce and the growing use of electronic and innovative methods of payment

- the emergence of new players, such as big tech and fintechs

- the emergence of new assets – crypto-assets and stablecoins – whose use could increase given the recent trend towards “tokenisation” of assets, which consists of issuing financial securities in the form of a digital token using new distributed ledger technologies, especially the blockchain

The challenges of digital finance

The Banque de France supports innovation, which has significantly enhanced the efficiency and security of the payments and financial sectors.

However, these developments challenge the role of central bank money:

- The digitalisation of payments is being accompanied by a decline in the use of cash. For the moment, cash, which is not present in the digital universe, is the only form of central bank money accessible to the general public, and it plays an "anchoring role". Using cash tests the free convertibility at par between the different forms of money on a regular basis, thereby ensuring the singularity of the currency and, ultimately, trust in the financial system.

- The tokenisation of the financial ecosystem raises questions about the assets used to settle transactions in tokenised assets (i.e. financial securities in the form of digital tokens). At present, only private assets are directly available on distributed ledger technologies (such as crypto-assets and stablecoins) to settle transactions in tokenised assets, even though they present a risk to the stability of the financial system. Conversely, central bank money is not currently available in tokenised form even though it is the safest and most liquid settlement asset : it removes all counterparty and liquidity risk from financial transactions.

This is why many central banks are studying the possibility of issuing central bank digital currency (CBDC).

Two solutions for partnering innovation

Innovating to preserve the role of central bank money in the digital era

To preserve the role of central bank money, the Eurosystem is considering introducing new forms of central bank currency that could complement existing forms of money without replacing them :

- A “retail" CBDC (the digital euro) would be the digital equivalent of banknotes: it would allow the general public to send and receive payments the length and breadth of the euro area, in central bank money, just as they can do with banknotes. Like banknotes, it would also guarantee a high degree of transaction confidentiality. As well as contributing to the "anchoring role" of central bank money, a retail CBDC could also strengthen European strategic autonomy and economic efficiency by facilitating the emergence of innovative pan-European means of payment created by private players.

- The Eurosystem will also conduct exploratory work to study how tokenised assets in central bank money could be settled using different technologies. A "wholesale" CBDC would enable financial players to settle tokenised assets in central bank money (either directly or indirectly). It could also help to improve the efficiency of cross-border transactions.

Creating a framework of trust

The Banque de France ensures the smooth operation of market and payment system infrastructures and participates in the work of the European legislator.

Central banks, along with the regulator, must ensure that the legal framework treats market activities fairly and responds proportionately to risks (based on the "same activity, same risk, same rule” principle). This approach helps to ensure fair competition between players and to prevent any risk of regulatory arbitrage, including between jurisdictions.

The European legislator has adopted this approach by drafting and adopting a set of measures on digital finance (the "digital finance package"), including a Markets in Crypto Assets (MiCA) regulation.

93%

According to data from the Bank for International Settlements (BIS), in 2022, 93% of central banks had begun work on CBDC and more than half had conducted experiments.

“The twin projects of wholesale CBDC and retail CBDC are like two sides of the same "mountain". In other words, the wish to offer central bank currency in digital form in order to combine both innovation and trust in the payment system."

Updated on the 30th of May 2024