Non-Technical Summary

When market interest rates rise, this move translates mechanically into an increase in interest expenses for indebted economic agents. Those indebted at a variable rate see their cost of debt increase with reference rates, and all indebted agents pay an increasing cost when refinancing. The exact timing and magnitude of this rise in interest expenses depend on the structure of their debt portfolio, mainly on the allocation between fixed vs. floating rates, and short vs. long maturities. In this paper, we describe a simple financial model to project the future interest expenses attached to any debt portfolio whose structure is sufficiently well known, under any exogenous scenario prescribing the future evolution of debt amounts and market interest rates. We apply this model to the market debt of the French sovereign state, and to euro area non-financial corporates.

The model simulates the run-off and re-issuance of existing debt, and interest rate adjustment through time. Starting from a summarized but precise description of the debt portfolio of interest, the simulation keeps track of the exact cost of expiring debt throughout the simulation. Taking as given future outstanding debt amounts as well as market interest rates scenarios, the cost of simulated new issuances associated with the cost of non-maturing debt provides the trajectory of the future nominal and average interest expenses on this portfolio. The model can accommodate a wide variety of scenarios of market interest rates and debt amounts.

A first use case is the French sovereign market debt, for which detailed public data are available. Back-testing shows the model’s ability to account for the cost of debt of the French central government from December 2019 to December 2024, up to an average relative projection error of 3%, linked to the strongly seasonal nature of the debt issuance schedule. Considering a “risk-neutral” scenario where the 10-year AAA-rated market interest rate rises from 2.8% to 3.5% between August 2025 and December 2029, the average cost of debt of the French sovereign state is projected to grow from 1.7% to 2.9% between end-2024 and end-2029, as cheap debt, contracted when market interest rates were low, is progressively refinanced at higher rates.

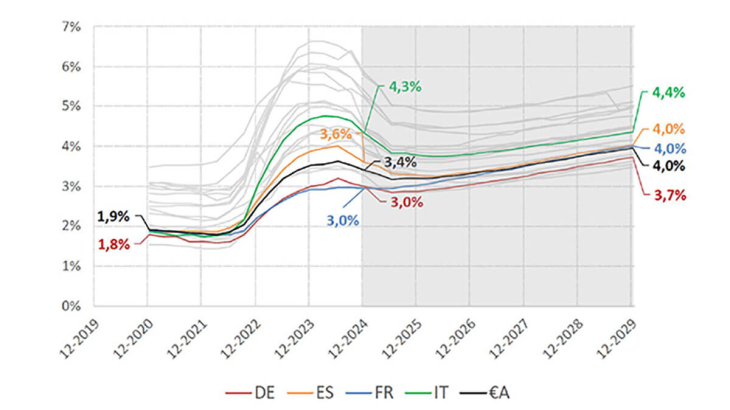

The model can also be applied to the debt of euro area non-financial corporates (NFCs), aggregated by country, thanks to detailed Eurosystem data on bank loans and debt securities. The resulting sensitivities of cost of debt to market interest rates turn out to be very different across countries. This heterogeneity originates from differences in the debt structure of non-financial corporates depending on their country of residence: as an example, Italian or Spanish NFCs are more indebted at short term and variable rate than French or German ones. Therefore, a sharp rise in market interest rates would lead to diverging trajectories: the first group of non-financial corporates would experience a quicker increase in their average interest expenses, as witnessed during the 2022-2023 rate hike. In the risk-neutral scenario, the average cost of debt of European NFCs is projected to converge again by 2029.

Keywords: Cost of Debt, Nominal Interest Rates, Firm Financial Structure, Sovereign Debt, Financial Forecast.

Codes JEL: E43, G32, H63.