- Home

- Publications et statistiques

- Publications

- Macroeconomic interim projections – Sept...

In order to contribute to the national and European economic debate, the Banque de France periodically publishes macroeconomic forecasts for France, constructed as part of the Eurosystem projection exercise and covering the current and two forthcoming years. Some of the publications also include an in-depth analysis of the results, along with focus articles on topics of interest.

- These interim projections incorporate the trade agreement concluded between the United States and the European Union on 27 July last. Average tariffs on French exports to the United States are expected to remain close to the assumption used in the June projections (i.e. 12%, compared with 2% before the increases decided upon by the US administration): in the case of France, the exemptions allowed to certain sectors (particularly aeronautics) offset the additional increases for other goods.

- However, in a more uncertain national context following the vote of no confidence in the French government, the projections are based on an unchanged fiscal policy assumption compared to June, which would result in a deficit of 5.4% of GDP in 2025, and a primary structural adjustment of 0.6% of GDP in 2026 and 0.4% in 2027. Less fiscal consolidation should not however lead to additional growth, as the prolonged fiscal uncertainty could lead to a more wait-and-see attitude on the part of households and businesses.

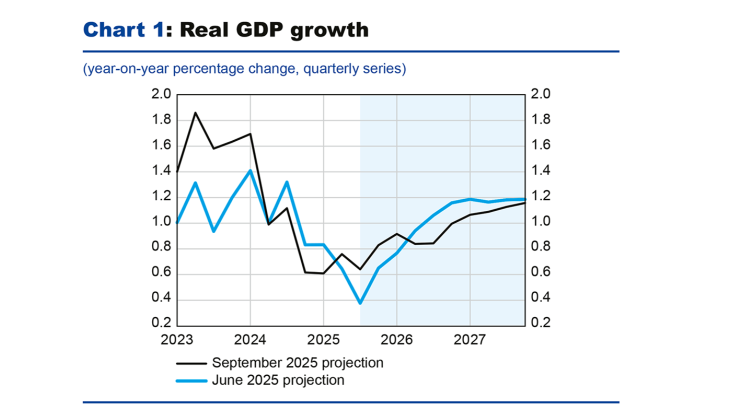

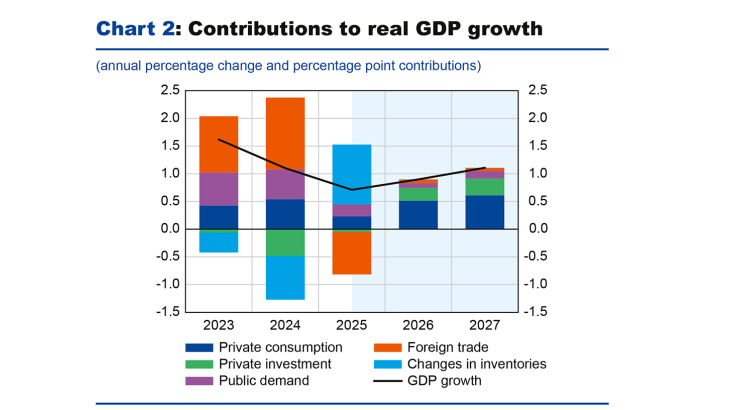

- Growth should come in at 0.7% for the year as a whole. It should then increase moderately to 0.9% in 2026, and to 1.1% in 2027, underpinned by stronger household consumption and a recovery in private investment, while the contribution of foreign trade is expected to be virtually nil over these two years. Compared with our June projections, growth has therefore been revised slightly upwards for 2025, but downwards for 2026 and 2027. The upward revision for 2025 is due to stronger growth carry-over for the first half of the year and better expected performance in the third quarter, based on our latest economic survey (+0.3%). The downward revisions for 2026 and 2027 are attributable to the more uncertain domestic business environment and more unfavourable assumptions concerning the international environment, notably due to a higher euro exchange rate and oil price, as well as weaker external demand.

- After averaging 2.3% in 2024, headline inflation is expected to remain below 2% throughout the projection horizon at one of the lowest rates in the euro area. As forecast in June it should initially fall markedly to 1.0% in 2025, due to lower energy prices and moderating services inflation, before rising again in 2026 and 2027 to 1.3% and 1.8%, respectively. Inflation excluding energy and food should continue to fall, to 1.7% in 2025 (after 2.3% in 2024), and to 1.6% in 2026 and 2027. As wage growth outpaces price increases, the annual growth in the purchasing power of wages of approximately 1% should underpin a recovery in household consumption.

- Unemployment is expected to remain close to its current rate of 7.5%.

These projections are based on Eurosystem technical assumptions, for which the cut-off date is 15 August 2025 (see Table 1 in the Appendices). They incorporate final HICP (Harmonised Index of Consumer Prices) inflation figures for July, published on 14 August, as well as the detailed figures for the second quarter 2025 national accounts published on 29 August 2025. Our standard fiscal assumptions remain unchanged in relation to those used in our June projections, based on a Budget Law that makes it possible to achieve a deficit of 5.4% of GDP in 2025, and a primary structural adjustment of 0.6% of GDP in 2026 and 0.4% in 2027.

Positive but moderate growth in 2025, before an uptick in 2026 and 2027

An upside surprise in growth in the first half of the year, driven by the positive contribution from inventories, should be followed by destocking and a net rebound in exports from the third quarter on. However, exports are subsequently expected to be less buoyant than in the June forecast due to the appreciation of the euro. Conversely, household consumption declined in the first half of the year, partly for one-off reasons: a decline in car purchases at the beginning of the year after a sharp increase at the end of 2024 (in anticipation of changes to the bonus-malus system) and lower energy consumption in the second quarter (due to mild temperatures). The savings rate thus reached 18.9% in the second quarter, its highest level since the late 1970s (excluding the Covid period). Increased uncertainty over fiscal policy is expected to continue to weigh on business consumption and investment at the turn of 2026 before both components strengthen. Household consumption should pick up again amidst continued growth in the purchasing power of wages in 2026 and 2027 (see below). Household investment has already begun to recover and business investment should rebound at the same rate as forecast in June, as less uncertainty over trade policies offsets renewed domestic uncertainty.

The risks surrounding our growth forecast are tilted to the downside after 2025. Political uncertainty in France over fiscal policy in 2026 could exacerbate the wait-and-see attitude of businesses and households. This is compounded by continuing uncertainty surrounding the implementation of the trade agreement between the United States and the European Union, particularly with regard to certain sector-based tariffs (pharmaceuticals, semiconductors, agri-food).

A sharp decline in inflation in 2025, followed by a gradual increase towards the 2% target in 2026 and 2027

In 2025, headline inflation as measured by the harmonised index is expected to fall significantly to an annual average of 1.0%, after the figure of 2.3% recorded for 2024 (see Chart 3). This decline should mainly be attributable to the reduction in regulated electricity tariffs at the beginning of the year. Moreover, the contribution of services should also decline, in line with the slowdown in nominal wages. In 2026, headline inflation is expected to rise moderately to an annual average of 1.3%, pushed up by the higher contribution of food and a less negative contribution from energy. Inflation should continue to rise in 2027 to 1.8%, thus approaching 2%, again sustained by energy prices and the introduction of the second European carbon market (ETS-2), although the impact of the new emission allowances remains highly uncertain given the offsetting measures that may be deployed. Core inflation (excluding energy and food) should come down to 1.7% in 2025, from 2.3% in 2024, and then stabilise at 1.6% in 2026 and 2027. The contribution of services is expected to remain broadly unchanged over this period.

When compared with our most recent projections, headline inflation for 2025 has not changed but its composition has: the upward revision in energy prices offsets the downward revision in service prices, particularly in the communication and healthcare sectors. Inflation for 2026 has been revised slightly downwards (by 0.1 point), with the appreciation of the exchange rate holding back the prices of manufactured goods.

Note : HICP, Harmonised index of Consumer Prices

Nominal wages continue to increase by more than prices

Our forecast for average wages remains unchanged from June due to a virtually unchanged inflation forecast and an unchanged assessment of the recovery of past productivity losses. The average wage per employee has been rising faster than prices since the second quarter of 2024 (+2.1% year-on-year in the second quarter of 2025 in the market sectors versus +0.8% for consumer prices, see Chart 5), and is expected to continue to do so in 2026 and 2027.

In the labour market, we continue to forecast a temporary rise in the unemployment rate to 7.6% through 2026, followed by a decline in 2027 to 7.4% (see Chart 6). This is slightly lower than anticipated in the second quarter of 2025 and should also benefit from a less negative short-term forecast for market sector employment in the third quarter of 2025. Consequently, the unemployment rate has been revised slightly downwards in 2025 and 2026, but remains unchanged in 2027 compared to our previous projection. Total employment has been revised slightly downwards over the entire projection horizon. The purchasing power of wages is expected to grow at a rate of close to 1% over our projection horizon, which is in line with our June forecast.

Appendix : Eurosystem technical assumptions and detailed projections

Download the full publication

Updated on the 30th of September 2025