Non-Technical Summary

This paper studies a class of tax reforms that lower the overall fiscal wedge on labor by shifting part of the tax burden from labor income to consumption under a strict budget-neutrality requirement. We call such reforms Fiscal Rebalancing policies. Such reforms aim to reduce the fiscal wedge on labor while preserving budgetary discipline, a key constraint in high-debt economies.

Focusing on France, we assess whether Fiscal Rebalancing can increase equilibrium employment, output, and capital. We develop a quantitative heterogeneous-agent model calibrated to French data, capturing labor-income risk, borrowing constraints, and wealth inequality. Results are compared with those from a representative-agent benchmark.

Analytically, we show that in the representative-agent economy, employment rises when the consumption-tax base is sufficiently larger than the labor-income tax base. This condition provides a benchmark for the quantitative analysis.

We then consider a reform that increases the consumption-tax rate by three percentage points and uses the additional revenue to cut payroll taxes, broadly in line with the French policy debate. The reform has a limited effect on employment, raising hours worked by about 0.3 percent in the long run in both models. The main macroeconomic effect operates through capital accumulation. In the heterogeneous-agent economy, aggregate capital increases by around 1.3 percent, about four times more than in the representative-agent case.

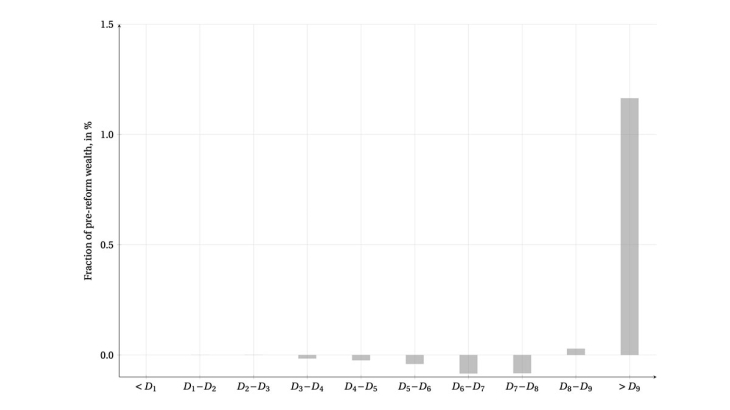

The stronger capital response reflects increased saving incentives, driven by higher consumption taxes and stronger precautionary-saving motives following wage increases. As a result, wealth inequality rises markedly, with the top decile capturing more than the entire increase in aggregate wealth.

From a welfare perspective, the reform generates clear gains in the representative-agent economy. In the heterogeneous-agent model, average welfare, which depends positively on consumption and negatively on labor, increases modestly, but distributional effects are significant: high-wealth, very-high-productivity, and low-productivity households experience welfare losses, largely due to transition dynamics. Indeed, on average, wealth-rich agents and low-productivity agents expect an increase in their labor supply and a decrease in their consumption (relative to the status quo) along the initial phase of the transition, which translates into a welfare loss.

Overall, Fiscal Rebalancing reforms are unlikely to deliver large employment gains but can substantially increase savings and capital accumulation, at the cost of higher inequality. These findings highlight the importance of accounting for household heterogeneity when evaluating tax reforms implemented under strict budget constraints.

Keywords: Fiscal Policy, Fiscal Rebalancing, Income and Wealth Distributions, Heterogeneous-Agent Models

Codes JEL: E62, D31, C54