Yet mining is only one pillar of Iran’s broader crypto plan; its use in cross-border payments is even more disruptive. Iran became the first country to formally acknowledge the use of cryptos for international trade. This is openly bypassing the traditional USD-based financial system and the global banking infrastructure, thus potentially disrupting the monetary system. Due to the inherently anonymous nature of crypto, which further helps the regime to obscure financial activity, the government utilizes it to circumvent sanctions. Incident-based reports indicate that Iranian companies and government-linked entities have been engaging in crypto-based import transactions. An investigation (source: Reuteurs, 2022) revealed that Binance, despite formally banning Iranian users, has processed approximately $8 billion in Iranian crypto trade since 2019. Much of this activity was done through indirect wallets and low-profile coins, allowing traders to bypass restrictions and operate discreetly.

The consequences of this system challenge core functions of monetary policy. When trade moves to crypto, central banks lose control over capital flows and exchange controls. As Iranian firms bypass the Iranian Rial for crypto, demand for the national currency drops, accelerating devaluation. While Iran evades U.S. sanctions through crypto, it strengthens dollar preeminence in the international monetary system since most stablecoins are dollar-pegged. Iran's "decentralized" trade still happens in dollar terms. This paradox illustrates a deeper dilemma and raises structural questions for central banks worldwide, showing that using crypto undermines central bank authority by stripping away control over exchange rates.

Iran's ambitions go further, attempting to solve this dual reality. The Central Bank of Iran is also considering the idea of launching a national cryptocurrency. While still in pilot and theoretical stages, the objective is to create an independent digital currency for international settlements, particularly with countries like Russia and China. Such thoughts reflect Iran's intent to build a parallel value-transfer system, independent of the Society for Worldwide Interbank Financial Telecommunications (SWIFT, the global bank-to-bank messaging system for cross-border payments), correspondent banks, or the dollar system.

The Geopolitical Stakes: From Sanction Evasion to Financial Fragmentation

All these strategies show that Iran is serious about incorporating crypto into its international trade and banking strategy. While the motivation is mostly driven by its unique sanction constraints, the tools used mirror possibilities that could be adopted elsewhere under economic or geopolitical pressure. That is why Iran's case is also a cautionary tale of the kinds of financial opacity market regulators and central banks may soon face in a more fragmented global economy. This raises an important question: what happens if a group of countries like Iran, Russia, and China successfully build interoperable crypto networks?

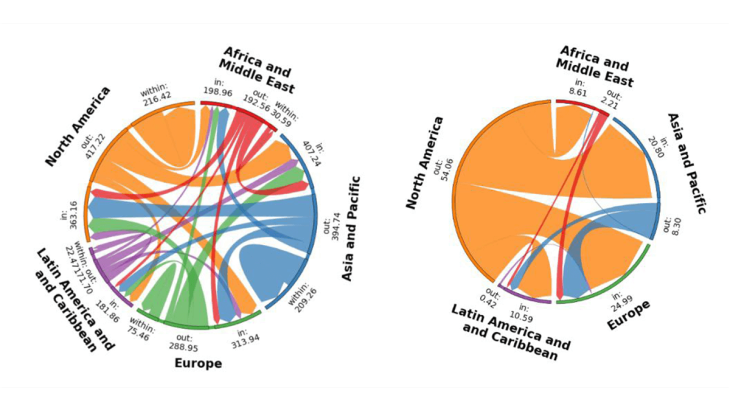

Such a shift could split global finance into competing blocs outside the reach of SWIFT and European banks. It would not only challenge dollar dominance but also weaken the Euro's role in global trade and limit Europe's ability to enforce sanctions or shape financial norms. This poses a particular risk for Europe, where sanctions on Russia have been central to the EU’s foreign policy since the Ukraine invasion and are continually reinforced by new packages. A parallel financial system built on crypto could allow sanctioned actors to reroute trade, blunt EU measures, and shield authoritarian regimes from economic pressure.

Europe’s Dilemma: Sovereignty vs. Control

European authorities know the stakes. The European Central Bank (ECB) frames the digital euro as essential for strategic autonomy and monetary sovereignty, not just payment modernization. It has launched extensive digital euro trials (source: BCE, 2025), while the Banque de France runs pilot projects testing wholesale settlement and cross-border payments (source: Banque de France, 2024). Alongside innovation, regulators have moved to contain risk through Markets in Crypto-Assets (MiCA) regulation (source: Banque de France, 2025), imposing traditional oversight via transparency requirements and licensing. Yet this raises a deeper question: can any single state truly control borderless technology? Without global coordination, digital sovereignty becomes an illusion as offshore platforms and cross-border evasion undermine domestic monetary control. These moves reflect a harsh reality; the EU must keep up with outside innovation while also protecting financial stability. Iran's example shows that crypto does not just exploit loopholes; it moves faster than the rules trying to control it. As crypto forms a parallel system, capital controls and bank reporting lose traction. Sovereignty now hinges on operational capacity: seeing and tracing cross-border flows in real time. To preserve their mandate, central banks should apply EU-level transparency to foreign issuers, enforce strict ID checks and monitor suspicious transactions. Third, European authorities should track the net flows of stable coins and digital dollars, and design the digital euro for safe interoperating while preserving control over money flows and preventing misuse.