Non-Technical Summary

What are the macroeconomic effects of tariff shocks? How are these effects shaped by the endogenous response of central banks to the tariff shock? Partly motivated by the 2025 rise in tariffs by the Trump Administration, a myriad of papers has emerged to answer these questions, primarily using microfounded structural models. These papers study the business cycle effects of tariffs, the design of tariff, and the optimal monetary policy response to tariffs. While the existing literature focuses mostly on theoretical analyses, there is little empirical evidence on the business cycle effects of tariffs, and no evidence on how the effects of tariffs are shaped by the endogenous reaction by the central bank.

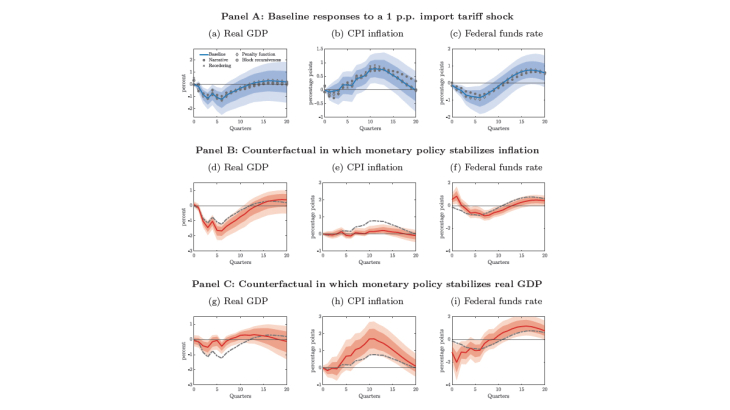

We fill this gap with two main contributions. First, we estimate the macroeconomic effects of U.S. import tariff shocks, using several tariff measurement and identification approaches over a sample spanning from 1990 to 2024. We find robust evidence that tariff shocks are contractionary, inflationary, and partially accommodated by monetary policy. A 1 percentage point increase in the U.S. import tariff rate induces a delayed increase in the CPI inflation with a peak effect of 0.78 percentage points after 11 quarters and a faster decline in real GDP with a trough at -1.23% after only 6 quarters. This contribution is valuable because the empirical evidence remains limited, with existing studies reporting estimates that range from tariffs being possibly expansionary and deflationary, contractionary but still deflationary, and contractionary and inflationary. While our results are consistent with the latter evidence, with tariffs being contractionary and inflationary, we also discuss potential reasons for the conflicting empirical results.

Second, we estimate how the macroeconomic effects of tariff shocks depend on the systematic monetary policy response, without relying on a fully specified structural model. This approach follows McKay and Wolf (2023) and is appealing because it is robust to the Lucas critique and to model misspecification. When the central bank aims to perfectly stabilize prices, the federal funds rate is raised sharply by 0.82 percentage points in the short run. As a result, the tariff shock generates only a modest increase in inflation, with a peak effect of 0.21 percentage points. In the same quarter, the baseline inflation response is almost four times larger. This comes at the cost of a substantial decline in real GDP, which is 36% (0.44 percentage points) lower at the trough. Under the alternative counterfactual in which monetary policy aims to strictly stabilize output, the federal funds rate is lowered more aggressively and rapidly than in the baseline, reaching a trough of −2 percentage points. This policy mitigates the recessionary effects but does not fully stabilize output. At the same time, the additional easing substantially amplifies inflation, with the peak effect being almost twice as large as in the baseline.

Keywords: Tariffs, Trade, Imports, Monetary Policy, Counterfactuals

Codes JEL : C32, E31, E32, E52, F14