- Home

- Publications et statistiques

- Publications

- Conducting monetary policy in an interco...

Post n°247. Since the previous ECB strategy review in 2003, interdependencies across countries have increased, making economic and financial conditions in the euro area more prone to foreign influence. However, the analyses behind the new ECB’s Strategy Review conclude globalisation does not impede the ECB from achieving price stability but calls for the adaptation of instruments and analytical toolkits.

Trade and financial integration are substantially deeper now than in 2003

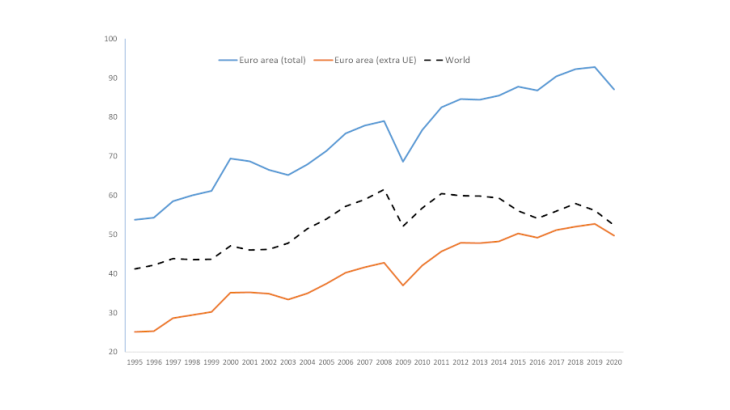

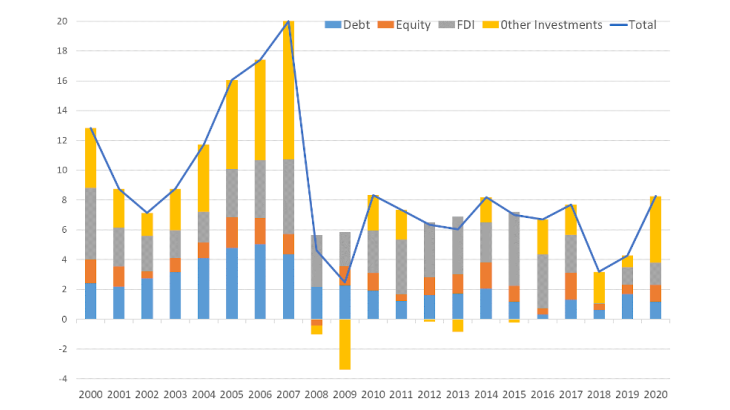

The ECB Strategy Review, launched in January 2020, was concluded in July 2021 with the announcement of a new monetary policy strategy, and the publication of the detailed analyses behind. The ECB’s previous Strategy Review was in 2003, i.e. before the era of “hyper-globalisation”. Major structural changes in the world trade system included an impressive surge in the weight of emerging economies, in particular China and other Asian countries, and the massive development of global production networks through Global Value Chains (Berthou, Carluccio and Gaulier, 2020). Gross cross-border financial flows increased from 2.5% of world GDP in the early 1990s to around 20% in 2007, with a salient fact being the expansion of global banking (Figure 2, where “other investments” mostly include banking flows which registered a steep growth before 2008, before levelling off).

Overall, in spite of the levelling off that occurred after the Great Financial Crisis and affected the euro area less than the rest of the world, most economies are currently much more integrated than they were in 2003 and the signs of an outright reversal of globalisation are limited. Such changes strongly affected the landscape in which monetary policy operates, as highlighted in a recent report conducted as part of the Monetary Policy Strategy Review of the ECB.

Increased synchronisation of economic and financial cycles across countries

Economic and financial variables across countries co-move more tightly in a world characterised by stronger trade and financial linkages. Such synchronisation is noticeable for real variables such as business cycles and for financial variables. Fluctuations in capital flows and the prices of risky assets respond to global factors which are common across countries. Importantly, inflation in the euro area became increasingly synchronised with that of other advanced economies, especially due to the co-movement of the most volatile portions of the CPI. Moreover, although globalisation has affected price and wage-setting, the analysis concluded it has had a second-order effect on trend inflation and on the flattening of the Phillips curve, when compared with factors such as de-anchoring of inflation expectations. One reason behind such - perhaps counterintuitive - result lies in that, whereas trade openness can intensify competition and thus exert downward pressure on inflation, it has also been associated to the emergence of superstar firms operating in oligopolistic contexts that tend to absorb cost fluctuations in their margins. Furthermore, although the share of goods originating from low-wage countries in euro area consumer expenditures doubled since the beginning of the 2000s, the overall contribution to consumer price index (CPI) inflation was rather modest because inflation in those countries increased at a similar pace than that of the euro area (even slightly faster) -see Balatti et al, (2021) for a detailed discussion of the inflation impact of globalisation).

Globalisation affects the environment in which monetary policy operates

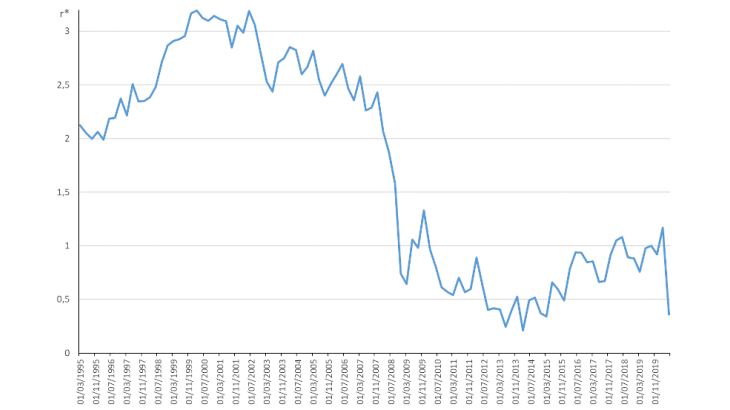

The Strategy Review study on globalisation concluded that trade integration contributed to boosting productivity growth by improving the allocation of resources to more productive countries, sectors, and firms, and by providing incentives for technological innovation. It also shows that financial integration explains to some extent the fall in the natural rate of interest (the rate at which inflation is constant over the longer run, labelled r*) by increasing the supply of global savings and by boosting the global demand for safe assets. r* has been steadily declining over the past decades (Figure 3, Federal Reserve Bank of New York) (Marx, Mojon and Velde, 2017; Brand, Bielecki and Penalver, 2018). The report also documents that globalisation has been associated with greater wealth and income inequality within countries.

It alters the transmission channels of monetary policy but not their relevance

The natural question is whether, and how, the transmission mechanisms of monetary policy are affected by international interconnectedness. Through its impact on r* and on inequality, globalisation limits the so-called “interest channel” by reducing (to some extent) the policy space and by changing the aggregate propensity to consume, as households with lower income tend to save less. Globalisation also affects the “wealth channel”, i.e. the impact of interest rates on demand via portfolio holdings, since wealth is more concentrated and held abroad. Most importantly, globalisation is associated with more complex exchange rate dynamics. Financial globalisation implies a stronger sensitivity of exchange rates to monetary policy shocks via rapid portfolio rebalancing and through valuation effects from foreign currency exposures, and a more active role for global banks in transmitting shocks across borders (the “Global Financial Cycle” hypothesis). Trade integration, on the other hand, allows consumers to switch expenditures between domestic and foreign goods following a monetary policy induced change in the exchange rate, thus reinforcing the exchange rate channel. However, at the same time, globalisation has been associated with a stronger role for dominant currencies in international trade invoicing, in particular the US dollar and the Euro thus dampening the real effects of devaluations.

Conclusion

The world is much more open and interconnected nowadays than at the inception of the euro. A more open economy is more prone to be affected by shocks (positive and negative) originating elsewhere in the world. Although one could think that such interconnectedness might impede monetary policy sovereignty, research rejects such claims, providing the good news that medium-term inflation in the euro area remains under the control of the ECB just as much as it did in the early 2000s. Indeed ECB monetary policy was very active developing new instruments to provide monetary stimulus during the crisis, in particular during the very acute phase in early 2020, for example with the introduction of swap lines to address the shortage of US dollars (Schmidt, 2020) and euros (Albrizio et al, 2021). Globalisation only requires extra work by Eurosystem staff to grasp the complexities of the integrated world and introduce them in their analytical toolkits.

Updated on the 25th of July 2024