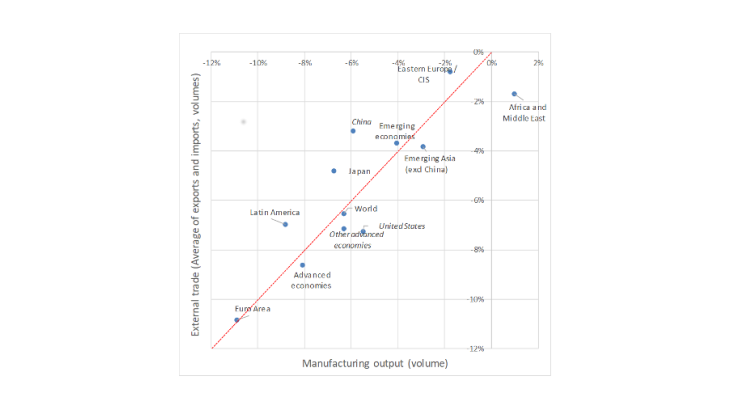

Note: Between the first four months of 2019 and 2020, euro area manufacturing output (x-axis; member countries are weighted by trade) and trade (y-axis, geometrical average of export and import growth) fell by around 11%. The point representing the euro area is therefore located on the red bisector.

World trade in the eye of the Covid-19 storm

The Covid-19 crisis has had a severe impact on world trade. According to CPB data, measured in volumes, trade flows plunged by 16.2% between December 2019 and April 2020. This decline is closely linked to the fall in manufacturing output. Chart 1, compares the evolution of external trade and of manufacturing output and clearly shows that the adjustment in both cases is very close to the 45 degree line. There is nonetheless some heterogeneity across regions, which can be explained by the geographical spread of the epidemic and by differences in the health measures adopted in response. In addition to the direct effects of the health crisis on output, world trade may have amplified the spread of the economic shock between countries via deliveries to (supply shock) or imports by (demand shock) trading partners.

World trade is shaped by global value chains

To understand how shocks linked to Covid-19 are transmitted through international trade linkages, we need to take account of the central role played by global value chains (GVCs), which are defined as production processes that are dispersed geographically and thus cover several countries. This international fragmentation of production chains, which intensified in the 1990s, has contributed to the rise in world trade over the past 30 years. Such impressive development has been made possible by technological advances, especially those linked to information and communication technology (ICT), and by the signature of numerous trade agreements, which have significantly reduced barriers to world trade.

Richard Baldwin shows fragmentation can be observed in all stages of the manufacturing process (research and development, design, manufacture of intermediate goods, assembly, marketing, distribution). For example, Boeing works with suppliers in around 150 countries, while Apple’s iPhone incorporates factors of production from around 50 countries spread across five continents. All sectors are affected by the internationalisation of production, either directly or indirectly.

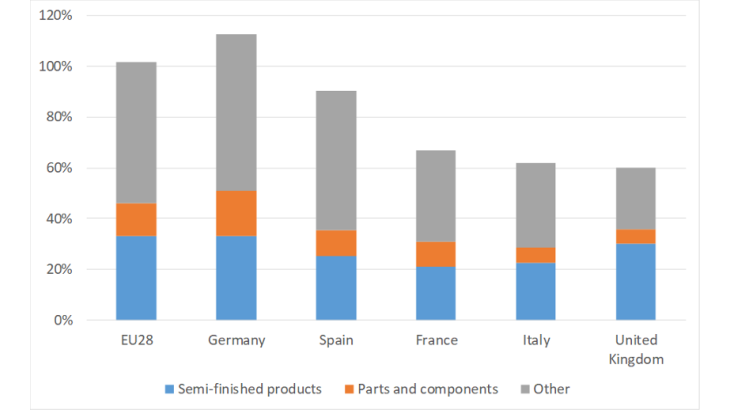

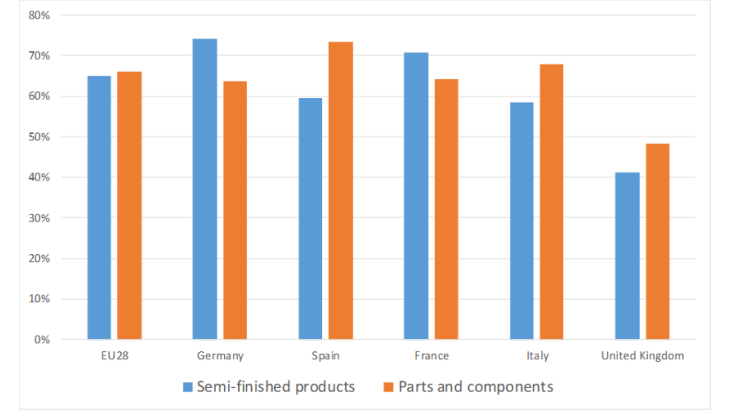

Chart 2 shows that over the period 2002-19, imports of parts and components and of semi-finished products used in manufacturing accounted for nearly half of the import growth in European Union countries. Gaulier, Sztulman and Ünal (2020) show that the Great Recession of 2008-09 did not slow the development of GVCs.