Post No.407. Every quarter, the Banque de France collects inflation expectations from 1,700 business leaders. They correctly anticipated the magnitude of the 2022–23 inflationary wave. Their expectations reacted in a more temporary and moderate way. With their expectations returning to 2% since 2024 and a strong consensus surrounding this scenario, companies remain confident that prices will remain stable over the long term.

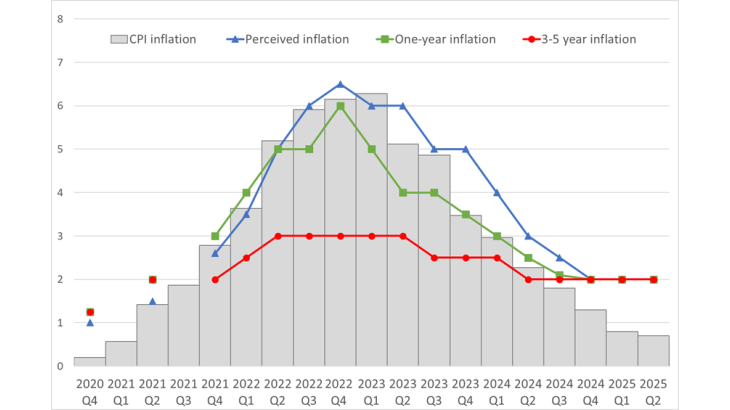

Chart 1: Inflation perceptions and expectations over the inflation cycle (medians, %)

Note: Data for the end of 2020 and mid-2021 are from the pilot survey conducted in two regions.

Inflation expectations are said to be anchored when economic agents believe that inflation will remain stable in the future, at a level close to the central bank's medium-term target. This anchoring is important for macroeconomic stability because inflation expectations influence economic decisions. For example, for businesses, expectations of rising inflation may result in price increases and higher wage growth, fuelling stronger inflationary pressures over time. From this perspective, the resurgence of inflation between 2021 and 2023 due to commodity price shocks represented a risk to the anchoring of inflation expectations and therefore to price stability in the medium term.

How did business leaders' inflation expectations react to the resurgence of inflation and then to disinflation between 2021 and 2025? To analyse this reaction, this article draws on the results of the survey conducted every quarter by the Banque de France among 1,700 business leaders. This survey questions them about their current perception of inflation and their inflation expectations for the next year and the medium term (3 to 5 years). The questions are relatively simple, not very technical, and do not refer to any specific index (CPI, HICP). This survey, which has been conducted since the end of 2020, provides an analysis of the recent inflation cycle as a whole (Chart 1).

Three criteria are used to analyse the anchoring of business leaders' inflation expectations (as in Coibion and Gorodnichenko (2025)): (i) have expectations remained close to the monetary policy target (2% in the medium term)? ii) what is the degree of divergence between business leaders' expectations? iii) does perceived short-term inflation affect business leaders' expectations of longer-term inflation?

Inflation expectations have stabilised at 2% over the last few quarters

While households greatly overestimate inflation, business leaders have a perception of inflation that is closer to actual inflation (Savignac et al., 2024). On average, their perceptions are slightly less than one percentage point (pp) above inflation, whereas for households the gap can be more than 5 pp (Bignon and Gautier, 2025). Business leaders therefore perceived the inflation cycle as a whole in a fairly accurately manner (Chart 1). However, with the recent decline in inflation, they have tended to overestimate it a bit more than usual: since early 2025, the median perceived rate has been stable at 2%, while actual inflation has been below 1% according to INSEE. This phenomenon can also be observed with household expectations and can be explained by the memory effects of past price increases.

One-year inflation expectations initially underestimated the rise in prices during the inflationary upturn (Gautier et al., 2025). At the end of 2021, business leaders expected inflation to reach 3% a year later, but prices actually increased by 6%. Households and professional forecasters also underestimated this rise. Furthermore, business leaders tended to overreact to the inflationary shock and expected inflation to be much higher than it actually turned out to be a year later. This overreaction can be seen at the peak of the inflationary cycle, as well as during disinflation. Nevertheless, for the past three quarters, one-year expectations have been stable at 2%, i.e. the inflation target level.

The assessment of the degree to which expectations are anchored is often based on long-term expectations, which are less likely to depend on short-term fluctuations in inflation. Three- to five-year expectations fluctuated much less during the inflation cycle, peaking at 3% before falling back to 2% and stabilising at that level over the last five quarters.

Strong consensus among business leaders that inflation will remain stable at around 2%

Business leaders' expectations are said to be anchored if there is a strong consensus among them that inflation will remain stable around the target. However, not all business leaders have the same expectations. For example, they are on average higher among smaller businesses.

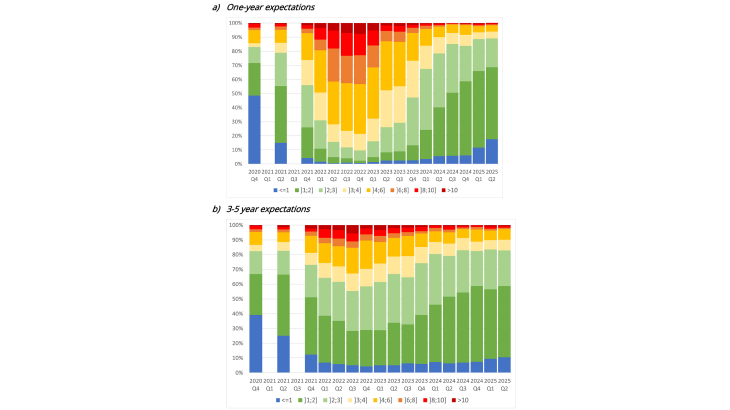

The dispersion of expectations among firms varied over the inflation cycle, increasing particularly sharply with the level of inflation (Chart 2a). When inflation peaked in late 2022, one in five business leaders expected one-year inflation to be above 8%, but an identical proportion expected it to be below 4%. At the three- to five-year horizon, this dispersion also increased with higher inflation, but less significantly than for the one-year horizon, indicating that the consensus view that inflation would return to target was stronger in the long term (Chart 2b).

Chart 2: Distribution of business leaders' inflation expectations between 2020 and 2025

Note: Data for the end of 2020 and mid-2021 are from the pilot survey conducted in two regions. For each quarter, a coloured bar corresponds to the percentage of responses within a given range.

However, the dispersion of expectations declined significantly as of early 2023. For several quarters now, there has been broad consensus among business leaders that their expectations are in line with the inflation target. Since the end of 2024, more than two-thirds of business leaders have expected one-year and three- to five-year inflation to be close to 2%. In the latest wave of the survey, less than 10% of businesses expect inflation to exceed 4% in a year's time, whereas a majority believed this would be the case at the end of 2022.

Long-term expectations are less sensitive to short-term changes.

When long-term expectations are anchored, this implies that they are not very sensitive to short-term changes in inflation. Generally speaking though, business leaders, like households, tend to form their expectations by extrapolating from current observations. Moreover, in periods of high inflation, a stronger link between perceived inflation and expectations makes it harder to stabilise inflation.

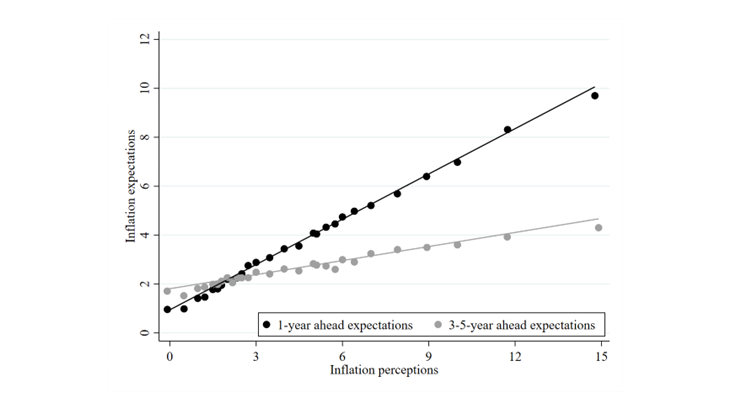

At the one-year horizon, business leaders' inflation expectations are strongly correlated with current inflation, based on their perceptions at the time of the survey (Chart 3). This correlation fluctuated over the course of the inflation cycle: it was strong during the inflationary phase (between late 2021 and late 2022), and weaker during the disinflationary phase (between 2023 and 2024) (Gautier et al., 2025). When inflation slowed, business leaders reported that they expected one-year inflation to be lower than their perceptions. In other words, they expected inflation to be less persistent than usual.

Chart 3: Correlation between inflation expectations and perceptions

Long-term expectations are much less sensitive to the level of perceived inflation. While the correlation between business leaders' one-year expectations and their perceptions is above 0.5, the correlation between their long-term expectations and their perceptions of current inflation is barely 0.2 (Chart 3). Long-term expectations therefore reacted less to the inflation cycle as a whole, remaining close to the inflation target.

These factors all confirm the assessment that business leaders' inflation expectations remained broadly stable during the inflation wave. This anchoring helped prevent a price-wage spiral from taking hold and enabled a rapid and lasting return to price stability in France without recession.

Download the full publication

Updated on the 27th of October 2025