Like many countries around the world, France experienced a wave of inflation that began in late 2021, peaked in late. 2022 early 2023 and then fell rapidly and sharply in 2024 (see Chart 1). From summer 2021 to the end of 2022, rising energy prices contributed to the resurgence of inflation. Then, from summer 2022 to autumn 2023, rising food prices kept inflation high. The products most impacted by inflation were therefore mainly those purchased by households on a daily basis. This affected households’ perception of inflation, and sometimes much more than observed inflation (Bignon and Gautier, 2022).

In order to closely monitor households’ perceptions of the different stages of this inflationary shock, the Banque de France, together with the CSA Institute, conducted three successive annual surveys, involving a total of just under 15,000 people: the first between May and June 2022 (Bignon and Gautier, 2022); the second in March 2023 (Bignon and Gautier, 2023); and the third between October and November 2024 (see Chart 1). These three surveys make it possible to track changes in households’ inflation perceptions and expectations, as well as their perceptions of the prices of everyday products at key moments during the wave of inflation. In addition, in the surveys conducted in 2023 and 2024, households were asked for the first time about their perceptions of income adjustments in response to the inflationary shock (see Appendix 1).

Three main lessons can be drawn from these surveys.

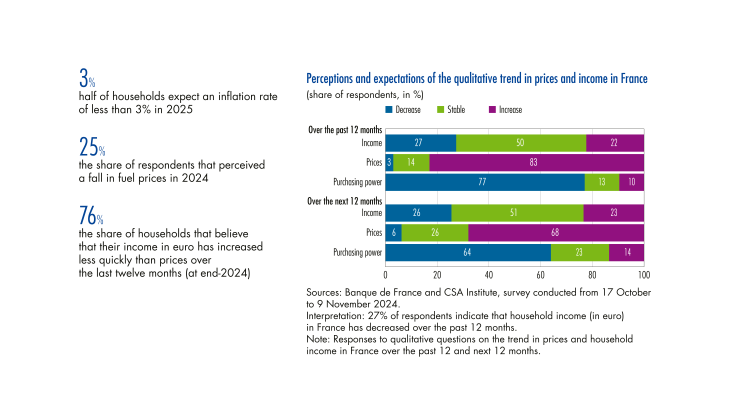

First, respondents perceived a decline in inflation in 2024: one in two respondents believed that inflation was below 5% in 2024, compared with only one in ten in 2023. Households also expected inflation to be lower in 2025: half of those surveyed believed it would be below 3%, reflecting their confidence in the continued decline in inflation.

Second, households were particularly sensitive to the decrease in petrol prices and the stabilisation of food prices. While a significant proportion of households had perceived sharp increases in fuel or food prices in 2022 and 2023, respondents observed in 2024 that these prices were rising less rapidly or even falling. This was reflected in their overall inflation perceptions. However, these perceptions continue to systematically overestimate inflation. In particular, households that report a higher share of their budget spent on food tend to believe that inflation has been higher than average. …