In France, since the end of 2021, the rise in the consumer price index (CPI) has been growing more rapidly: it stood below 2% in the first half of 2021 on an annual basis, reached almost 3% at end-2021 and stood at 5.2% in May 2022 (and 5.8% according to the European harmonised index). In this context, the topic of inflation and its future trend is once again at the heart of households’ and business leaders’ concerns. Now, what companies and households expect in terms of inflation tomorrow influences their economic decisions today (Weber et al., 2022). For example, companies' price setting decisions or wage negotiations may depend on what business leaders or households expect about aggregate price developments, which ultimately affects inflation dynamics. It is therefore important for central banks to have tools that enables them to monitor economic agents' inflation expectations in real time, to ensure that they remain compatible with the monetary policy's medium-term inflation target of 2%.

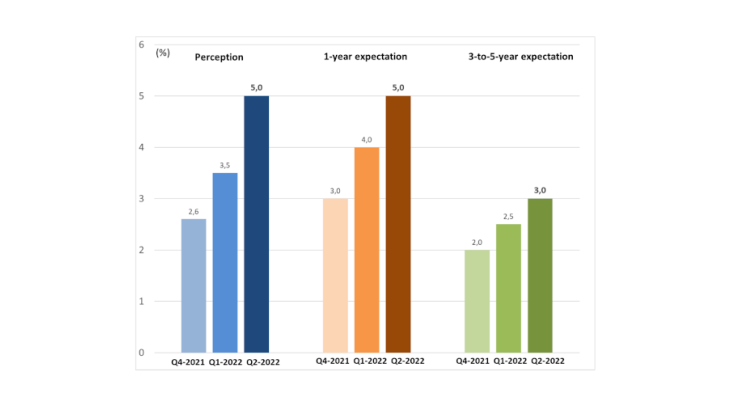

A new Banque de France survey measures business leaders’ inflation perception and expectations. They perceive and expect inflation to be higher today than at end-2021 (Chart 1).

The two-pronged challenge of measuring firms’ inflation expectations

For a long time, the only indicators available to central banks were those derived from the financial markets or from surveys of professional forecasters. However, financial market participants or forecasters do not have the same level of attention or information as households or companies on inflation issues. Their expectations therefore differ quite widely (Coibion et al. 2020) and one cannot extrapolate the expectations of financial markets and professional forecasters to businesses and households.

Today the Banque de France is publishing for the first time the results of a regular nationwide survey of business leaders on their inflation expectations regarding general consumer price developments. Setting up a tool for monitoring business expectations is a two-pronged challenge. The first challenge concerns technical feasibility: conducting such a survey requires contacting a large sample of economic decision-makers who are available to respond. To this end, the survey on corporate inflation expectations is based on the usual contacts that the Banque de France branches establish with business leaders as part of the Monthly Business Survey (MBS). The survey is designed as a short module of questions within the MBS, and this module is conducted on a quarterly basis. The second challenge consists in obtaining relevant information for monetary policy assessment: in particular, asking companies about an aggregate variable rather than its immediate environment, gathering quantitative information for a medium to long term horizon. However, most business surveys provide information on the activity of the company and the dynamics of their own sales prices and consider relatively short time horizons (a few months). Adding a module on expectations regarding general consumer price developments thus makes it possible to enrich the MBS and its assessment of the anchoring of inflation expectations.

The new Banque de France survey

Currently, in the euro area, only the Bank of Italy has conducted a national survey for over 20 years. In the world, this type of survey is being developed by central banks but is still rare (Candia et al. 2022).

After an experimental phase (Bouche et al., 2021), the inflation expectations (IE) module of the MBS has been conducted on a national scale since the end of November 2021. Each quarter, around 1,700 companies of all sizes and sectors (industry, construction, services) are surveyed. The survey is conducted by telephone during the business interviews carried out for the MBS. In the end, over 7,000 business leaders will be contacted each year to find out what they think about inflation.

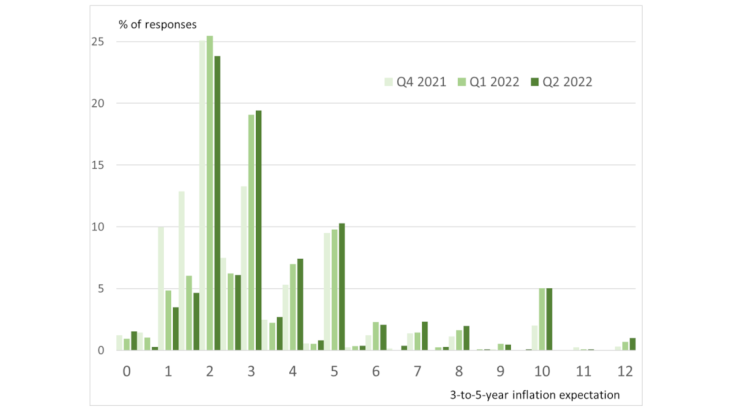

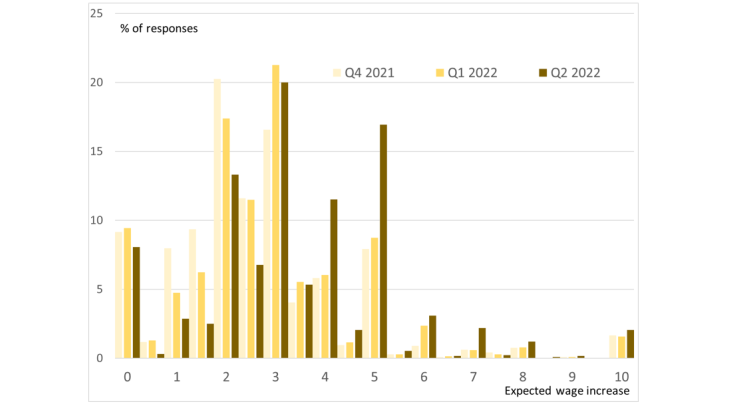

The information gathered concerns business leaders’ current perception of inflation, and their inflation expectations for the next year and the medium term (3 to 5 years). Each respondent is also asked about its expectations regarding wage trends over the next 12 months within the firm (Gautier, 2022). Thanks to this survey, it is thus possible to determine, as close as possible to the reality of economic decisions, what firms think about future inflation.

Since end-2021, firms’ inflation expectations have risen with inflation

Since inflation picked-up in France three main conclusions about inflation expectations can be drawn from the analysis of the first three waves of the survey.

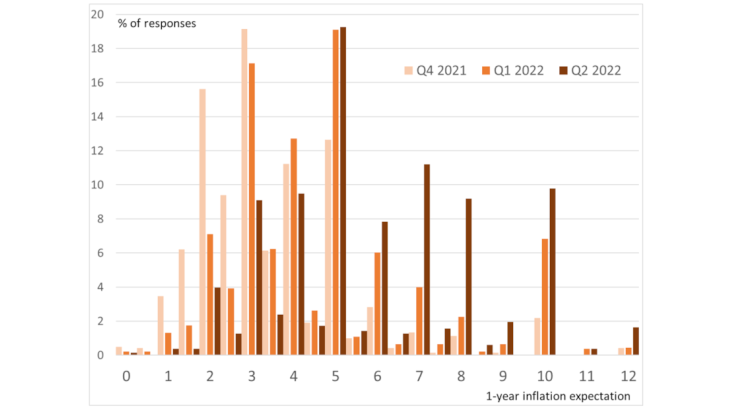

First, business leaders perceive this rise in inflation correctly; on average over the last three quarters, the average perception of inflation is close to the inflation measured by the consumer price index (CPI, INSEE). Business leaders have a relatively less upwardly biased perception of inflation than households (Savignac et al. 2021). Moreover, the dispersion of their responses has decreased significantly over the past few months and at the end of May - beginning of June 2022, almost 50% of business leaders put inflation at a level close to 5%.