The Basel III agreement led to a significant strengthening of banking regulation following the Great Financial Crisis of 2008, including by introducing new solvency and liquidity requirements. An estimate based on French data shows that these requirements have not constrained the supply of credit, but shows a relationship of partial substitutability in times of financial stress for the most poorly capitalized banks.

The Basel III agreement, which was broadly concluded in 2010 following the 2008 financial crisis and implemented from 2012 onwards, introduces a combination of banking solvency and liquidity standards for the first time at international level. To the existing risk-weighted solvency ratio, whose requirements have been tightened, it adds a leverage ratio aimed at limiting banks' indebtedness, a short-term liquidity ratio aimed at ensuring that banks have sufficient liquid assets at 30 days in a market stress situation (the “Liquidity Coverage Ratio”, LCR) and a one-year liquidity ratio (the “Net Stable Funding Ratio”, NSFR), aimed at containing transformation risk.

The banking industry expressed concerns about the potentially overly restrictive nature of this set of standards on banks' credit supply and the risks of activity escaping to less regulated sectors. While the individual impact of the various ratios has been studied and, on the whole, concluded that the current calibration of ratios does not appear excessive, the economic literature has given little attention to the combined effects of solvency and liquidity standards, due to the low historical depth of data, timing and anticipation effects associated with phased implementation and the conceptual difficulty in understanding interactions that add to the individual effects of each ratio.

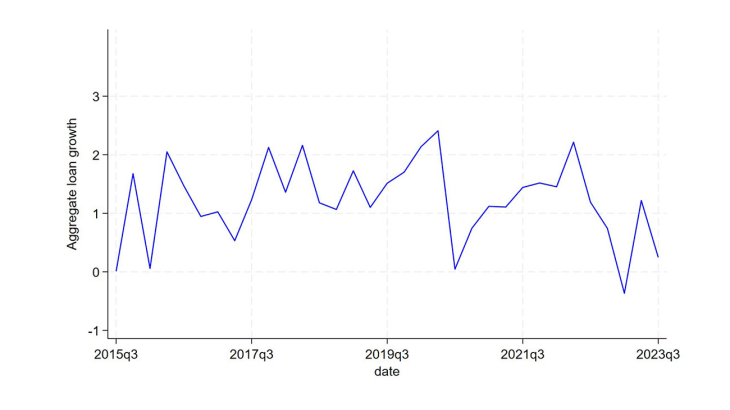

In this working paper, we propose a joint modelling of the regulatory constraints introduced by Basel III and an estimate of the effect of the interactions of these standards on banks' credit supply. We estimate an empirical model with fixed effects to analyse the combined effect of bilateral ratios on banks' credit supply. Our data covers a panel of 54 French banks on a consolidated basis for the period 2014-2023 at a quarterly frequency, that is 570 observations. We seek to explain the impact on credit growth in the non-financial private sector (households + non-financial enterprises) of the Basel 3 ratios taken two by two and their interactions by controlling for a number of economic and financial variables (including bank-specific variables -other regulatory ratios, size of the bank, loan share on the balance sheet, ratio of non-performing loans, profitability -, macroeconomic variables, as well as individual and time fixed effects). We consider that two ratios are complementary when the coefficient of the interaction term is of the same sign as the coefficients of these same ratios taken individually, because in this case the combined effect of the two ratios, which takes into account their interaction, is greater than the sum of individual effects. These ratios are considered (partially) substitutable if the signs are different.

Our results indicate that four pairwise interactions (management buffer/LCR, leverage/LCR, leverage ratio and LCR/NSFR) have a significant effect on lending growth. We also emphasize that the regulatory ratios interact more for banks with lower regulatory ratios and in periods of financial stress. More specifically, our results highlight a significant relationship of partial substitutability between the leverage ratio, the LCR and the NSFR for such banks in such periods, resulting from the positive effect of bank own funds on liquidity.

Keywords: Bank Capital Regulation, Bank Liquidity Regulation, Basel III, Stress Tests

Codes JEL : G28, G21