- Home

- Governor's speeches

- “The Savings and Investments Union: (Fin...

“The Savings and Investments Union: (Finally) turning an idea into actions”

François Villeroy de Galhau, Governor of the Banque de France

Published on 11th of September 2025

AEFR/REF Conference “Where Do Savings Go?”

Paris, 11 September 2025

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and gentlemen,

It gives me great pleasure to speak before you to mark the publication of the 158th edition of the Revue d’économie financière,i which is devoted to an essential question: “Where Do Savings Go?” I would like to pay a friendly tribute to the remarkable work of the AEFR, its President Pervenche Bérès, and the two coordinators, Marie-Laure Barut-Etherington and Pierre Bollon. Today, I shall focus on one of the three main issues they raise: mobilising European savings to support the European economy. For that, I shall take another look at a project that is not new but has recently had something of a “makeover”: the Savings and Investments Union (SIU). To keep it brief, clear and concrete, I shall start by recalling three stylised facts about European savings and investment (1), before going on to dispel three doubts (2) and then proposing five principal levers for finally turning an idea into actions (3).

1.Three stylised facts about European savings and investment

1.1. Europe does not lack savings or credit, it lacks equity.

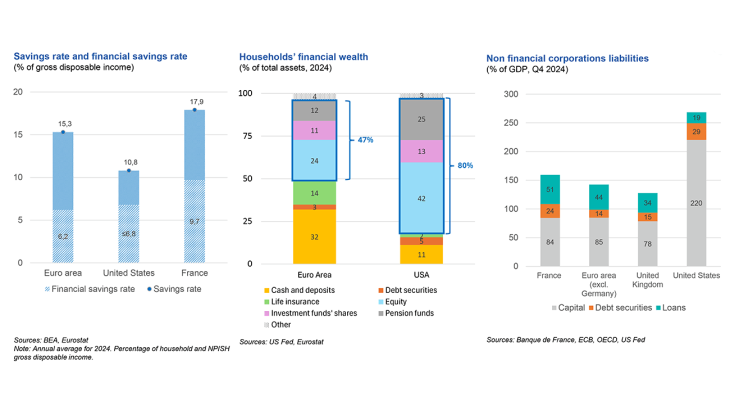

First of all, the euro area has a significant and frequently overlooked asset: a higher household saving ratio than in the United States – 15.3% of gross disposable income compared with 10.8% across the Atlantic. The gap is less stark in financial savings – due to the size of real estate savings in Europe – but the main problem is how these financial savings are allocated: they are predominantly invested in low-risk assets and far less in shares or investment funds. Europe has a wealth of savings but it lacks equity capital, which is vital to enable firms to innovate due to the higher associated risk. Non-financial corporation (NFC) equity financing amounts to just 85% of GDP in the euro area, compared with 220% of GDP in the United States. Conversely, euro area NFCs have higher levels of debt.

1.2. Europe does not lack investment, it lacks productive investment, and above all innovative investment

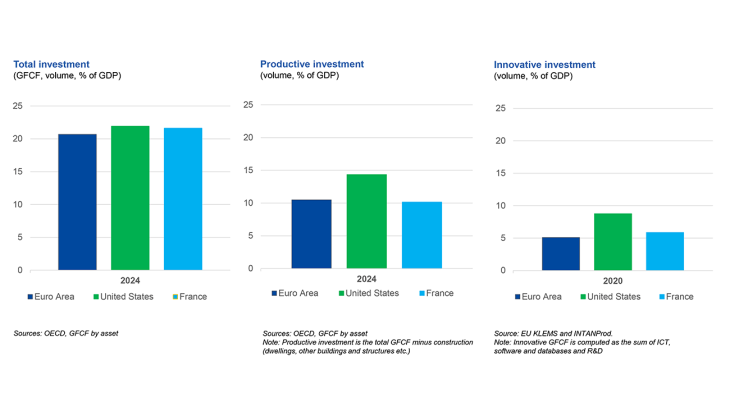

As a share of GDP, total investmentii in the euro area is almost the same as in the United States. However, productive investment (excluding investment in construction) is much lower in the euro area (10.5% of GDP compared with 14.3%). In innovative investment in particular – calculated as the sum of investment in ICT, software, databases and research and development – the gap between the two countries was already significant in 2020 (8.8% of GDP compared with 5.1%), and it has since continued to widen.

1.3. A “European” puzzle: a surplus of financial savings but a high cost of equity

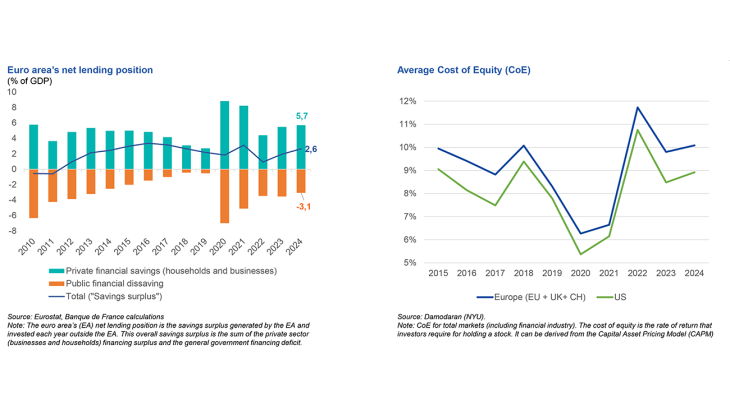

For more than a decade, Europe has had a net financial savings surplus – EUR 400 billion last year or 2.6% of GDP – which is invested in the rest of the world, especially in the United States; or it lacks productive investment – which is basically just another way of saying the same thing. But at the same time, the cost of equityiii remains higher on our continent than in the United States, and half of our large firms’ capital is held by non-residents, a significant portion of whom are American.

I’m not describing this landscape to depress you, but rather to shed light on the goals of the Savings and Investments Union. We’ve often talked about reducing fragmentation. Yes, but firstly to achieve a quantitative goal: mobilising European savings for European investment. Even more importantly, it’s about achieving a qualitative goal: supporting innovation in key sectors (digital and artificial intelligence, energy, defence). On a broad level, in “macro” terms, we have plenty of financial resources to bolster the European economy in the face of America’s radical policy shift.

iv .

2. Dispelling three doubts

The idea of a Savings and Investments Union was first put forward back in 2014, and the amount of time that has since passed occasionally gives rise to scepticism.

2.1. “Why would this time be any different?”

The project has had a new name since last year and is part of Commissioner María Luís Albuquerque’s portfolio. This is much more than just a change of brand: today, the SIU adds together, or unites, the old Capital Markets Union and Banking Union projects. We have finally stopped making that slightly theological distinction between banks and markets. Most of all, the new brand explains “what for” rather than just talking about the means: we’ve gone from a plethora of technical measures – over 30(!) – in the Commission’s 2015 and 2020 plans, to a strategic ambition endorsed by political leaders.

2.2 “You’re just paving the way for the US champions”

A second doubt – which is less openly admitted – is that by reducing fragmentation and regulatory barriers, the SIU simply leaves the door wide open for US champions. There’s clearly an advantage to keeping European markets open – notably to lower the cost of equity – but we have the means to develop European champions – because yes, we do have some, in banking, insurance and asset management. We need to pay closer attention to them on a political and strategic level – including to those in corporate and investment banking (CIB) which is a field too often neglected. And, of course, we need more cross-border consolidation to achieve critical mass.

2.3 “It’s not a lack of funding but a lack of projects”.

The third doubt is the suggestion that the real obstacle may not be a lack of financing but a lack of projects and economic opportunities in Europe. Let’s be honest, both could be true. But the answer here is “top-down”: the Letta and Draghi reports combine a deepening of the single market and a Savings and Investments Union, economic sovereignty and financial sovereignty. Rather than asking ourselves where to start, it is high time we put a complete package on the table. And that we mobilise around a deadline for putting all this into place.v Jacques Delors succeeded when he set 1 January 1993 for the single market and 1 January 1999 for the single currency. In Strasbourg yesterday,vi the Commission President mentioned a 2028 roadmap for the first time. We now need to really emphasise this, and go even faster.

3. Five levers for turning an idea into actions

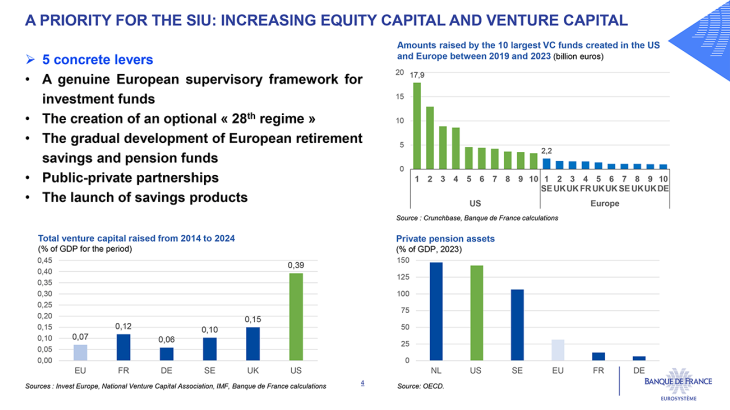

I shall now take the risk of prioritising five concrete levers for action. Only five, compared with the 21 in the excellent roadmap published in March by the Commission. But a “Top 5” to focus our energy on the central objective of increasing equity and venture capital. So I will not talk this evening about securitisation or innovative market technologies or simplification – without deregulation – or about euro-denominated safe assets, which are four desirable components, but which do not bring in capital. The order here is of no particular importance, and none of the levers can claim to be a “silver bullet”, the surefire solution. But each can and must be launched, unconditionally.

1) A genuine European supervisory framework for investment funds, based on the American SEC model, as proposed by Christine Lagarde, because it is vital to accelerate the scale-up from national to “pan-European” funds that are therefore genuinely cross-border. Between 2014 and 2025, venture capital funds raised the equivalent of 0.39% of GDP in the United States, while in Europe they raised less than a fifth of that, or 0.07% of EU GDP. What’s more, the European venture capital fund that raised the most money from 2019 to 2023 – which is actually Swedish, so from outside the euro area – is smaller than the tenth largest venture capital fund in the United States.

2) The creation of an optional “28th regime” could lower administrative costs for firms, especially the “cost of failure”. As highlighted by Olivier Coste in particular,viiEurope’s higher restructuring costs compared to the United States can discourage risk taking on the continent. The consultationviii on the 28th regime launched by the Commission in July 2025 is therefore a promising step forward, although questions still need to be answered: will the regime be just for start-ups or for all firms? Will it apply only to new inflows or to existing structures as well? Will it initially include only insolvency and company law, or will it also include labour and tax laws? Ideally it should combine ambition with speed. But if we have to choose, it will be better to go fast than to aim too broadly.

3) The Commission is stressing the need to gradually develop European retirement savings and pension funds, which could generate significant social and economic gains; they could provide long-term and patient savings. In Europe, the funds in the Netherlands and the Nordic countries are by far the most developed, and these countries manage to combine both strong social cohesion and better innovation.

4) The development of ambitious public-private partnerships in venture capital is another way of increasing the size of funds. There are some national initiatives – BPI France and TIBI in France, WINix .in Germany. But here again we need to scale up to a European level: the EIB/EIF’s European Tech Championship Initiative (ETCI) has enabled joint investments of EUR 2 billion in venture capital funds; let’s aim for at least EUR 10 billion.

5) This leaves the retail sector and the launch of savings products that are accessible to households. I hear two objections to this: investing in equity capital should be left to the professionals, to institutional investors. Yes, but we should not underestimate the potential of the retail sector for increasing the political ownership of the “Union” or the financial literacy of European citizens. Second, it will ultimately be a question of taxation, and there will be a need for European harmonisation or at the very least substantial tax breaks. The former is a somewhat utopian vision, while the latter, in my view, are not essential at this stage. There is genuine scope for simplification and standardisation. The “Finance Europe” label launched in June by France, in conjunction with Spain and Germany in particular, is a first positive step. The Swedish model, based on the widely distributed ISKx investment savings account, is one example that has proved its worth: at the end of 2023, 51% of Swedish households’ financial savings was invested in listed shares, compared with just 21% in the euro area.xi

I shall conclude with another of the treasures found in this new issue of the REF,xii the rediscovery of the Dickens classic, A Christmas Carol.xiii In a single night, the old money-lender Ebenezer Scrooge radically changes his attitude to savings and discovers the joys of sharing them... or, in our case, of using them wisely. It’s a similar awakening that I would like to see in Europe, centred around a genuine SIU. We will probably need more than one night, but it is high time we set ourselves a mobilising deadline and transformed a good idea into a few concrete actions: a little, done well and seen through to the end. Thank you for your attention.

i AEFR (2025), “Où va l’épargne ?”, Revue d’économie financière No. 158, 2nd quarter.

ii Measured as the volume of gross fixed capital formation (GFCF).

iii Defined as the return an investor requires in order to purchase or retain a firm’s share given the risk it poses (Banque de France (2017), “Cost of equity and corporate profitability in France”, Eco Notepad blog, 4 October).

iv Villeroy de Galhau (F.) (2025), Letter to the President of the French Republic: From stupefaction to a general mobilisation, how to respond to America’s policy shift, 9 April.

v Villeroy de Galhau (F.) (2025), “A mobilising deadline for seizing “Europe’s moment”, speech, 14 May.

vi Von der Leyen (U.) (2025), 2025 State of the Union Address, speech, Strasbourg, 10 September

vii Coste, O. and Coatanlem, Y. (2024), “The Cost of Failure and the Quest for Competitiveness: Disruptive Innovation as a Catalyst”. IEP Policy Brief No. 24, IEP Bocconi

viii European Commission (2025), 28th regime – a single harmonized set of rules for innovative companies throughout the EU, 8 July.

ix Wachsturms und INnovationskapital für Deutschland (Capital and growth for innovation for Germany).

x Investeringssparkonto.

xi European Savings Institute (2025), “Households’ long-term savings and stock market participation in Europe”, February.

xii Slama (A.-G.) (2025), “Charles Dickens et le « miracle » en économie”, Revue d’économie financière No. 158, 2nd quarter, pp. 249-256.

xiii Dickens (C.) (1843), A Christmas Carol, Chapman & Hall, London.

Download the full publication

Updated on the 28th of November 2025