- Home

- Governor's speeches

- Disruptions in the international monetar...

Disruptions in the international monetary landscape: threats or promises?

François Villeroy de Galhau, Governor of the Banque de France

Published on 6th of January 2026

G7 IMS Conference, Paris – 6 January 2026

Speech by François Villeroy de Galhau, Governor of the Banque de France

Dear and honored guests, Ladies and Gentlemen,

I would like to start by extending, on behalf of the Banque de France, our warmest wishes to you and your loved ones. This year, France is taking on the G7 Presidency, with a number of priorities – addressing global imbalances but also delivering practical progress on six financial stability items: cross-border payments, NBFI, cybersecurity, AI, quantum technology and climate-related risks. It is therefore my pleasure to introduce today’s stimulating sessions dedicated to the challenges of digital innovation and the consequences for the International Monetary System (IMS).

Let me first outline two major disruptions, a fast-moving technological one and a slow-moving geopolitical one – to quote Governor Panetta’s recent speechi – (1), before sharing with you a triangle of three objectives, three “S’s” that should guide us in the transition to a new global landscape for payments (2).

1. Two major disruptions are affecting the international monetary landscape

1.1. A technological disruption

The first disruption is technological: financial innovations have the potential to reshape the IMS. Among them, tokenisationii is accelerating end-to-end transaction execution and reducing costs, notably through “smart contracts”. It can revolutionise cross-border payments and possibly domestic payments.

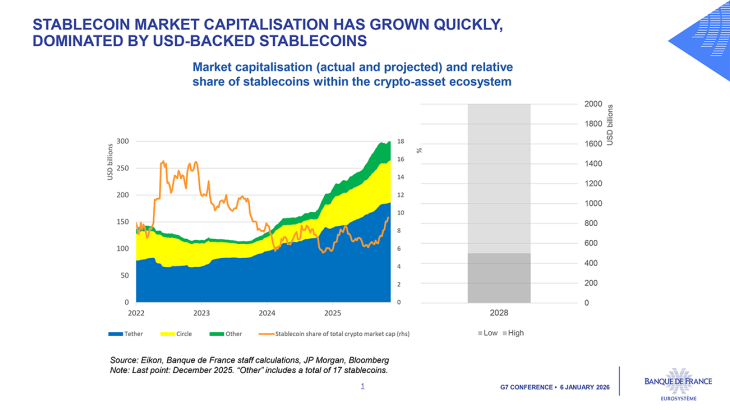

Tokenisation could affect the IMS through two opposite forcesiii. On the one hand, it may reinforce the US dollar’s centrality with a potentially rapid development of stablecoinsiv in USD held outside the United States. Supported by a resilient US financial sector and actively promoted by the US administration, stablecoins – 99% USD-backed so far – could reach a market capitalisation of between USD 500 billion and USD 2 trillion by 2028 according to some projections.v

The very breadth of this range illustrates the uncertainty surrounding potential uses: will stablecoins remain confined to the realms of crypto and cross-border exchanges, or will they quickly expand to domestic financial or even “economic” transactions? On the other hand, innovations lowering the cost of cross-border payments may weaken the international role of the USD and strengthen multipolarity within the IMS by offering third countries the opportunity to develop exchanges in other currencies or in stablecoins backed by other currencies.

1.2. A geopolitical disruption

The second disruption is geopolitical, and the first days of 2026 already confirmed we live in a new geopolitical world. Let us say it upfront: despite a multipolar global economy, the IMS is still dominated by the USD in all the areas considered.

This strong inertia within the system is driven by powerful network externalities, which amplify the US dollar’s strong fundamentals.

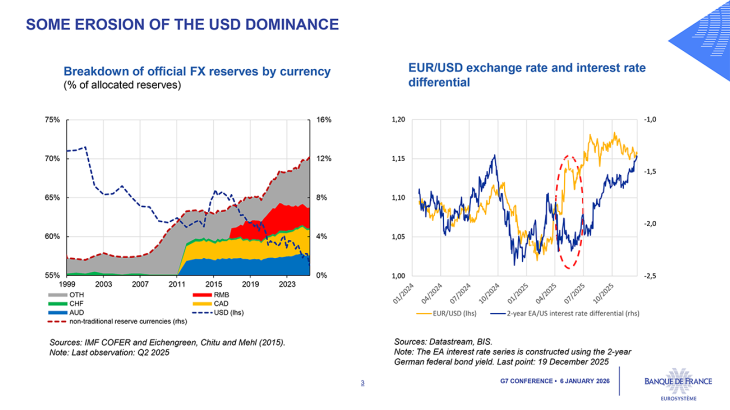

However, some recent US policies have undermined some pillars of the USD dominance by attacking the Fed’s independence, raising doubts as to US fiscal discipline, and imposing tariffs that diminish US integration with the global economy. Moreover, fears that the US could increasingly weaponise USD-based global payments are leading some jurisdictions to develop alternative payments systemsvi. These US policies are undermining global investors’ confidence in USD assetsvii and will likely fuel the gradual trend toward diversification: between Q2 2020 and Q2 2025, the share of the USD in allocated official reserves declined by 5 percentage points. Another sign of this erosion of confidence has been the decoupling, although transitory, between the EUR/USD exchange rate and the EA/US 2-year interest rates differential after the 2 April 2025 US tariff announcement.

2. How to address these disruptions? A “compatibility triangle” of 3 “S’s”

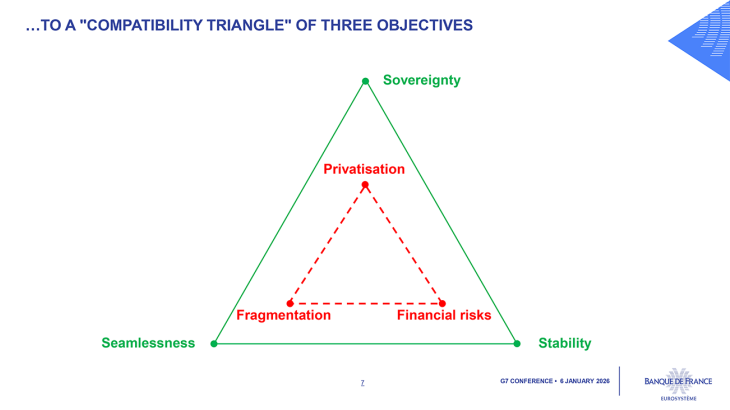

These two developments can be positive: tokenisation represents a highly promising innovation for payments, and the pursuit of diversification could make the IMS more balanced. Yet both developments also carry potential contradictions, and their combination may give rise to at least three threats: the privatisation, and/or the increased “Americanisation”, of money; the fragmentation of payments; and greater financial instability.

How can we get the best of the two worlds? I will now share with you a triangle of three objectives, which is for once a “compatibility triangle”, three “S’s”.

2.1. Sovereignty

Let me start with the first objective: preserving monetary sovereignty, understood as the ability of a jurisdiction to issue its own currency to finance its real economy, conduct monetary policy in line with its own objectives and maintain independence in payment systems. Launched more than 25 years ago, the euro is Europe’s greatest leap towards sovereignty and a huge popular successviii, with the support of 82%ix of European citizens. But today this hard-won achievement could be threatened if we don’t secure the pivotal role of “sovereign” central bank money in the digital world. The Eurosystem has already taken steps to offer a digital euro for the general public and a wholesale central bank digital currency (CBDC) for the interbank market. The first project aims to issue a “digital banknote+” designed to transpose the features of cash to the digital world, while preserving the anchoring role of central bank money. Last month, the Council of the EU unanimously supported the project and agreed on a fully-fledged digital euro, covering both online and offline use cases, that would be accepted universally in the euro area and offer a high degree of privacy. After the vote expected in the European Parliament in May, we intend to run a pilot as early as 2027 and to potentially launch the digital euro in 2029.

The second project is less well-known than the first, but it is even more important. The Eurosystem and the Banque de France are actively working on it as part of the Pontes project: by the end of 2026, a pilot solution of wholesale CBDC in euro will enable financial intermediaries to settle their tokenised assets in central bank money via a distributed ledger which will be linked to the TARGET Services.x In parallel, as part of the Appia project, the Eurosystem will work on interoperability standards and how to deal with tokenised assets in collateral management for monetary policy purposes. In the longer run, building on both Pontes and Appia projects, the Eurosystem intends to design a new generation of critical infrastructures for the European post-trade market. This could be achieved via a European platform where public and private blockchains could communicate seamlessly, allowing atomic transactions between tokenised central bank money – i.e. CBDC –, tokenised commercial bank money and tokenised assets.

While the provision of a CBDC is essential, it is not intended to cover all uses in the tokenised economy. It is also necessary to have tokenised commercial bank moneyxi so that the European two-tier monetary system can adapt coherently to the tokenisation revolution, while fully preserving monetary sovereignty. The technical choice remains open between tokenised bank deposits or EUR-backed stablecoins issued by banks: we could have both, but we must not end up with neither.

2.2. Seamlessness of payment systems

The second objective is the seamlessness of payment systems across currency blocks: a multi-polarisation of the IMS must not lead to monetary fragmentation. A lack of interoperability between each block’s payment systems may indeed fragment international liquidity and harm the Global Financial Safety Net (GFSN) by undermining reserves’ convertibility. It may also threaten the “singlenessxii” of each currency: in practice, the price of one USD could possibly differ in New-York, Frankfurt or Beijing.xiii

Central banks, which ensure the smooth functioning of payment systems, should therefore promote financial innovations enhancing cross-border payments, beyond tokenisation. A first avenue, in line with the G20 Roadmap, is the interlinking of fast-payment systems (FPS), already deployed domestically in over 100 jurisdictions worldwide. The Eurosystem is actively engaged in interlinking its FPS, TIPSxiv, with those of other countries, either bilaterally – with India’s UPIxv and Switzerland’s SIC IPxvi – or multilaterally, as we consider connecting TIPS to a network of instant payment systems through the Project Nexus, led by the BIS. Another promising avenue, explored by the BIS Project Agorá – that will nevertheless require more time – is the development of shared ledgers to connect tokenised commercial bank monies and central bank digital currencies for the settlement of cross-border payments.

2.3. Stability

The third corner of my triangle is stability: we need to ensure global financial stability in an increasingly multipolar and digitally transformed IMS.

Stablecoin markets are expanding rapidly and may eventually represent a challenge to global financial stability due to their inherent vulnerabilities – chief among them is the risk of de-pegging – and their growing interconnectedness with the traditional financial system. Another concern for the stability of the IMS is that a new form of the “Gresham’s law”xvii might apply: the coexistence of several stablecoins and CBDCs could lead to an unbundling of the traditional “functions of money”xviii. Lower switching costs may enable economic agents to retain CBDCs – benefitting from central bank credibility and safety – as a store of value, while using the riskier stablecoins as a medium of exchange. In such a scenario, a handful of dominant private issuers could exert disproportionate influence over global payments, raising concerns about market concentration and financial stability.

How should we respond? Europe has a head start with the MiCAxix regulation (MiCAR), but it does not fully address the risks that could arise from a rapid adoption of stablecoins issued by non-banking and non-European actors. Enhancing the MiCA regulatory framework is necessary to restrict the use of stablecoins for retail payments, particularly when they are backed by a currency other than the euro. MiCAR would also benefit from a much stricter regulation of the multi-issuance of the same stablecoin within and outside the EU to reduce regulatory arbitrage risks in times of stressxx.

But a more multipolar IMS could also be a more stable one. It would help deal with the modern version of the “Triffin dilemma”xxi: the supply of USD global safe assets is currently limited by the fiscal capacity of the US, while demand for these assets is bound to increase.

In this context, the creation of a euro-denominated safe asset merits our renewed attentionxxii. We can begin pragmatically by exploring three options – enhancing existing EU frameworks, transforming part of sovereign debt into supranational debt and/or merging existing supranational debt –, each of which would significantly increase the volume of available safe assets. If several options coexist for a time, they may later converge.

Let me conclude: facing these disruptions in money and payments, it is common but too easy to oppose innovation and regulation, as well as private and public stakeholders. The truth is that real progress on the three “S’s” I have just outlined – sovereignty, seamlessness and stability – requires all these ingredients. It requires pragmatic, non-ideological public-private partnerships. “Agile pragmatism” is my favourite motto for monetary policy. Be assured we will also apply it rather than political systematism to the practical deliverables of the 2026 G7 French Presidency. Thank you for your attention.

i Panetta (F.) (2025), “The struggle to reshape the international monetary system: slow- and fast-moving processes”, Whitaker Lecture 2025, Dublin, 9 December

ii Tokenisation is the process of issuing and registering a financial or non-financial asset in the form of a digital token, using distributed ledger technology, such as blockchain.

iii Bénassy-Quéré (A.) (2025), “Is tokenization a game-changer for the International Monetary System?”, 15 September

iv Type of crypto asset whose value is designed to remain stable relative to one or more assets, such as an official currency or basket of currencies.

v J.P. Morgan (2025), “What to know about stablecoins”, Global Research, 4 September; Bloomberg (2025), “Stablecoin Sector May Reach $2 Trillion: Standard Chartered”, 15 April

vi Amsellem (L.), Crespy (N.), Ishii (K.), Grieco (F.) (2025), “Can innovation in payment systems affect the ranking of international currencies?”, Banque de France Bulletin 258, Article 1, 11 July

vii Villeroy de Galhau (2025), “Europe has the means to respond strategically to the currency revolution”, interview with “Le Grand Continent”, 25 September

viii Bénassy-Quéré (A.), Villeroy de Galhau (F.) (2025), “Stablecoins : The real economic or ideological disruption lies in the possible privatization of money”, Le Monde, 4 November

xix Standard Eurobarometer 104 – Autumn 2025

x ECB (2025), “ECB commits to distributed ledger technology settlement plans with dual-track strategy”, press release, 1 July

xi Villeroy de Galhau (F.) (2025), “Fintechs and sovereignty: three pillars to be strengthened together”, speech at the ACPR-AMF Fintech Forum, 9 October.

xii Singleness ensures that monetary exchange is not subject to fluctuating exchange rates between different forms of money, whether they be privately issued money (eg deposits) or publicly issued money (eg cash).

xiii Bénassy-Quéré (A.) (2025), “Is tokenization a game-changer for the International Monetary System?”, 15 September

xiv TARGET Instant Payment Settlement (TIPS)

xv Unified Payments Interface

xvi ECB (2025), “ECB and SNB explore link between instant payments systems”, 29 September

xvii According to Gresham’s law, bad money tends to drive good money out of circulation.

xviii Brunnermeier (M.K.), James (H.), Landau (J.-P.) (2019), “The Digitalization of Money”, NBER Working Paper Series, Working Paper n°26300, September

xix Markets in Crypto-Assets (MiCA), Regulation EU 2023/1114 of 31 May 2023.

xx Villeroy de Galhau (F.) (2025), “Fintechs and sovereignty: three pillars to be strengthened together”, speech at the ACPR-AMF Fintech Forum, 9 October

xxi Triffin (R.) (1960), Gold and the Dollar Crisis : The Future of Convertibility, Yale University Press ; Farhi (E.), Gourinchas (P.-O.) Rey (H.) (2011), “Quelle réforme pour le système monétaire international” in Bénassy-Quéré (A.) et al. (2011), Réformer le Système Monétaire International , rapport du Conseil d’analyse économique, n°99, pp. 51-94.

xxii Villeroy de Galhau (F.) (2025), “The international role of the euro and the development of European safe assets”, speech at the ESM, Luxembourg, 2 October.

Download the full publication

Updated on the 6th of January 2026