The international role of a currency is traditionally associated with the three functions of money: medium of exchange, unit of account, and store of value (Krugman, 1980). Furthermore, the theoretical corpus looks at a currency’s internationalisation using three complementary approaches that integrate: i) market aspects (transaction costs associated with the use of a currency, in particular); ii) institutional issues (government decisions); and iii) geopolitical issues, where the internationalisation of a currency is part of a broader international political order (Bénassy-Quéré, 2016).

Current initiatives aimed at improving cross-border payments mainly concern the use of an international currency in its function as a medium of exchange and can be analysed using the three approaches mentioned above. This article presents these strategic initiatives for the Eurosystem and examines their effects on the international role of currencies from a geopolitical and institutional perspective. It concludes with a discussion of how these initiatives could affect the transaction costs associated with international currencies.

1 The dominance of the dollar is threatened by geopolitical tensions and innovative payment systems

An international monetary system organised around the US dollar and, to a lesser extent, the euro

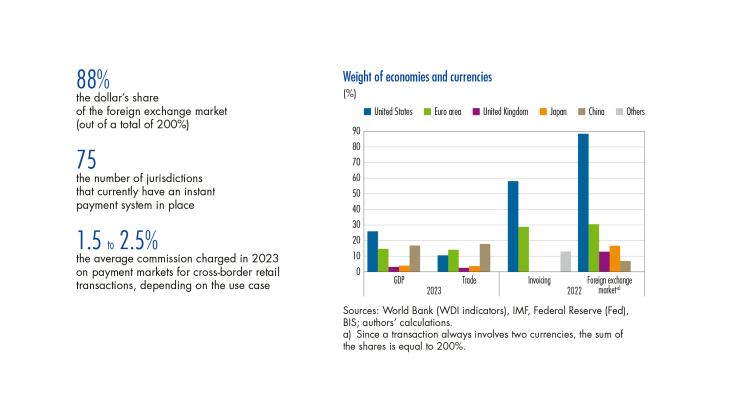

In the context of international payments, the attractiveness of the US dollar (hereinafter referred to as the dollar) stems in particular from its role as a medium of exchange, which gives it a dual function as a invoicing/settlement currency and a vehicle on the foreign exchange market. The dollar’s dominance in this role is illustrated by the gap between the weight of the US economy (around 26% of GDP and 11% of world trade in 2023) and the use of its currency in international payments (over 50% of trade denominated in dollars in 2022) and on the foreign exchange market (with the dollar present in around 88% of currency pair trades in 2022) – see Chart 1. The dollar’s dominance as a vehicle currency is particularly noticeable on the foreign exchange market, where even trade between major currencies, such as the euro and the pound sterling, is predominantly carried out indirectly through the dollar. In 2022, 74% of transactions involving the euro were against the dollar, and only 5% against the pound sterling and 3% against the yen. In other words, only 12% of transactions were carried out without involving the dollar. …