- Home

- Governor's speeches

- « The international role of the euro an...

« The international role of the euro and the development of European safe assets »

François Villeroy de Galhau, Governor of the Banque de France

Published on 2nd of October 2025

ESM, Luxembourg – 2 October 2025

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

It is a great pleasure to speak before you today in Luxembourg. I would like to express my sincere gratitude to my friend Pierre Gramegna, Managing Director of the European Stability Mechanism (ESM). Luxembourg holds a unique place in the history of European integration. It is the birthplace of Robert Schuman. But it is less known that, in 1963, Luxembourg listed the world’s first international bond denominated in a foreign currency, an innovation that helped finance one of the most strategic projects of its time: the Autostrada del Sole, linking northern and southern Italy.

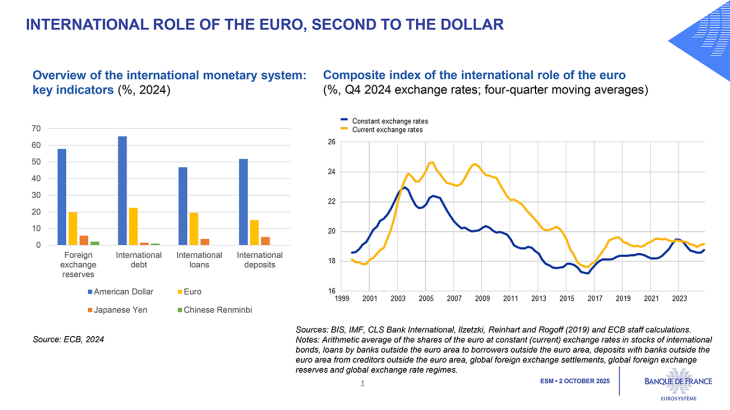

Since 1963, much progress has been made in facilitating cross-border financing, and we managed together the tremendous success of the euro: let me pay tribute here to Pierre Werner and his 1970 report. Yet, dramatic changes in the new world order over the past three years call for a bold step forward to strengthen the international role of the euro.

The US administration’s aggressive protectionist stance and defiant attitude toward international cooperation are increasing global uncertainty and fragmentation. Confidence in the dollar as the safe-haven currency could be reviewed by market players. i Financial innovations, like stablecoins, may change the dynamics of the international monetary and financial system.ii Some consider that our international system is at risk of falling into the “Kindleberger trap”, iii with no clear hegemonic power acting as a stabilizer and public goods provider.

As dramatic and dark as these changes may seem, we are fortunate to face them having the euro, and they are an opportunity for our currency. iv We shall not be naïve in believing that the euro will replace the US dollar soon. Let me also be clear: promoting the international role of the euro does not mean expecting its exchange rate to rise. We have no exchange rate target, but we are very attentive to the possible effects of a stronger euro on the inflation outlook.

Surprisingly, this international role was not stipulated in the objectives of the European treaties as the euro was originally created for internal purposes. Yet, the reasons that led the ECB until recently to favour a neutral stance on the euro's global role, notably the fear of losing control over monetary policy, are no longer valid. In her seminal speech in Berlin last May, President Lagarde mentioned three key factors to reach the full potential of a “global euro” v : (i) geopolitical credibility, (ii) legal and institutional integrity, and (iii) economic resilience. As my colleague José Luis Escrivá recently put it, there is a chance to move toward an international monetary system that relies less on one single global currency. vi Today, I will focus on the economic pillar and the relevant tools we can use to enhance the international role of the euro. The debate is no longer about the strategic “why”, it is about the practical “how”.

I will first discuss how increasing the external appeal of our single currency goes in parallel with strengthening internal integration (I). Second, I will share some remarks on how we can make progress on the issuance of a European safe asset (II).

I. Strengthen internal integration to boost external attractivity

First emergency: Single market and Savings and Investments Union

I firmly believe that the attractiveness of our currency ultimately stems from deepening integration within our Union. In this respect, there is a ‘happy coincidence’ between the Eurosystem's internal objectives and the external dimension of the euro. vii Deeper, more attractive and easier to navigate European capital markets would encourage savings to stay here in Europe, strengthen the financing of our companies and boost their innovation and competitiveness. This in turn would drive greater demand for euro-denominated assets and bolster the euro’s international role. To this end, our task is clearly defined: completing the Single market and establishing a genuine Savings and Investments Union (SIU), as outlined in the Letta and Draghi reports. viii .

26 years after having established our monetary sovereignty, it is high time to complete our economic sovereignty and financial sovereignty. One practical and yet critical step is to set a clear, "mobilizing" deadline ix Jacques Delors succeeded when he set 1 January 1993 as the deadline for the Single market and 1 January 1999 for the single currency. Why don’t the Commission and the Council put forward now such a comprehensive package, with a clear implementation date? The 1/1/2028 would be thirty-five years after the single market. But, if we don’t react fast, we are at serious risk that the window of opportunity will close. This is my strong call in Luxembourg, perhaps the last possible call.

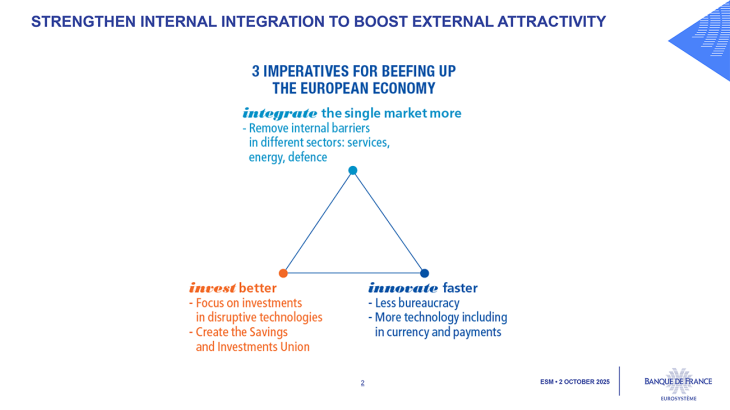

Let me sum up the crucial mobilisation with three ‘i's.’ x .

First, we need to integrate the Single market more. In purchasing power terms, our single market is worth EUR 17.9 trillion, which makes it nearly as big as that of the US (EUR 18.4 trillionxi). However, it is less attractive because it remains still fragmented.

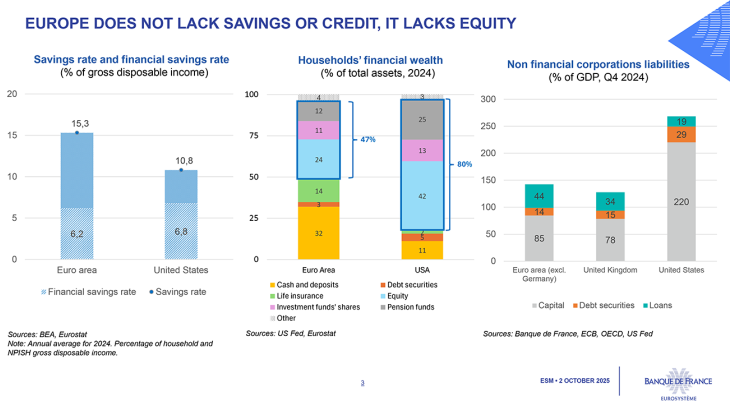

Second, Europe must invest and save better. The euro area household saving ratio is more than 15% of gross disposable income, which is 4 points higher than in the US (11% of GDI). xii . This financial windfall is insufficiently channelled into European corporate equity financing. Non-financial corporation (NFC) equity financing amounts to just 85% of GDP in the euro area, compared to 220% of GDP in the United States. This is one of the main reasons why Europe lags behind on innovation, and still more on disruptive innovation. We need to beef up European venture capital. Between 2014 and 2025, venture capital funds raised the equivalent of 0.39% of GDP in the United States, compared to 0.07% for European players.

To turn ideas into actions and to focus on equity, I propose to prioritize five levers, out of the 21 proposed in the Commission roadmap. The order does not matter, but all of them must be launched unconditionally and urgently:

(i) a genuine European supervisory framework for investment funds to accelerate the scale-up from national to “pan-European” funds.

(ii) the creation of an optional “28th regime” with a common EU-wide set of business law rules with the aim of lowering administrative costs for firms doing business in several EU countries. Although certain questions remain, the Commission consultation on the subject is a promising step forward.

(iii) the gradual development of European retirement savings and pension funds.

(iv) the implementation of ambitious public-private partnerships. Drawing on the experience of the EIB and its European Tech Champions Initiative (ETCI), we should leverage private investors in the venture capital market by public funds.

(v) introducing European retail investment products through simplification and standardization. The Commission is already working on a blueprint for a European savings product.

Third, we need to innovate faster. Less bureaucracy, but also more technology including in our core business of currency. The rapid surge of stablecoins in USD, dominated by American players, xiii raises the risk that our money will become “privatised” and “de-Europeanised.” In this context, the creation of a wholesale central bank digital currency (CBDC), as well as a digital euro for retail, are both urgently needed, not only to strengthen our economic and financial sovereignty, but also to enhance the global standing of the euro.

Some additional paths to leverage the euro

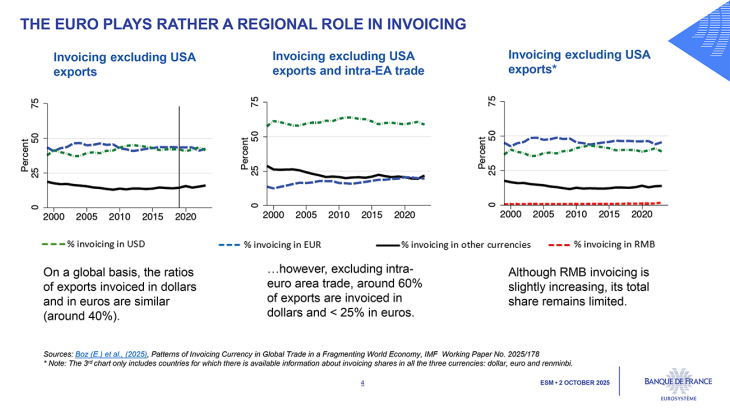

Beyond the Single market and the SIU, we must also explore other paths. Giving greater prominence to invoicing in euros is one of them. Excluding US exports and intra-euro area trade, around 60% of global exports are invoiced in US dollars and less than 25% in euros. xiv

Admittedly, invoicing denomination stems largely from private and complex decisions xv , and exhibits a persistent pattern. xvi Still, geopolitical alignment plays a role in this choice, as China illustrates with the renminbi. We could leverage EU negotiations with trade partners that have been hit hard by America’s new protectionist measures (e.g. India, Switzerland, Indonesia).

Furthermore, some of our actions as Eurosystem can make euro invoicing more attractive. The provision of euro liquidity lines to non-euro area central banks (so called EUREP) can be expanded further, which, together with deeper capital markets, would make it more attractive for firms and banks to fund and invoice their commercial activities in euros. xviiIn addition, pushing forward the use of central bank digital money for wholesale transactions on distributed ledger platforms could also contribute to facilitating trade denominated in euros. xviii Central banks along with the ECB are also working to make cross-border payments faster and more efficient by connecting instant payment systems across jurisdictions.xix Today TARGET services already accept other currencies such as those of Sweden and Denmark; tomorrow they should be interconnected to India, Switzerland, but also in my view possibly UK, Canada or Brazil.

Ultimately, we must reinforce the virtuous cycle between growth, size of capital markets, and international currency use.xx But, on top of this, a sufficient amount of safe assets helps create a reliable environment for investors, even in times of stress. This virtuous circle explains the rise of the US dollar since the end of World War II. Europe has the potential to set in motion a similar self-reinforcing cycle. But this will be much more powerful if we promote deep and liquid markets for European safe assets.

II. A catalyst for the international role of the euro: developing the market for safe assets.

Let me say upfront that advocating for a European safe asset does not and cannot mean advocating for fiscal indiscipline or mutualization. There is little doubt that fiscal consolidation must take place and can be achieved in Member States where it is needed, starting with my own country. As my colleague Joachim Nagel noted, this will improve sovereign bond ratings and thus the amount of national assets perceived as safe. xxi

Let's face it: there is a relative scarcity of safe assets in Europe.

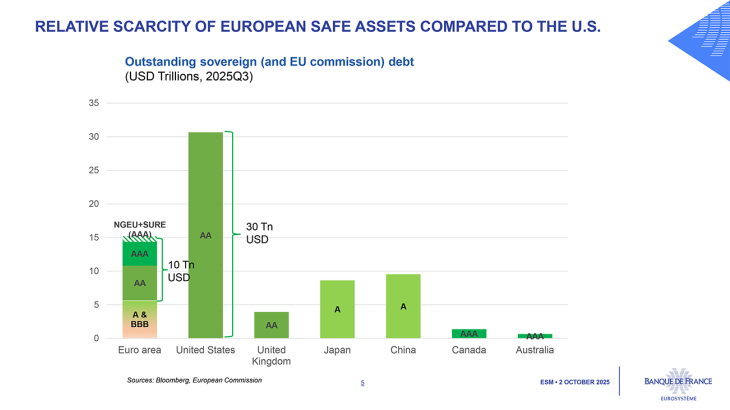

Even when combining supranational debt (a little over 1 USD trillion) with sovereign bonds rated at least AA in the Euro area [S&P] (almost 9 USD trillion), the total amounts to barely 33% of U.S. Treasuries (over USD 30 trillion). How can we expand the supply of European safe assets? There is no silver bullet, but broadly speaking we have three main levers at our disposal: xxii

A. Merging existing supranational debt

B. Transforming existing national sovereign debt into genuine European sovereign debt

C. Creating and rolling over new supranational debt

Each option involves a trade-off between feasibility and ambition. Let me briefly dig into each of them.

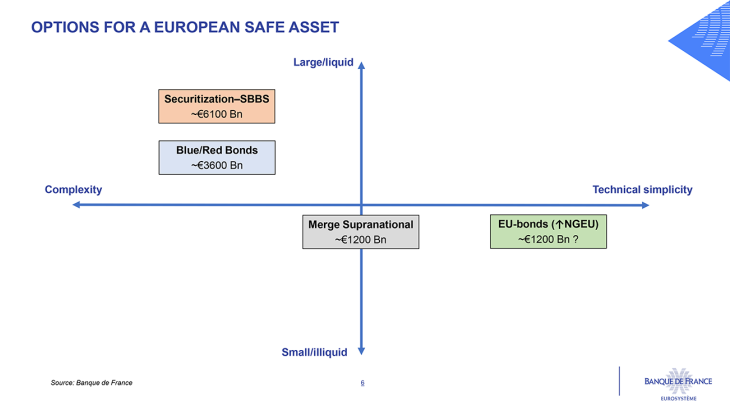

A. Merging existing supranational debt (Commission, ESM, EIB) may appear straightforward. The impact in terms of size would be limited – on aggregate it would amount to around € 1.2 trillion – but the signalling effect would be powerful. It would nevertheless require addressing some legal complexities, as these are institutions with different legal foundations. To circumvent the latter, an option may be to purchase or to pool these securities and issue a common Eurobond in exchange, with a common debt agent. And this brings us to the next set of options: transforming existing debt.

B. We could transform part of sovereign debt into supranational debt (or, even better, into genuine European sovereign debt) through financial engineering. xxiii Various solutions have been proposed since the euro area crisis and, in some cases, have even been put in draft legal texts. These essentially involve pooling or withdrawing a large share of sovereign bonds, issuing Eurobonds in exchange, and introducing seniority structures to ringfence a “safe” tranche against default riskxxiv . This “partial transformation” would help to create more European safe assets without adding to the EU’s fiscal burden: up to €6 trillion in supranational bonds in the Euro area, xxv together with the remaining AA-rated sovereign bonds.

The “blue/red bonds” option, proposed in 2010 by Delpla and von Weizsäcker and more recently by Blanchard and Ubide xxvi consists in replacing part of sovereign debt by supranational “blue bonds” issued by the EU (up to 25% of the aggregate GDP), backed by Member States’ tax revenues, and ranked legally senior to national “red bonds.”. Appealing as it looks, it raises some issues, for instance about the coordination between national and supranational debt issuers during the “transition” period, or the liquidity of remaining “red bonds” as the market share of “blue bonds” gradually increases.

A second financial engineering option, the so-called “ESBies”, has been proposed among others by Brunnermeier.xxvii It consists in a securitisation arrangement that would, in principle, be easier to implement than capital-based structures like a European Debt Agency. xxviii Rebranded as sovereign bond-backed securities (SBBS), a proposal was put forward by the Commission in 2018. While this initiative was met at the time with limited support, it is worth revisiting it with fresh eyes.

C. Last but not least, a feasible step to strengthen the supply of European safe assets is to build on and enhance existing EU frameworks, such as SURE and NGEU. xxix- The launch of the NGEU programme in 2021 marked a milestone in European debt markets. The Commission’s recent measures (a unified funding approach, the launch of repo facilities)xxx are fostering a more complete and integrated EU-bond market. Investors’ appetite has been strong, with EU-bonds quickly gaining recognition as a credible benchmark asset for international investors. A (limited) possible start would be to roll over the existing NGEU debt, rather than reimbursing it from 2028.

The main advantage of leveraging the success of NGEU lies in its comparative technical simplicity. We are talking about plain vanilla bonds, that are widely accepted by markets. Politically, it remains more challenging: some may consider that aiming for a common debt is not timely when some large Member States face strained public finances. As said, this should not be seen as a license for some countries to free-ride. Rather, joint debt should be issued to fund only investments that raise potential growth and finance European public goods. We could consider, for example, some EU-bonds issuance earmarked for financing the new needs in defence infrastructures and their industrial integration xxxi replicating the NGEU model.

Let me sum up and look ahead. All the options I have just highlighted are worth our renewed attention. May I, here in Luxembourg, revisit the spirit that guided Pierre Werner in 1970, and later Jacques Delors, who drew inspiration from it in his 1989 report, and take three lessons from them?

1. First, to set a clear long-term ambition: for them, it was a single currency; for us today, it is the creation of a euro-denominated safe asset.

2. Second, to accept pragmatic steps along the way: I propose that we begin by exploring various avenues for developing euro safe assets, each of which would significantly increase the volume available. If several coexist for a time, they may later converge. But if none exist within three years — the duration of the first phase of the Werner Plan — the consequences would be far more serious.

3. Third, to stay the course regardless of international monetary turbulence — and precisely because of it. We all know that the Werner Plan had to contend with the collapse of the Bretton Woods system in 1971… yet it remained, albeit with extended timelines, the inspiration behind the EMS and later the EMU.

Today, we do not face at this stage the same kind of international monetary crisis, but we no longer have more flexibility with timelines. This must be Europe’s moment — and the euro’s moment. It is now or never: emerging currencies will not wait for us.

Let’s come back to the first Eurobonds issued here in 1963. The truth is that these bonds were denominated in dollars at the time. Our challenge today is to develop true Eurobonds, i.e. bonds issued in euros at the European level and that are seen as sovereign bonds.

Financing tools carry with them more than financial capacity. They materialize a vision. Today, we are once again called upon to show our spirit of ambition. Our Union now faces even greater challenges, which demand collective solutions — from defence and security to the green and digital transitions. And our Union must complement its monetary sovereignty with economic and financial sovereignty.

By completing this unfinished work, we would not only honour the pioneering spirit of Robert Schuman and the founding fathers, but even more serve well our fellow European citizens by building confidence in our shared future.

i Posen (A.S.) (2025), “The New Economic Geography”, Foreign Affairs, 19 August

ii Landau, (J. P.), « Un monde financier sans actifs sûrs », Les Échos, 20 August

iii Kindleberger (C.) (1973), The World in Depression, 1929-1939. Berkeley: University of California Press

iv Rey (H.) (2025), « Une fenêtre d’opportunité pour l’euro », Le Monde, 11 May

v Lagarde (C.) (2025), Earning influence: lessons from the history of international currencies, speech, 26 May

vi Escrivá (J.L.) (2025), The future of payments and the international role of the euro, speech, 18 September

vii Villeroy de Galhau (F.) (2025), A mobilising deadline for seizing “Europe’s moment”, speech, 14 May

viii Letta (E.) (2024), Much more than a market, April. Draghi (M.) (2024), The future of European competitiveness, September

ix Villeroy de Galhau (F.) (2025), A mobilising deadline for seizing “Europe’s moment”, speech, 14 May

x Villeroy de Galhau (F.) (2025), Letter to the President of the Republic, 10 April

xi GDP PPP in current euro in 2024, source: AMECO/European Commission, October 2024.

xii Villeroy de Galhau, (F.) (2025), The Savings and Investments Union: (Finally) turning an idea into actions, speech, 11 September

xiii As of August 2025, dollar stablecoins represented 99% of the market, with two issuers (Tether and Circle) accounting for 90% of the total. Source: Sentora Research

xiv Excluding U.S exports and intra-euro area trade. See Figure 4 in Boz (E.) et al., (2025), “Patterns of Invoicing Currency in Global Trade in a Fragmenting World Economy”, IMF Working Paper No. 2025/178

xv Amiti (M.), Itskhoki (O.), Konings (J.) (2020), “Dominant Currencies: How Firms Choose Currency Invoicing And Why It Matters”, NBER Working Paper n°27926

xvi Boz (E.) et al. (2022), “Patterns of invoicing currency in global trade: New evidence”, Journal of International Economics, Vol. 136

xvii Schnabel (I.), Panetta (F.) (2020), The provision of euro liquidity through the ECB’s swap and repo operations, Blog, 19 August

xviii ECB (2025), Eurosystem expands initiative to settle DLT-based transactions in central bank money, 20 February

xix ECB (2024), Eurosystem launches initiatives to improve cross-border payments by interlinking fast payment systems, 21 October

xx Lagarde (C.) (2025), Earning influence: lessons from the history of international currencies, speech, 26 May

xxi Nagel (J.) (2025), “Building blocks for a strong and sovereign Europe”, speech, 22 September

xxii Lane (P.) (2025), “The euro area bond market”, speech, Dublin, 11 June; Gossé (J.-B.), Mourjane (A.) (2021), “A European safe asset: new perspectives”, Bulletin n°234, article 6, Banque de France, April

xxiii Lane (P.) (2025), “The euro area bond market”, speech, Dublin, 11 June

xxiv For a comprehensive comparative analysis of some of the options discussed in this speech, see Leandro (A.), Zettelmeyer (J.) (2019), “Creating a Euro Area Safe Asset without Mutualizing Risk (Much)”, Working Paper, PIIE

xxv For the maximum amount of safe assets we take the baseline scenario for ESBies (Brunnermeier et al (2016) : EA GDP ~ 14.5 Tn €, Total securitized debt = 60% of EA GDP, of which 70% would be the senior tranche [ 14.5*0.6*0.7 = €6.1 Tn]. In turn, following the proposal blue/red by Blanchard and Ubide (2025), up to 25% of EA GDP would be “blue”, i.e. €3.6 Tn (a share large enough to get a liquid market but still leaving an important portion of “red” bonds as a buffer to make blue bonds safe).

xxvi Delpla (J.), von Weizsäcker (J.) (2010), “The Blue Bond Proposal”, Bruegel Policy Brief, 6 May; Blanchard (O.), Ubide (A.) (2025), “Now is the time for Eurobonds: A specific proposal”, PIIE, 30 May

xxvii Brunnermeier (M.) et al. (2016), “ESBies : safety in the tranches”, Working Paper Series No 21, ESRB; Brunnermeier (M.) et al. (2017), “ESBies : safety in the tranches”, Economic Policy, Vol. 32, Issue 90, April

xxviii Leandro (A.), Zettelmeyer (J.) (2019), “The Search for a Euro Area Safe Asset”, Working Paper, PIIE; Giavazzi (F.) et al. (2021), “Revising the European Fiscal Framework”, 23 December; Amato (M.) et al. (2023), “European Sovereign Debt Risk Management: the Role of a European Debt Agency”, Working Paper

xxix Lenarčič (A.), Sušec (M.) (2020), “Pandemic crisis as a catalyst for a common European safe asset”, Blog, ESM, 20 October

xxx European Commission (2025), “How EU issuance works”, website ; Born (A.) et al. (2024), “Do EU SURE and NGEU bonds contribute to financial integration?”, Financial Integration and Structure in the Euro Area 2024

xxxi Villeroy de Galhau, (F.) (2025), “Europe has the means to respond strategically to the currency revolution”, Le Grand Continent, 25 September

Download the full publication

Updated on the 2nd of October 2025