Non-Technical Summary

From an economic perspective, a gender gap in access to business financing is of first-order importance: unequal access to credit among women- and men-led firms may entail underutilization of women’s talent, reduced survival and growth prospects for efficient and innovative firms, and, ultimately, macroeconomic inefficiencies arising from capital misallocation.

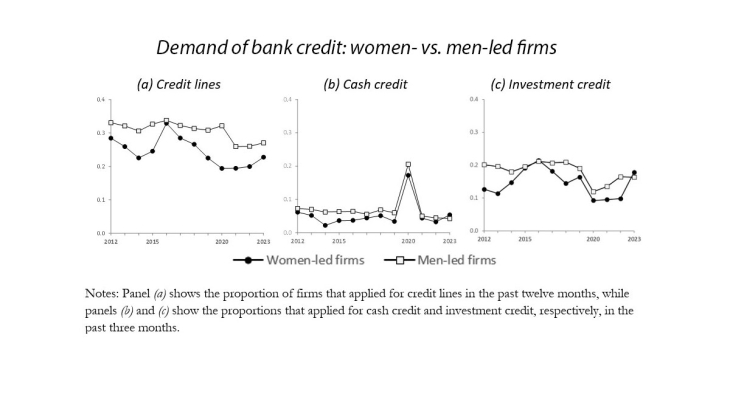

In this context, this paper documents the existence and evolution of a gender gap in bank financing among non-financial firms, using data on French firms covering the period 2012-2023. We first show that, everything else equal, women-led firms operate with less bank debt than men-led firms. We then investigate whether this gap in bank financing originates primarily from the demand side (i.e., women CEOs demand less bank credit) or from the supply side (i.e., women CEOs who apply for loans face higher rejection rates).

We show that women-led enterprises are consistently less likely to apply for bank credit, by between 12% and 26% depending on the type of credit instrument (credit lines, cash loans, and investment loans). This gender ‘ask’ gap holds when taking into account a wide range of differences in the characteristics of women- and men-led firms, and women and men CEOs. For example, it is not driven by women managing smaller firms, nor by their disproportionate presence in specific industries. In contrast, women-led firms do not face higher rejection rates than men-led firms, once controlled for confounding factors. Taken together, the demand and supply results suggest that the gender gap in bank financing is primarily driven by lower demand from women-led firms. The gap in credit demand has remained remarkably stable over the 12-year period, suggesting little progress toward gender equality.

We discuss the potential determinants underlying the gender differences in bank credit demand. Recent research suggests caution in attributing gender gaps to presumed differences in risk aversion or self-confidence. Seeking alternative explanations for the gender gap in credit demand, this paper provides new evidence that female business leaders in France tend to be less financially literate than their male counterparts. We believe this should be a priority for future research. Promoting greater equality in financial literacy is important in its own right, both for reasons of fairness and efficiency, but it would be even more so if it led to improved access to external financing.

Given that France is broadly representative of major European economies in terms of the societal status of women and is comparable to the United Kingdom, Germany, and Spain, our findings are likely to be relevant at the European level.

Keywords: Finance Gender Gap, Bank Credit, Gender Ask Gap

Codes JEL : E51, G30, J16