Non-Technical Summary

This paper investigates how the Federal Reserve’s monetary policy announcements impact financial markets, and more specifically how it depends fundamentally on the type of information they convey. We propose a novel classification of statements, over the period from 1999 to 2022, that identifies two distinct signal types: those giving a clear policy direction and those communicating about uncertainty surrounding future policy.

Through our classification, we resolve the following puzzle. Typically, researchers measure the impact of the central bank’s decisions based on monetary policy “surprises”, defined as the change in asset prices measuring monetary policy expectations in tight windows around the policy announcement. They face a paradox, however: despite being major financial market events, FOMC announcements explain only a small fraction of the daily variance in long-term interest rates. Yet, long-term rates dynamics across time can almost entirely be captured by their dynamics around FOMC events. This paper resolves this puzzle by demonstrating that not all FOMC announcements are equal; their impact is largely determined by the nature of the information they convey.

We propose a novel classification based on the interplay between the target factor (that reflects surprise in the current interest rate decision and further-ahead policy expectations) and the path factor (that reflects information orthogonal to the surprise in the current interest rate decision) from Gürkaynak et al. (2005). This approach enables us to identify two main categories of announcements. On the one hand, policy stance announcements (about half of all FOMC meetings) send signals about the future course of monetary policy consistent with the current interest rate decision. These announcements have a notable effect on short-term rates and stock prices but no significant influence on long-term interest rates, which are crucial for long-term investment and financing decisions.

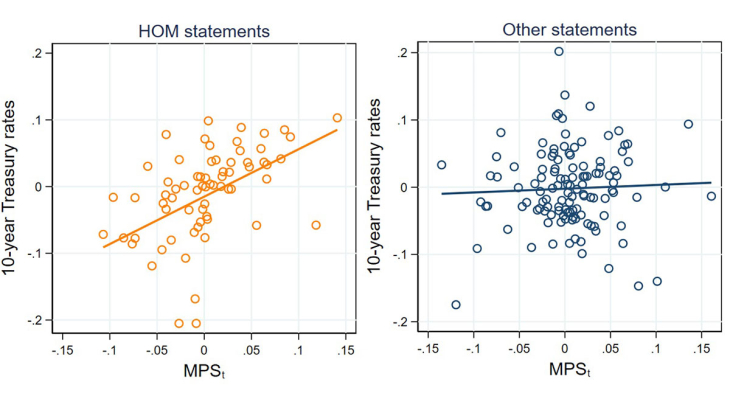

On the other hand, higher-order moment (HOM) announcements measuring notably uncertainty (about one-third of all FOMC statements) are characterized by contradictory signals about future policy. For example, a central bank may convey signals about future policy rate decreases (a decrease in the target factor) while signalling increased uncertainty for future policy (an increase in the path factor). It is precisely this category of announcements that is found to be the main driver of long-term interest rate movements. For this subset of FOMC statements, a monetary policy surprise can have an effect more than ten times greater on 10-year rates than the average effect observed across all other announcements. Its explanatory power is also significantly higher than for other FOMC announcements.

We shed light on the transmission mechanism of these announcements. First, we show that the effect of HOM announcements is driven by real interest rates, not by inflation expectations, suggesting that these statements do not convey news about the strength of the policy response to economic activity or the inflation target, but appears to affect investors’ perceptions of long-run economic fundamentals. Second, and most importantly, HOM announcements do not work by changing market expectations about where the policy rate will be, but by altering investors’ perceptions of how uncertain this future policy rate is. They directly affect the term premium – the extra compensation investors demand to hold long-term debt because of uncertainty. Textual analysis confirms that these HOM statements use far more language focused on risk and uncertainty.

In conclusion, this result, confirmed with ECB announcements and euro area asset prices, suggests that the effects of monetary policy effects are heterogeneous and that central banks should be aware of how different types of signals about policy direction or uncertainty – are perceived, and transmitted to investors.

Keywords: Monetary Policy Surprises, Term Structure, Identification, Policy Signals.

Codes JEL : E43, E52, E58, G12