Since the late 2000s, after many central banks hit the lower bound on policy rates in the wake of the Global Financial Crisis, shadow-rate models of the yield curve—building on the original idea of Black (1995)—have gained prominence. These models address situations where policy rates cannot fall further, even though economic forces would push them lower. Although recent inflation has led to higher rates, the risk of returning to very low yields remains, especially given the long-term decline in the natural rate of interest driven by slower productivity growth, demographic changes, and rising inequality. This makes it essential to use yield curve models that account for lower-bound constraints.

This paper extends the traditional shadow-rate framework, which typically focuses only on nominal yields, by incorporating real (inflation-adjusted) interest rates. Real rates are central to household and corporate decisions about saving, borrowing, and investment, and they play a key role in asset valuation. Modeling nominal and real yields jointly also makes it possible to study the dynamics of inflation compensation (the difference between the two), which reflects investors’ expectations of future inflation. We propose approximation techniques to price inflation-linked securities alongside nominal ones within a unified shadow-rate model.

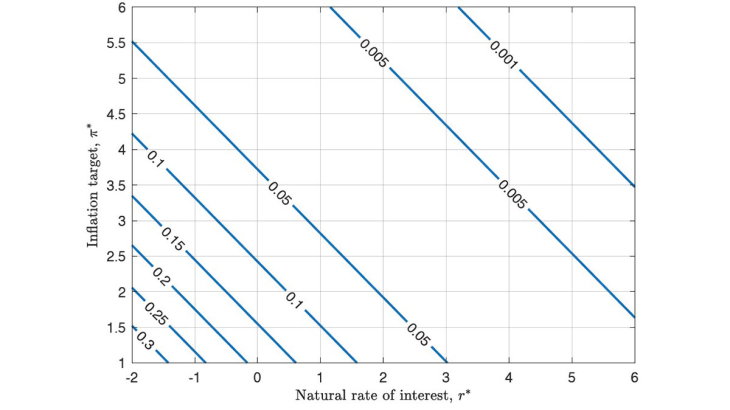

We apply this framework to U.S. data spanning the past fifty years, allowing us to examine how nominal and real term premiums evolve and how the dynamics of yields change when monetary policy is constrained by the zero lower bound (ZLB). A central insight is that the probability of being stuck at the ZLB is highly sensitive to the level of the equilibrium nominal short-term interest rate. When this equilibrium rate is relatively high—for example, 4 percent—the chance of hitting the lower bound is modest (around 5 percent). But when it falls to 2.5 percent, the probability roughly doubles to 10 percent (see the figure below). This finding underscores how a low natural rate environment amplifies the risk of ZLB episodes.

Overall, the paper demonstrates that extending shadow-rate models to include both nominal and real yields provides a richer understanding of bond market dynamics under policy constraints. It highlights how secular trends in the natural rate of interest make economies more exposed to the lower bound, and why tools that account for these risks are essential for policymakers and market participants alike.

Keywords: Shadow Rate, Real and Nominal Risk Premiums, Yield Curve.

Codes JEL : E31, E43, E52, E58, G12