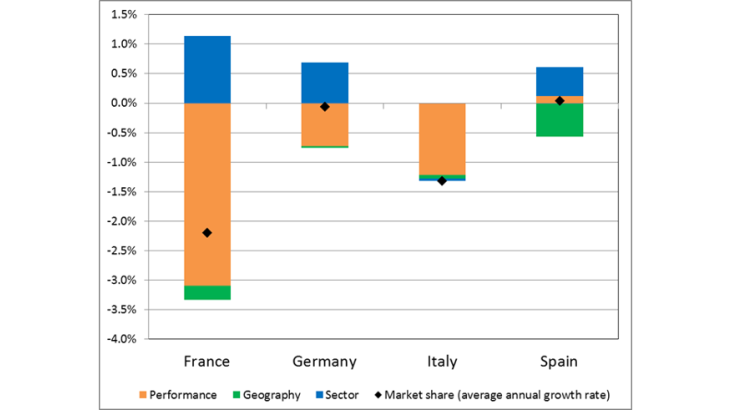

Note: Green represents geographical specialisation; blue represents sectoral specialisation; orange represents the performance effect; and black diamonds denote growth in market shares.

Thus, France's specialisation is favourable in the sense that on average it benefits from relatively robust demand for its stronghold export sectors. However, this favourable specialisation does not ensure that France keeps its market share, as (i) businesses within these sectors may fail to capture the demand directed towards them (orange bars), and (ii) foreign trade dynamics depend heavily on the performance of a limited number of industries.

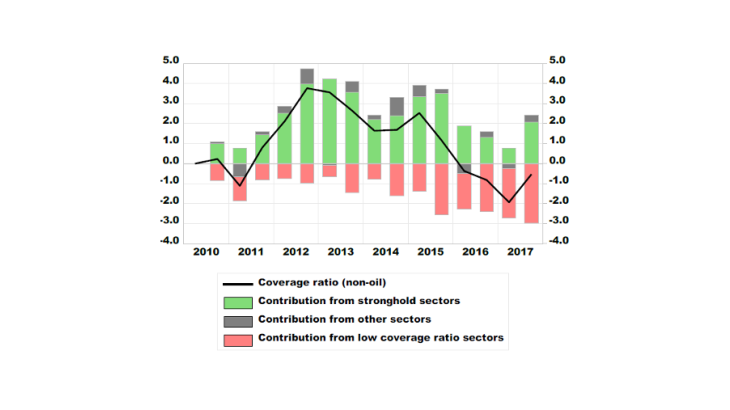

The stronghold sectors account for the downturn in the foreign trade balance since 2014

In Chart 1, the sectors are broken down on the basis of their average foreign trade coverage ratio (value of exports/value of imports) in order to analyse their cumulative contributions to growth in the French coverage ratio for all non-energy goods since first-half 2010. France's stronghold sectors, defined as sectors whose average coverage ratio exceeds 110%, mainly include aeronautics, automobile equipment, pharmaceutical products, cosmetics and, to a lesser extent, agrifood products. Its weak export sectors, with an average coverage ratio of less than 90%, include IT and electronic equipment and consumer goods such as clothing. The automobile industry and machinery and mechanical equipment form part of the intermediate category sectors.

The stronghold sectors (represented by green bars in Chart 1) have played a key role in the decline in the non-energy goods coverage ratio over the recent period, accounting for 65% of the deterioration in the coverage ratio between 2014 and 2016. By contrast, the weak export sectors (represented by pink bars in Chart 1) account for only 29% of the decline. This tends to temper the view that the recent difficulties can be attributed to an inability of production capacity to meet demand.

2015 and 2016: weak global demand and difficult years for the stronghold sectors

Global demand, particularly outside the euro area, was extremely weak in 2015 and 2016 and hampered French – and more generally, European – exports. Furthermore, there was a sharp plunge in the French export sector in 2016, with several industries among France's stronghold sectors experiencing exceptional difficulties. The agrifood sector was hit by poor harvests due to adverse weather conditions. In aeronautics, the flagship sector of French specialisation, global demand slowed and Airbus experienced problems in its supply chain. In addition, the performances of other sectors that normally make a positive contribution to France's foreign trade (excluding trade in manufactured goods) were disappointing. For example, part of France's nuclear production capacity was unavailable, restricting energy sector exports, while tourism suffered as a result of the terror attacks in Paris and Nice.

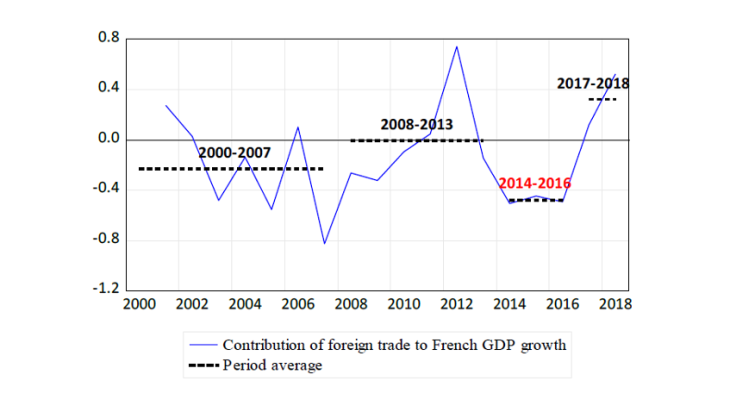

In the medium term, will the recovery after the 2015-16 plunge be temporary or lasting?

Foreign trade made a slightly positive contribution again in 2017 (a positive 0.1 pp contribution) and will continue to do so in 2018 with a positive 0.4 pp contribution according to Banque de France projections (see the macroeconomic projection for June 2018), on the back of an upturn in global demand and the start of a turnaround for France's stronghold export sectors. Nevertheless, part of the previous under-performance recorded by these stronghold sectors could persist if it proves to be more structural: agricultural trade has still not returned to 2015 levels and its market share continues to trend downwards; aeronautic exports remain disappointing in view of the order books; and trends in exports of automobile equipment continue to be unfavourable.

In the longer term, France's foreign trade recovery will depend on the ability of the French economy to reinforce or reinvent its comparative advantages.