Return on Investment on AI: The Case of Capital Requirement

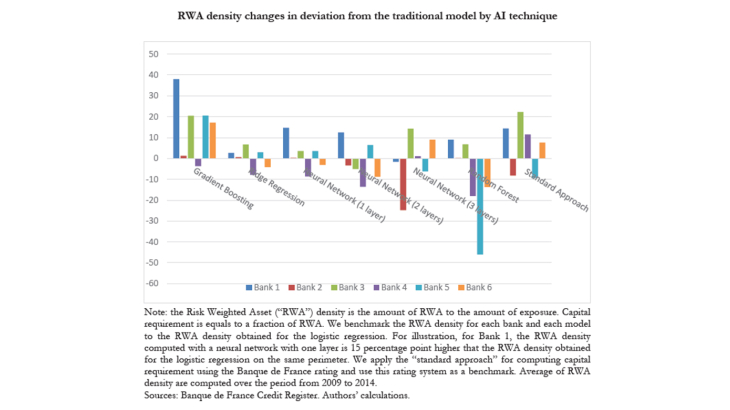

Working Paper Series no. 809. Taking advantage of granular data we measure the change in bank capital requirement resulting from the implementation of AI techniques to predict corporate defaults. For each of the largest banks operating in France we design an algorithm to build pseudo-internal models of credit risk management for a range of methodologies extensively used in AI (random forest, gradient boosting, ridge regression, deep learning). We compare these models to the traditional model usually in place that basically relies on a combination of logistic regression and expert judgement. The comparison is made along two sets of criterias capturing : the ability to pass compliance tests used by the regulators during on-site missions of model validation (i), and the induced changes in capital requirement (ii). The different models show noticeable differences in their ability to pass the regulatory tests and to lead to a reduction in capital requirement. While displaying a similar ability than the traditional model to pass compliance tests, neural networks provide the strongest incentive for banks to apply AI models for their internal model of credit risk of corporate businesses as they lead in some cases to sizeable reduction in capital requirement.