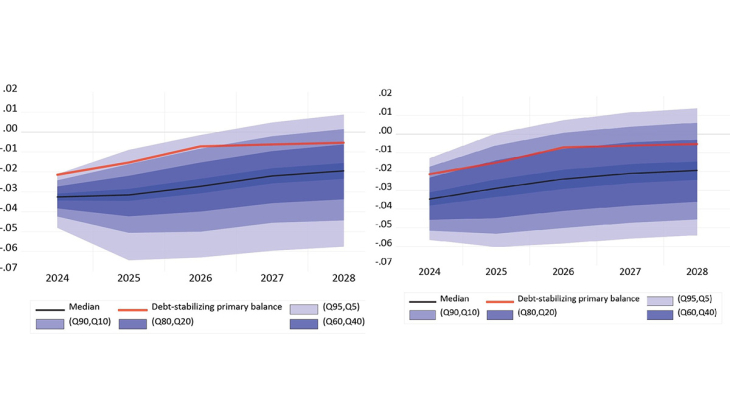

Working Paper Series no. 1019. We propose a simple, simulation based framework for stochastic debt sustainability analysis. Estimating a parsimonious vector autoregression (frequentist and Bayesian) on quarterly French data (1990:Q1–2023:Q4) for the debt's key drivers, we generate predictive fan charts and probability statements for debt to GDP outcomes. Median VAR projections are close to a hypothetical deterministic baseline derived from the deterministic debt sustainability analysis framework. Assuming this illustrative central scenario, historical relationships estimated by our VAR models imply a corresponding confidence band around the debt trajectory. The BVAR yields slightly wider cones and lower tail probabilities than the frequentist VAR, with cone widths between those reported by the European Commission and the ECB. Our analysis, which does not reflect the most recent developments in public finance, suggests that an ambitious fiscal consolidation effort would be required to materially enhance the prospects of stabilizing the debt-to-GDP ratio over the medium term.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche