- Home

- Publications and statistics

- Publications

- Paris-aligned investments offer similar ...

Post No. 422. This study shows that Paris-aligned indices (PAB) have similar return and volatility to conventional indices for both equities and bonds. Thus, from an investor’s perspective, Paris aligned investments do not necessarily add volatility despite reduced diversification, and they may offer investors, including institutionals, an opportunity to green their portfolios without taking on additional risk.

1- Introduction and methodology

To enhance the understanding of green investments, this blog focuses on Paris-Aligned Benchmarks (PAB) investments, knowing that these investments have been very little studied in the literature. PAB Investments refers to investment strategies that align with the goals of the Paris Agreement, which aims to limit global warming to well below 2°C, ideally 1.5°C, compared to pre-industrial levels. The design of these indices is based on exclusions and best-in-class effort. The PAB indices developed by Bloomberg are sub-indices of a broader index. Consequently, PAB investments underweight fossil fuels and high-emission industries while overweighting green sectors. This sectoral concentration may in theory result in increased risks and volatility. It is also important to note that past performance is no guarantee of future performance.

For four selected zones (Eurozone, United States, Japan and Asia Pacific (APAC) excluding Japan), we have calculated returns and volatilities of five indices that have a PAB sub-index. The analysis covers the period from 6 April 2020 till 31 December 2024, in order to exclude the month of March 2020 which was characterized by a severe liquidity stress at the start of the COVID-19 crisis, and as this marks the period during which the majority of Paris-aligned indices were established. This starting point allows us to obtain the data for all the indices in the study.

2- Results for the equity component in the selected zones around the world show similar returns and volatility for PAB indices

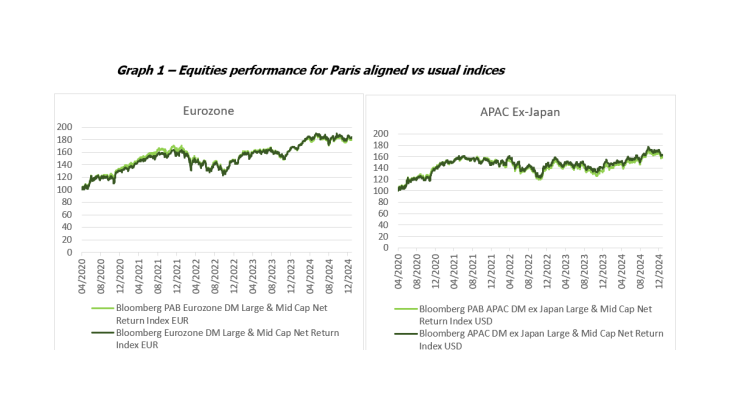

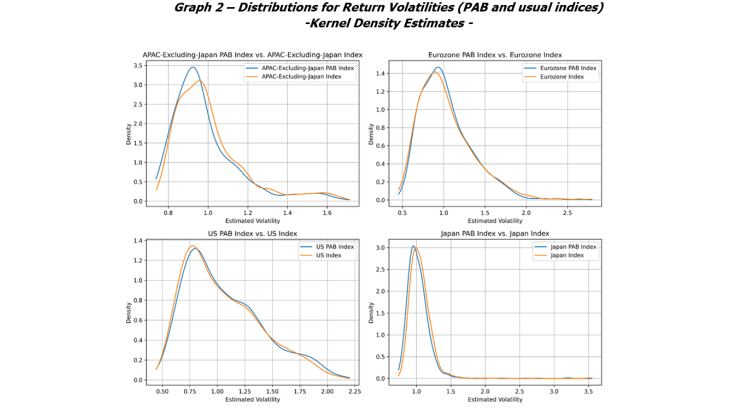

Overall, for the equity component, this study shows that the return and volatility of the PAB indices are similar to those of the usual indices over the period considered. For Japan and APAC ex-Japan, the returns are slightly lower over the period considered, as illustrated by Graph 1. While the returns of the PAB indices are similar or slightly lower, the volatilities are also very similar (Graph 2).

Graph 2 shows how the day-to-day variability of PAB portfolios compares with that of the parent indices. In all four markets, the PAB kernel-density estimates of the distribution of return volatilities almost perfectly overlie those of the broad indices. This indicates that excluding “brown” firms under the PAB methodology has not induced a systematic change in realised volatility. The APAC-ex-Japan PAB index exhibits a very slight shift toward lower volatilities—its average density peak is marginally left of the benchmark, suggesting a modest drag on high-frequency variability, but this effect is subtle. In both the Eurozone and the U.S., the two curves coincide almost exactly, with neither appreciable compression of variability nor fatter tails. The Japan panel likewise reveals near-identity, save for a barely perceptible steeper rise at very low volatilities for the PAB series.

Note: Kernel density estimation is a nonparametric model used to estimate probability distributions. The equity volatilities and fixed income volatilities are all calculated by EGARCH(1,1) models of returns, which are calculated as the log difference of daily index levels multiplied by 100. The following Bloomberg tickers were used: APXPABN Index, APACXJN Index, EURPABNL Index, EURODN Index, USPABP Index, US Index, JPPABPL Index, JPL Index.

Two key factors may initially explain this result, though further analysis is needed to strengthen these conclusions. First, the PAB indices overweight the technology and financial sectors, which have outperformed over the past five years. Second, sectors with high carbon exposure, particularly utilities, have generally underperformed – except in 2022. If we look at the APAC ex-Japan index, one of the reasons for the divergence in performance and volatility between the PAB index and its parent index could stem not only from differences in sectoral composition but also from the currency composition, adding a component of foreign exchange risk.

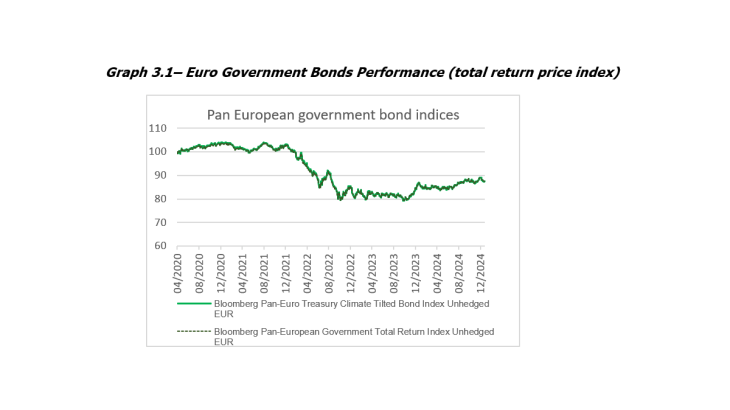

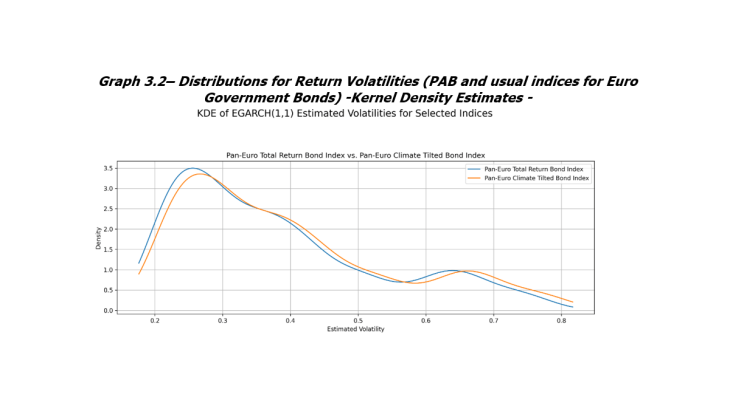

3- For bonds, the only comparable indices (Euro Government bonds) show the very same results

When comparing bond indices, the only fixed-income class with a comparable duration (±1 per cent) between PAB and non-PAB indices is the Euro government bond market. In other regions, such as the U.S. and APAC, the modified duration of the indices varies by more than 10 per cent, making the overall analysis inconclusive. For Eurozone government bonds, the results are similar to those of equities, showing close returns with comparable volatility (Graph 3).

This analysis highlights two important takeaways for central banks as investors. First, if we look at different indices since the COVID-19 crisis, we can conclude that in terms of financial stability from an investor perspective, PAB ETFs or equity investments, despite their reduced diversification, do not necessarily add volatility. Second, the similar returns of PAB equities, and to some extent fixed income, could present an opportunity for central banks to green their investments, particularly as these assets are generally denominated in local currency, while taking into account other parameters that could intervene, such as liquidity or size of the market.

This joint study conducted by the Banque de France and The South East Asian Central Banks Research and Training Centre (SEACEN) as part of their strategic partnership is an extract of a paper titled “Challenges ahead in implementing central banks’ sustainable practices: a survey from Banque de France and Asian central banks”.

Download the full publication

Updated on the 9th of December 2025