Identifying geopolitical shocks through high-frequency sign restrictions

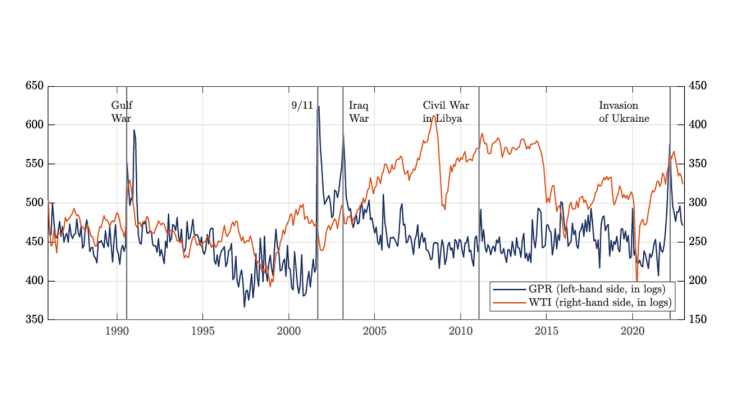

Geopolitical shocks of different kinds can be identified by looking at comovements of the geopolitical risk index and oil prices around key geopolitical episodes. To do so, I construct a new dataset of three-day “surprise” responses of the geopolitical risk index and oil prices around 31 major geopolitical events since 1986. The idea is to focus on what happens at the geopolitical risk index and oil prices around major geopolitical events. When GPR and oil prices rise together, I interpret the event as a geopolitical energy shock. When GPR rises but oil prices fall, I interpret it as a geopolitical macro shock.

This comovement between oil prices and the geopolitical risk index is measured using a three-day window around key events – a technique inspired by high-frequency methods in monetary policy research. In particular, the paper builds on the approach developed by Jarociński et Karadi (2020),which uses short-term market reactions to disentangle overlapping shocks. By applying this framework to geopolitical events, the paper constructs a dataset of "surprises" – sudden shifts in risk and oil prices – and feeds it into a structural vector autoregression model (VAR) identified by imposing sign restrictions on the comovement of GPR and oil prices around the largest geopolitical events in the GPR series (>3 standard deviations).

Inflationary or deflationary? It depends on the type of shock

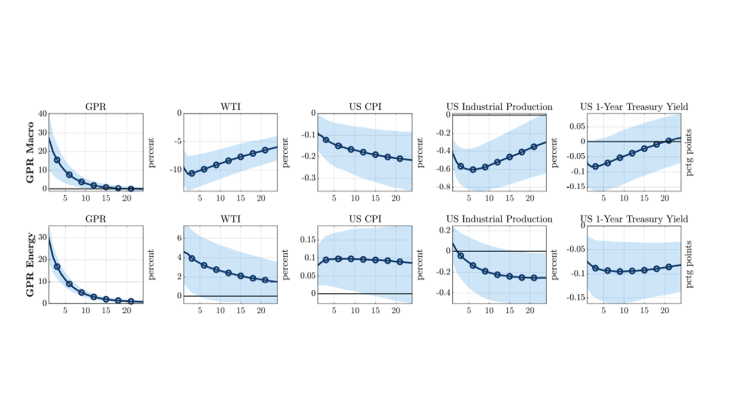

The effects of these shocks on the US economy differ in meaningful ways. As illustrated in Chart 2, while both shock types are contractionary for output, their effects on inflation diverge. Geopolitical energy shocks raise both geopolitical risk and oil prices. They act like adverse supply shocks, increasing production costs and consumer prices. In contrast, geopolitical macro shocks typically raise geopolitical risk but are associated with falling oil prices, reflecting demand-side concerns. Quantitatively, geopolitical energy shocks on average raise inflation by up to 0.2%, while macro shocks on average reduce it by 0.1%-0.4%. This inflationary effect of energy shocks persists for several months and reflects their supply-side nature, similar to conventional oil price shocks.

Chart 2: Macroeconomic effects of GPR macro and energy shocks