Do all geopolitical events affect the economy in the same way? This paper shows that distinguishing between different kinds of geopolitical shocks is essential to understanding their effects on inflation and output. Using a novel identification strategy, this paper identifies two distinct types of shocks: those related to disruptions in energy markets (geopolitical energy shocks) and those tied to broader non-energy macroeconomic developments (geopolitical macro shocks). By distinguishing between these, the paper provides insights into how energy markets contribute to shaping the response of inflation to geopolitical shocks.

The first type, labelled geopolitical energy shocks, typically occurs when geopolitical tensions lead to a sharp increase in oil prices—such as during the Gulf War or the Russian invasion of Ukraine. These shocks tend to be both inflationary and contractionary: they push consumer prices upward while reducing economic activity. The second type, geopolitical macro shocks, are characterized by rising geopolitical risk but falling oil prices—suggesting a deterioration in global demand.

To identify these shocks, the paper exploits the comovement of the Geopolitical Risk Index (GPR) developed by Caldara and Iacoviello (2022) and oil prices in a three-day window around major geopolitical events. This approach builds on the methodology developed by Jarociński and Karadi (2020), combining narrative information and high-frequency sign restrictions.

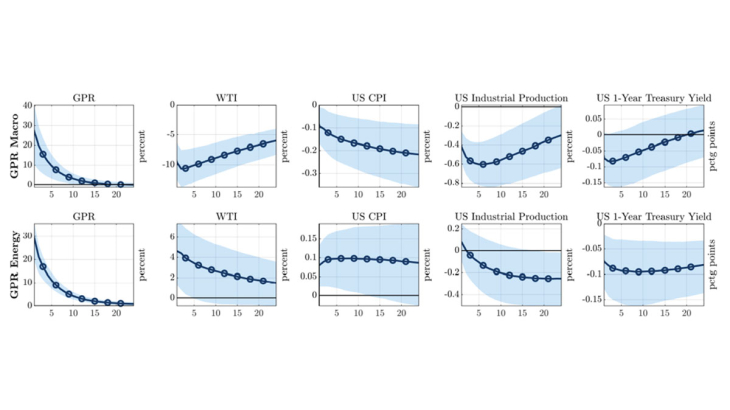

Figure 1 illustrates the estimated response of inflation and industrial production to a geopolitical energy shock and a geopolitical macro shock. Geopolitical energy shocks are both contractionary and inflationary. They lead to increased oil prices and higher overall inflation. Conversely, geopolitical macro shocks are typically contractionary and deflationary, resulting in decreased economic activity and a decrease in inflation. Furthermore, the paper shows that sectors within the U.S. economy respond differently to these shocks based on their energy intensity. Sectors with higher energy intensity suffer larger output losses and price increases when faced with geopolitical energy shocks.

These results underscore the need for policymakers to tailor their responses based on the type of shock encountered. Countering geopolitical macro shocks requires easing the monetary policy stance, as these shocks generally reduce inflation while also contracting economic activity. In contrast, energy-related shocks are associated with a more complex trade-off. In response to these, policymakers must balance efforts to stabilize inflation and economic output. Recognizing the distinctions between energy-related and macro-related geopolitical shocks is crucial for formulating effective economic policies in an environment marked by geopolitical uncertainty. Understanding these differences can lead to more informed policy decisions that better address the challenges posed by different types of geopolitical risks.

Keywords: Geopolitical Risk, Business Cycles, Energy, High-Frequency Sign Restrictions, High-Frequency Identification.

Codes JEL : E31, E32, Q41, Q43.