- Home

- Publications and statistics

- Publications

- Monthly Business Survey – Start of Janua...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 22 December and 7 January), activity continued to grow in December at a slightly slower pace than in November. Growth remained strong in industry, driven by aeronautics and defence-related sectors, and more moderate in market services, while activity remained largely unchanged in construction.

In January, industrial activity is expected to slow down, due to a pause in aeronautics production, limited visibility on order books and a high degree of uncertainty. Conversely, market services firms expect their activity to strengthen and grow at a rate closer to the average observed over the last decade. In construction, activity is expected to remain broadly unchanged, with the finishing works sector still outperforming the structural works sector.

Our monthly uncertainty indicator declined once again in the three main sectors but remained at high levels.

The cash position was deemed to be balanced overall, but this masks persistent disparities between sectors. Supply difficulties in industry remained at low levels, with the exception of aeronautics and sectors dependent on certain critical metals. Selling prices remained broadly stable in industry and trending downwards in construction, while price increases in services were still moderate.

Recruitment difficulties have stabilised but remained an issue in certain skilled trades and in construction.

Based on the survey results as well as other indicators, we estimate that GDP grew by at least 0.2% in the fourth quarter.

1. In December, activity picked up in industry, grew more moderately in services, but changed little in construction

In December, industrial production continued to grow at a sustained pace, albeit at a slightly slower rate than in the two previous months. Manufacturers therefore ended the year on a generally positive note amidst better-than-expected economic conditions. This confirms the relatively buoyant role of industry compared to services and construction in the second half of 2025.

Aeronautics and electrical equipment manufacturing enjoyed notable growth reflecting deliveries concentrated in the end-of-year period. Activity also picked up in the agri-food sector, driven by last-minute orders related to the festive season. After a decline in November, manufacturing of non-metallic mineral products, which includes rubber, plastics and glass, enjoyed a significant rebound, as did the pharmaceuticals sector. Conversely, production declined in the computer-electronics-optical products and wood, paper and printing sectors. Other sectors recorded more moderate changes.

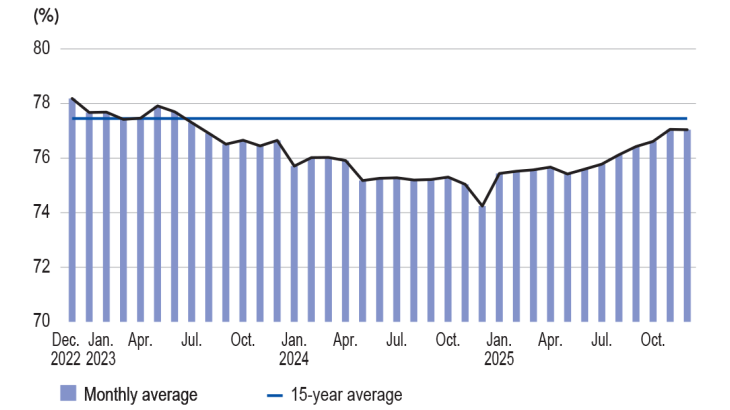

The capacity utilisation rate

The capacity utilisation rate (CUR) stabilised at 76.7%, slightly below its long-term average (77.1%). It rose in electrical equipment (up 2.4 percentage points), wearing appareltextiles- footwear (up 1.4 percentage points) and aeronautics (up 1 percentage point), but declined in wood, paper and printing (down 0.8 percentage points).

According to business leaders, inventories of finished goods were deemed to be fairly high in most sectors, reflecting both prudent risk management and a desire to secure supply chains. Compared with November, however, inventories declined in several sectors (electrical equipment, aeronautics, computerelectronics- optical products) in line with deliveries made.

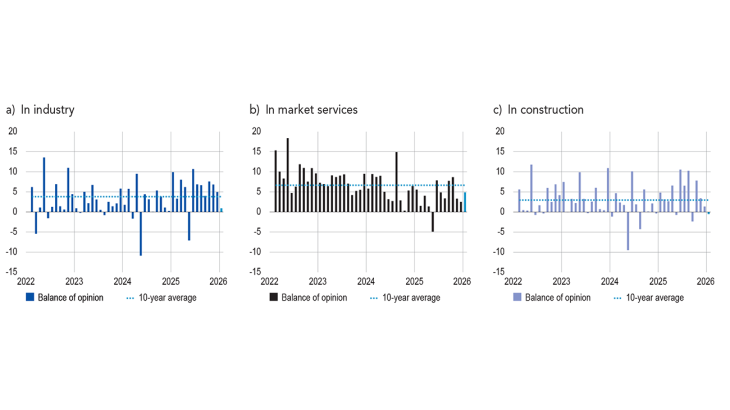

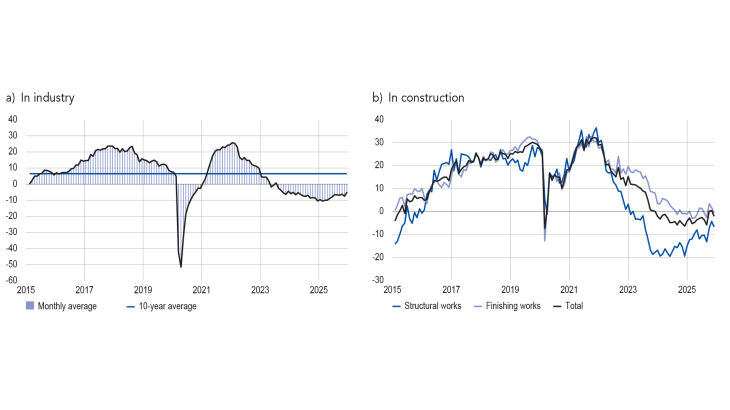

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working-day variations, for January: forecast)

a fall over the past month) stood at 5 percentage points for December in industry. For January (light blue bar), business leaders in industry expect activity to increase by 1 percentage point.

In market services, as expected, activity grew more moderately in December than in the previous month. Accommodation and food services enjoyed strong momentum, driven by foreign customers, particularly in Paris and mountain resorts, especially in high-end segments. Personal services also benefited from favourable activity in December. Publishing enjoyed a significant improvement, mainly driven by application software. Advertising also recorded an upturn in activity in December, despite the fact that 2025 as a whole was generally considered disappointing by industry professionals. Conversely, programming and consultancy services reported a decline in activity at year-end amidst increased competition, particularly internationally.

In the construction sector, activity remained largely unchanged in December, in line with expectations. Activity in the structural works sector contracted further, due to longer seasonal interruptions than last year caused by unfavourable weather conditions. However, activity in the finishing works sector remained relatively buoyant, underpinned by renovation work.

Inventories of finished goods in industry

Cash position

At end-December, the balance of opinion on cash positions remained very slightly negative in industry, masking significant differences between sectors. The cash position remained very weak in the automotive sector, as well as in non-metallic mineral products (particularly rubber, plastic and glass), agri-food and metal and metal products. Conversely, it was deemed to be much stronger in the pharmaceutical industry and in dynamic sectors such as aeronautics and electrical equipment.

In market services, the cash position was considered to be broadly balanced at the end of December. However, certain sectors deemed their cash flow to be insufficient, especially advertising, vehicle repairs, food services and IT services. By way of contrast, rental services, as well as information, communication and publishing services, reported historically high levels of cash flow.

2. In January, activity is expected to slow down in industry but strengthen in services

Business leaders expect industrial production to slow down significantly in January 2026, due mainly to a pause in aeronautics production, which had previously been very buoyant. Most other sectors also forecast a significant slowdown in production, particularly in electrical equipment, chemicals, textiles, wearing apparel, leather and footwear. This could be exacerbated by partial destocking in sectors where inventory levels are deemed to be high, in contrast to the growth recorded in December.

Conversely, market services activity is expected to grow at a more sustained pace in January, in a relatively general manner. Business leaders’ expectations for the start of the year are particularly optimistic in publishing, rental and engineering services.

In the construction sector, contractors continue to forecast a generally sluggish month of January, still penalised by structural works, whereas finishing works should remain more buoyant, boosted by renovation work.

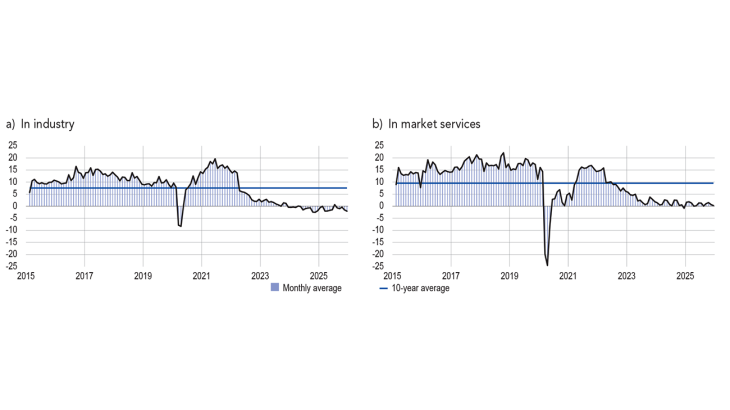

The expected slowdown in industrial production may be partly due to continued limited visibility over order books, amidst persistent uncertainty over both domestic and foreign demand. At the end of December, order books were still considered weak in most sectors, although there was a slight monthon- month improvement. The lowest levels were observed in agri-food and non-metallic mineral products, especially glass, and chemicals. Conversely, order books were once again healthier in aeronautics and computer/electronic/optical products, underpinned in particular by defence contracts, including international contracts. In construction, however, they continued to decline.

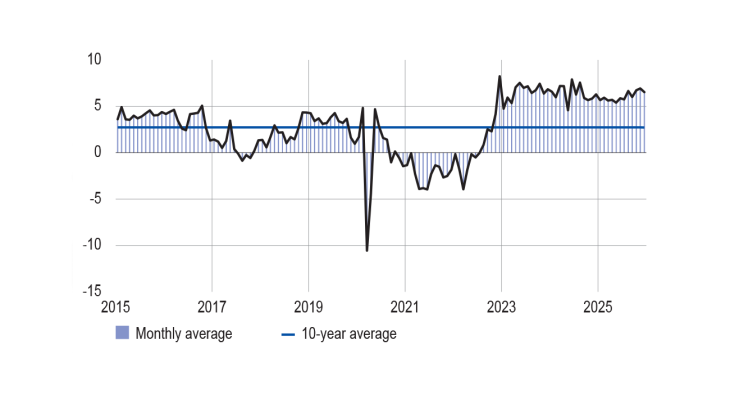

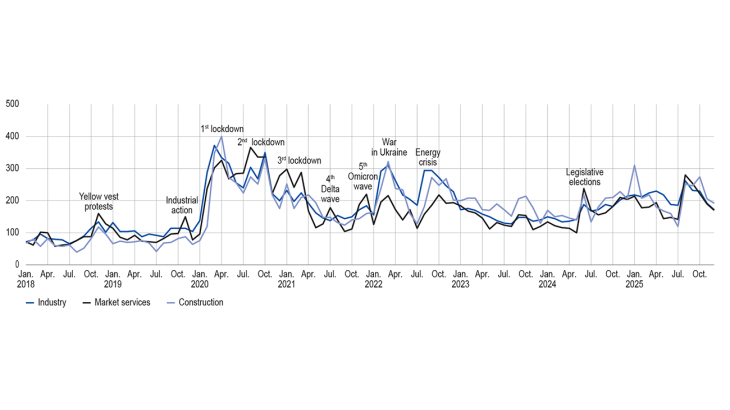

The uncertainty indicator, based on a textual analysis of company’ comments, continued to decline slightly in December but remained high, reflecting in particular the uncertainties surrounding the adoption of the French government’s budget.

Level of order books

Indicator of uncertainty in the comments section of the monthly business survey (unadjusted data)

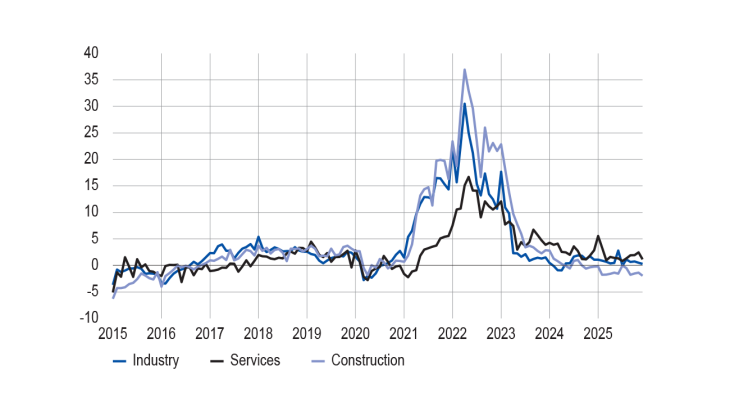

3. Selling prices grew moderately in services, remained stable in industry, and declined in construction

In December, only 7% of manufacturers reported supply difficulties, the lowest level in over four years. Pressure continued to be concentrated in the aeronautics sector, where 19% of companies were still experiencing problems. More limited difficulties were also recorded in other sectors dependent on certain critical industrial metals such as tungsten.

In industry, business leaders reported a slight increase in raw material prices, amidst stability in the euro exchange rate. However, the rise in copper and steel prices was reflected in the perception of higher input prices, particularly in the metal and metal products and electrical equipment sectors.

The balance of opinion on industrial finished goods prices was close to zero in December, reflecting overall stability in industrial prices. Selling prices continued to decline in the chemical and agri-food sectors and, to a lesser extent, in machinery and equipment and the automotive industry. In the agri-food industry, increased competition and pressure from large retailers are encouraging manufacturers to pass on lower input prices. Conversely, the non-metallic mineral products, metal and metal products and other industrial products sectors have been more successful in passing on their cost increases in their selling prices.

Overall, only 10% of manufacturers reported having changed their selling prices in December: 6% lowered them and 4% raised them. As in November, price decreases were mainly observed in the chemical and agri-food industries (16% of companies in these sectors), whereas increases were most frequent in the manufacture of non-metallic mineral products (8%).

In construction, the balance of opinion regarding price movements remained negative in both structural and finishing works. In December, 9% of building contractors reported having lowered their prices, mainly in order to win contracts in a highly competitive environment, while only 1% indicated having raised them.

In market services, selling prices were deemed to have risen slightly, with increases mainly reported in accommodation and food services, engineering and cleaning services. 17% of business leaders expect prices to increase from January onwards. Conversely, prices are expected to continue to fall in programming and consulting and in temporary employment services, reflecting strong competitive pressure and a compression of margins in sectors facing rapid changes in their business models, especially those linked to the deployment of artificial intelligence.

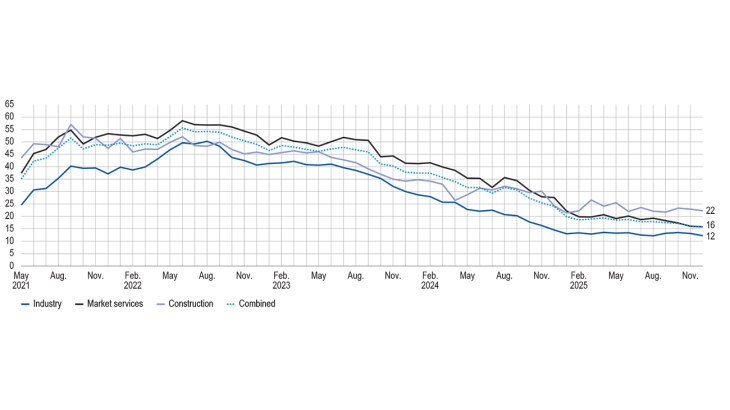

Lastly, recruitment difficulties stabilised at 16% in December and continued to be concentrated mainly in sectors with a high demand for skilled technical personnel, as well as in construction.

Change in finished goods prices by major sector

Share of businesses reporting recruitment difficulties

4. Our estimates suggest that GDP grew by at least 0.2% in the fourth quarter

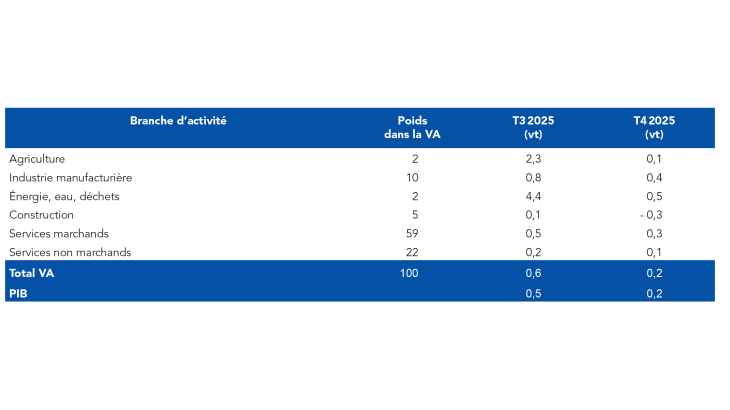

Based on the results of our monthly business survey, rounded out by other available data (INSEE industry production indices and surveys and high-frequency data), we estimate that GDP increased by at least 0.2% in the fourth quarter.

Activity was underpinned by strong growth in value added in manufacturing, as suggested by the monthly business survey. Higher value added in market services was driven by trade, information and communication as well as business services. Value added is estimated to have grown in the energy sector and declined in the construction sector.

Quarterly changes in gdp and value added in France (%)

Note: QoQ = quarterly change.

Download the full publication

Updated on the 19th of January 2026