Non-Technical Summary

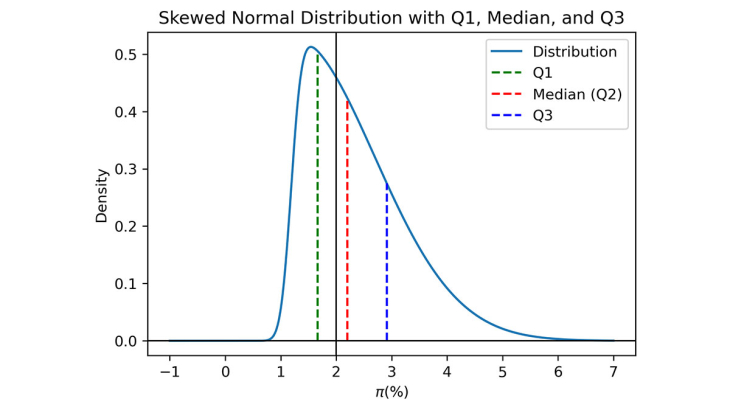

Monetary policy operates not only through policy rates but also through how banks perceive the inflation outlook when setting lending rates and credit supply. Even when inflation expectations remain well anchored around the 2 percent target, banks may face elevated uncertainty about future inflation outcomes. This paper shows that banks’ subjective beliefs uncertainty and asymmetry about inflation play a role in monetary policy transmission. Figure 1 illustrates the paper’s core mechanism: a bank’s subjective inflation distribution with a median above the 2 percent target and positive skewness, placing excess weight on high-inflation tail risks. Such a strong asymmetric inflation forecast implies elevated and tilted inflation risks, to which banks respond by increasing loan rates and tightening credit conditions for non-financial corporations. These effects are strongest for financially constrained borrowers. The paper therefore examines how the variance and skewness of subjective inflation expectations—capturing uncertainty and tail risks—affect bank lending rates and loan volumes.

To explore this mechanism, the paper extends the classical Monti–Klein model to incorporate subjective inflation probability distributions and bank risk aversion. Three channels emerge. First, the interest-margin channel: expected inflation affects the real value of loan repayments and the real cost of deposits. Second, the default-risk channel: inflation alters firms’ real debt burdens and default probabilities. Third, the credit-rationing channel: higher lending rates exacerbate adverse selection and moral hazard, incentivizing risk-averse banks to restrict quantities. The model predicts that an increase in the dispersion of inflation beliefs raises optimal lending rates and credit rationing; additional skewness towards inflation tails further increases pricing; and ambiguity aversion amplifies both effects. These results imply that the second and third moments of inflation expectations—uncertainty and asymmetry—are independent drivers of monetary policy transmission.

The empirical analysis combines two granular datasets: French AnaCredit loan-level data (2018–2025) and subjective density forecasts of inflation from professional forecasters. From these distributions, the paper constructs three indicators: Normalized Inflation Uncertainty (NIU), capturing the width of subjective distributions; the Asymmetry Strength Index (ASI), capturing skewness and tail risks; and a disagreement index capturing cross-sectional dispersion.

Because loan interest rates are highly heterogeneous and multimodal across banks and borrowers, the paper employs finite mixture density regressions. Each loan rate arises from one of several latent pricing regimes, allowing the model to capture nonlinear responses and heterogeneous risk structures. Empirically, increases in NIU significantly raise loan rates: moving from the first to the third quartile increases average rates by 10–14 basis points and raises the upper tail by around 16 basis points—equivalent to roughly €0.5 billion in additional annual interest expenses for French firms. ASI also increases both median lending rates and skewness, indicating that banks price tail risks separately from variance. Forecast disagreement has weaker effects, suggesting that idiosyncratic uncertainty is more relevant than cross-sectional dispersion. Results remain robust in overdraft-rate regressions, where contract terms are standardized and identification concerns are minimized. Placebo tests confirm that the NIU effect is not mechanical.

Keywords: Monetary Policy Transmission, Inflation Uncertainty, Bank Lending

Codes JEL: D84, E52, G21