The prolonged period of low policy interest rates, large-scale asset purchases and the recent inflationary shock raised concerns about higher inequality and the distributional effects of monetary policy. These topics were highlighted by Jerome Powell at Jackson Hole in 2020 through the strategy of “maximum employment as broad-based and inclusive goal”. The cost-benefit analysis of such a policy (higher inflation for longer vs. tighter labor market for longer) depends on the ability of monetary policy to affect transitions to employment and wage growth at the bottom of the distribution. Does the effect of monetary policy on the extensive and intensive margins of labor income differ across households?

To answer this question, we use matched administrative-survey individual data to disentangle the distributional effects of monetary policy on transitions from/to unemployment (the extensive margin) and on labor income changes for individuals continuously employed (the intensive margin). We take advantage of matched administrative-survey data for France, the “Statistiques sur les Ressources et Conditions de Vie” (SRCV), which is produced by the national statistical institute (INSEE). SRCV combines individual-level detailed administrative income tax data with survey-based information about labor market status, the number of months employed each year, job characteristics and demographics. The survey dimension of this annual panel dataset enables us to investigate labor market transitions above and beyond labor income changes only. Our sample covers the years from 2007 to 2019. To measure the causal effect of monetary policy, we use the ECB monetary policy shock series constructed by Jarocinski and Karadi (2020) that uses a high-frequency identification strategy and adjusts monetary surprises for central bank information effects.

The first result of this paper is that the effect of an expansionary monetary policy shock on labor income exhibits a U-shaped pattern across the labor income distribution. A 10 basis points (bp) expansionary monetary policy shock increases the labor income by 0.9% for the Bottom 50% and by 0.6% for the Top 10% of the labor income distribution over one year, while the effect is more limited on the middle of the distribution. The sizeable effects of monetary policy on labor income for top earners are new.

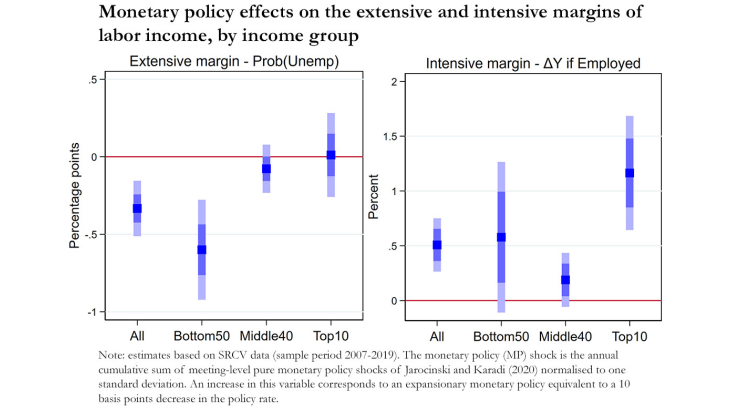

Second, we provide new original evidence regarding the transmission channels of the heterogeneous effects of monetary policy to labor income. We find that the U-shaped pattern of monetary policy effects on labor income is driven by the extensive margin at the bottom of the distribution but by the intensive margin at the top (Figure 1).

Third, we also show the crucial role played by sectoral heterogeneity in explaining the distributional effects of monetary policy on labor income. Cross-sectoral differences in the effect of monetary policy shocks are large for both the intensive and extensive margins. Moreover, the effects of monetary policy on labor income are more pronounced in sectors with high levels of capital intensity or of leverage, suggesting that the sensitivity to monetary policy of a given sector explains its impact on labor income. Such results also suggest that a higher procyclicality of labor income in relation to the labor force composition plays a crucial role in explaining the monetary transmission to labor income.

What are the consequences for labor income inequality of the heterogeneous impact of monetary policy? To address this question, we perform some simulation exercises based on our estimates. The expansionary monetary policy increases overall labor income inequality both in terms of Gini coefficient and of the share of labor income held by the Top 10%. It also increases, to a lesser extent, the Bottom 50% income share while it reduces the income share of the Middle 40%. As a result, the increase in overall inequality is also associated with a decrease in bottom inequality.

Regarding monetary policy, the findings of this paper have two implications. First, the heterogeneity of labor income responses across sectors suggests differentiated impacts in firms’ marginal costs, so potential different price-setting dynamics across sectors. Second, the distributional effects of monetary policy may generate an amplification mechanism through its impact on aggregate consumption as individuals more likely to be financially constrained and with larger propensities to consume are the most affected. Distributional monetary policy effects might therefore have aggregate implications beyond inequality issues.