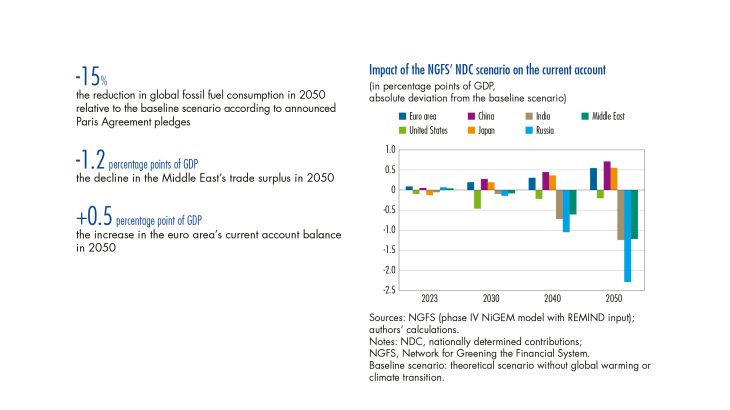

Bulletin No. 261, article 2. The impact of low carbon transition policies on foreign trade has not been greatly explored, but the gradual implementation of the Paris Agreement pledges and macroeconomic transition scenarios such as those prepared by the NGFS (Network for Greening the Financial System) are providing some insight on the issue. The transition could lead to a reduction in global trade due to the expected decline in fossil fuel imports, which would see the trade balances of advanced countries, which are net importers, improve at the expense of fossil fuel exporters. However, the financing for the investments needed will be a determining factor. If the public deficits of advanced countries increase as a result of these investments, their current account balances could deteriorate. Furthermore, if oil-producing countries anticipate the transition by reducing their fossil fuel investments, the negative effect of the transition on their current account would be mitigated. Lastly, private capital flows must be directed towards the green sectors of emerging economies to ensure a balanced transition.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche