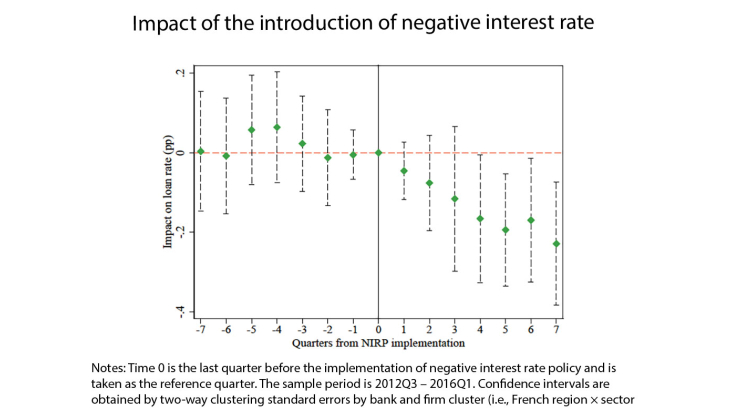

Working Paper Series no. 877. We study how negative interest rate policy (NIRP) affects banks’ loan pricing. Using contract-level data from France, we show that NIRP affects bank lending rates to firms through a portfolio rebalancing channel: banks holding a one standard deviation more of cash and central bank reserves offer a 8.6 basis points lower loan rate after NIRP is introduced. The impact concentrates on medium-term loans (with maturity comprised between three and six years) but not on loans to risky firms, indicating that banks conduct a search for yield focused on term spreads. These findings suggest that NIRP complements quantitative easing policies.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche