Non-Technical Summary

In a financially integrated world, asset markets act as powerful transmission mechanisms of real, monetary, and financial shocks across countries. This paper provides a new perspective on how shocks originating abroad are transmitted domestically via asset markets, particularly when the domestic central bank does not react, for instance because it is at the Effective Lower Bound (ELB).

We develop a two-country model with non-Ricardian heterogenous agents where the relative supply and demand of assets have macroeconomic effects. We assume that international capital markets are partially segmented. In particular, different liquidation costs in the bond markets of both countries, Home and Foreign could lead to convenience yields. We examine shocks that affect the supply or the demand for liquid assets and study their international spillovers.

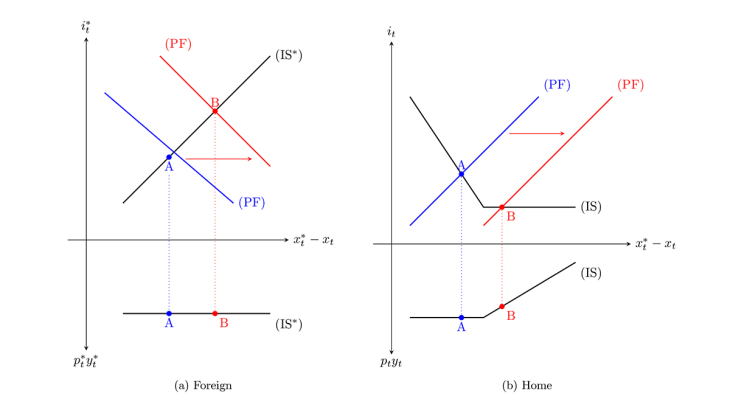

For example, consider a permanent decline in Foreign investment opportunities. This reduces Foreign investment and output, but it also reduces the supply of Foreign assets. This implies a reallocation of portfolios from Foreign to Home assets and a potential appreciation of the Home currency to accommodate the increase in the demand for Home assets. The Home central bank can prevent the appreciation by lowering its interest rate. This has an expansionary impact in Home, so that there is a positive spillover from Foreign to Home. This is what happened after the 1997 Asian crisis, when the redirection of financial flows towards the US and Europe led to lower interest rates that supported growth. But if monetary policy does not react enough (for instance if Home is at the ELB), the Home currency appreciates, resulting in disinflation and an increase in the real interest rate, which can have a contractionary effect in the presence of nominal rigidities. In this case there is a negative spillover. The eurozone crisis in the years 2010, which decreased the supply of safe and liquid euro assets, triggered portfolio reallocation towards Switzerland and the US, which appreciated their currency and led to subdued inflation, hurting growth. Similar results obtain when considering a financial shock, namely a negative liquidity shock on Foreign bonds (see Figure 1), and a monetary shock represented by an increase in the Foreign price level targeted by the Foreign central bank.

The impact on the Foreign economy is also different when the Home central bank does not fully accommodate the shock, a case spillbacks. When Home is at the ELB, all three shocks cause the Home currency to appreciate for a number of periods, resulting in a temporary increase in the excess return in Home currency. In the short run, this further drives capital away from Foreign. This greater capital flight increases the Foreign real interest rate temporarily, resulting in a greater reduction in capital accumulation and output than when Home is outside of the ELB

The paper focuses on two extreme responses of monetary policy: the ideal scenario of a robust monetary reaction effectively stabilizing prices, and the case of no response exemplified by the ELB. Between those two scenarios, there is a continuum, where too weak a monetary response fails to fully insulate prices from the effect of international asset market shocks. In those intermediate cases, adjustment comes from a mix of interest rate cuts and below-target inflation with currency appreciation and, possibly, unemployment. Our findings would carry over to these intermediate cases, underscoring the key role of monetary policy in shaping the sign and magnitude of international spillovers.

Keywords: International Spillovers, Zero Lower Bound, Liquidity Trap, Asset Scarcity.

Codes JEL: E40, E22, F32