- Home

- Publications et statistiques

- Publications

- Institutional investments in crypto exch...

Post No. 424. In 2024, US authorities authorised the listing and trading of the first crypto-asset-backed exchange-traded funds. These regulated financial products mean that institutional investors, banks and hedge funds are able to play a more significant role in the US crypto-asset markets, which may create risks to financial stability.

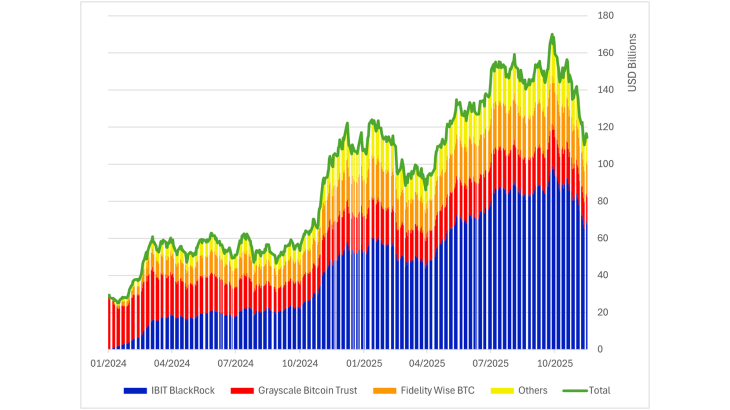

Chart 1: Spot Bitcoin exchange-traded funds (ETF) assets under management

Note: Data as of November 26th, 2025.

In 2024, institutional investors invested in crypto assets through ETFs

Until the end of 2023, crypto-assets markets (decentralised digital assets, including Bitcoin and Ether) had largely been the domain of retail investors. In 2024, institutional investors capitalised on the launch of products regulated and authorised by the US Securities and Exchange Commission (SEC) to invest in crypto assets through exchange-traded funds (ETFs): spot Bitcoin ETFs and spot Ether ETFs were launched in January 2024 and June 2024, respectively. These ETFs are continuously listed on a stock exchange and aim to track the price of a crypto-asset as closely as possible. They have grown strongly, with cumulative inflows since their listing and assets under management for the main Bitcoin ETFs and Ether ETFs at the end of November 2025 amounting to almost USD 115 billion and USD 17 billion, respectively (Chart 1). By way of comparison, the total market capitalisation of Bitcoin and Ether at the end of November 2025 stood at USD 1,735 billion and USD 354 billion, respectively.

Form 13F datasets (SEC, 2025) provide a granular overview of institutional investors' exposure to crypto-ETFs issued and listed in the United States. Form 13F is a quarterly report that institutional investors with USD 100 million or more in assets under management must file with the SEC. It details their holdings of equity securities or equivalents traded on the US markets, including holdings of Bitcoin and Ether ETFs since their listing on US exchanges was authorised.

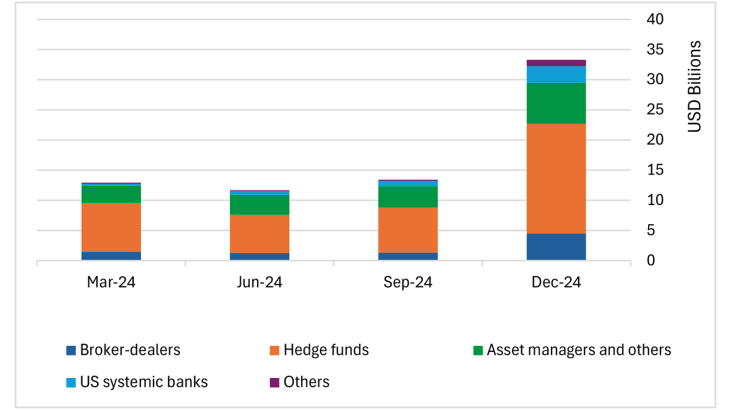

Form 13F data clearly show that the launch of crypto-ETFs has catalysed institutional demand. In 2024, nearly 2,000 institutional investors were exposed to Bitcoin ETFs, either for their own account or on behalf of their clients. The Bitcoin ETF holdings of institutional investors grew considerably, from USD 13 billion in the first quarter of 2024 to more than USD 33 billion at the end of the year, with a remaining USD 10 billion held by retail investors (Chart 2). By the end of 2024, institutional investors accounted for approximately 30% of the market. The main investors in Bitcoin ETFs are hedge funds and asset management firms, with positions of nearly USD 18 billion and USD 7 billion, respectively.

Chart 2: Institutional investors’ holdings in Bitcoin ETFs on the US market

Systemic banks fuel the crypto-ETF market

ETF market making is mainly conducted by SEC-registered broker-dealers selected by the ETF issuers. These “authorised participants” have the right to create or redeem ETF shares to adjust supply to demand. The broker-dealers are often subsidiaries of US global systemically important banks (G-SIBs).

The ability of authorised participants to exchange crypto-assets with issuers was initially restricted by the SEC. However, the SEC subsequently reversed its position and the exchange of crypto-assets between broker-dealers and issuers was authorised at the end of July 2025.

G-SIBs also have specialised asset management subsidiaries that manage crypto-asset portfolios on their clients’ behalf. Certain US G-SIBs report significant crypto-ETF investments (of more than USD 2.7 billion at the end of 2024), which derive from their dual activity combining market intermediation through their broker-dealer subsidiaries and asset management services.

Hedge funds engage in arbitrage between the spot and futures markets

Investors can put money into crypto by purchasing the crypto-assets directly or by buying shares in crypto-ETFs; or alternatively they can enter into crypto futures contracts traded on the Chicago Mercantile Exchange (CME), committing them to purchase crypto-assets at a predetermined price and future date. These futures contracts offer synthetic exposure to Bitcoin without the need to have a direct holding of the underlying asset or an ETF share. Institutional investors are thus able to leverage their positions, as futures require an initial outlay less than the price of the underlying asset.

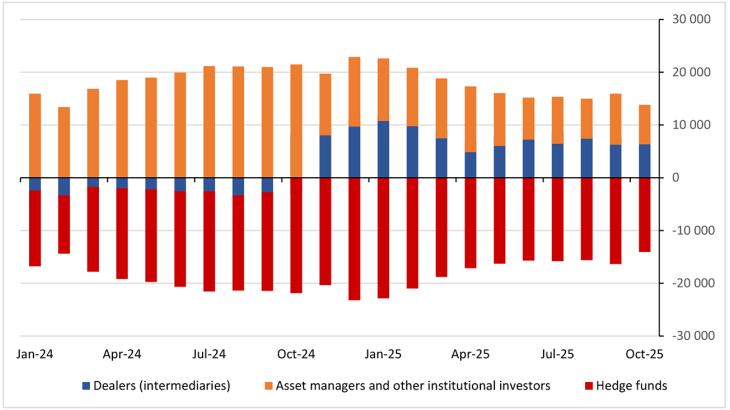

Data from the Commodity Futures Trading Commission, the agency that regulates the US derivatives market, reveal that asset managers and pension funds hold net long positions in Bitcoin futures contracts, indicating bullish betting on Bitcoin’s future (Chart 3).

Chart 3: Number of CME Bitcoin futures contracts by investor category

Note: Five Bitcoins per futures contract unit.

Hedge funds, however, hold net short positions in futures contracts (Chart 3). These Bitcoin futures sales do not imply that expectations are bearish, but are instead the result of arbitrage strategies between the Bitcoin spot market for ETFs and the futures market. There is a price difference between Bitcoin ETFs and futures contracts – futures prices are generally higher than spot prices – which is referred to as the “basis”. The basis varies between 0.3% and 0.8% for a one-month futures contract (or between 5% and 12%, annualised) and hedge funds exploit this by taking short futures positions and hedging them with long spot positions in Bitcoin ETF shares. They thereby make a profit when this price difference narrows at the futures contracts’ maturity. The advantage for hedge funds of using Bitcoin ETFs rather than trading in Bitcoins is mainly that ETFs are more liquid and subject to lower transaction costs.

Potentially systemic players are positioning themselves as intermediaries in the market

The custody of crypto-assets underlying crypto-ETFs is generally carried out by third parties and is highly concentrated around a few major players, such as Coinbase, which acts as custodian of 80% of the crypto-assets underlying the main ETFs. Such concentration presents a systemic risk in the event of a cyberattack or bankruptcy, which could erode confidence and raise questions about the security of investors' assets. This risk was underlined by the collapse of the FTX platform in 2022.

Institutional investors’ crypto-ETF investments are creating new contagion channels that could threaten the traditional financial system, as these new products could transmit the high volatility of crypto-assets to financial markets. Moreover, ETFs are only traded during US stock market hours. Outside these hours, they cannot hedge against high volatility, creating liquidity asymmetry and liquidity risk for issuers.

Download the full publication

Updated on the 19th of December 2025