Post No. 423. Survey data covering 100 “non-advanced economies” show a negative correlation between inflation and trust in the central bank, which is more pronounced under inflation-targeting regimes. While this trust is affected by a number of factors and also influences inflation, it depends on the central bank's ability to meet its monetary policy objectives.

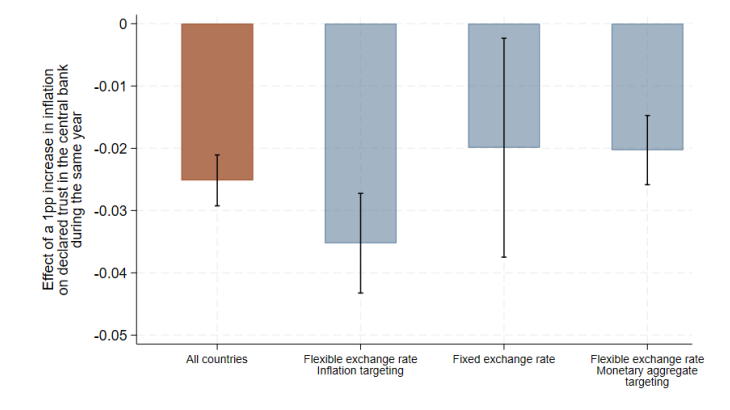

Chart 1: Impact of an increase in average annual inflation on trust in the central bank

Note: A one percentage point (pp) increase in average annual inflation is associated with a 0.025 unit decline in reported trust in the central bank during the same year (on a scale of 1 to 10). The estimate is net of survey year, macroeconomic and political characteristics of the survey country, characteristics of the respondent and their trust in the government. 95% confidence interval.

Inflation and trust in the central bank: a little-explored correlation in non-advanced economies

The effectiveness of monetary policy depends crucially on the trust that citizens place in it. Maintaining this trust is key for the monetary policy strategy of the European Central Bank (ECB, 2025) as well as various other central banks, both in advanced economies and in emerging markets and developing economies (EMDEs). It is therefore essential to understand the factors influencing this trust in order to improve the transmission of monetary policy. Nevertheless, while the literature has often examined the determinants of related concepts, such as the credibility of the central bank, which reflects its ability to achieve its objectives, it has less often explored the drivers of trust. Unlike credibility, which can be measured using easily observable macroeconomic data (Jung et al., 2025), trust is based on more subjective aspects such as individual perceptions of central bank action (Blinder et al., 2024) and can only be measured using survey data, whose availability is more limited.

Existing research has shown that trust in the central bank depends on individual, institutional, or macroeconomic factors. Among the latter factors, inflation plays a key role. Recent analyses, particularly in the euro area (see Ehrmann, 2024 for a summary), suggest that the rise in inflation in recent years has led to a decline in trust in the central bank. Conversely, a decline in trust would lead to less anchored inflation expectations and could contribute to higher inflation. However, the studies that examined these effects focused almost exclusively on advanced economies, particularly the euro area, due to data availability: the Eurobarometer is the only cross-country survey that systematically tracks estimates of trust in central banks.

It would indeed be particularly useful to extend such analyses to EMDEs. Firstly, these economies are characterised by higher and more volatile average inflation than advanced economies. In 2024, according to the IMF, inflation averaged 7.7% for EMDEs, compared with 2.6% in advanced economies, and was highly dispersed, ranging from -0.5% to around 700% in EMDEs, compared with a range of 0.7% to 5.9% in advanced economies. Secondly, the monetary policy frameworks of EMDEs differ from those of advanced economies and are more diverse. Indeed, although the primary objective of central banks is generally price stability, not all of them target the same aggregates to achieve this. While central banks in advanced economies opt almost exclusively for floating exchange rates (87% in 2023 according to the IMF's AREAER) and inflation targeting (84% in 2023), fixed exchange rates are still widespread in EMDEs (53% in 2023, including notably the CEMAC area, WAEMU and the countries of the Southern African Common Monetary Area (CMA) excluding South Africa), and inflation targeting is in the minority (23%). Furthermore, 17% of EMDE central banks opt for monetary aggregate targeting, whereas this is no longer the case for advanced economy central banks.

However, the monetary policy framework tends to affect the relationship between inflation and trust in the central bank. It is indeed possible that high inflation could have a greater impact on trust in the central bank if it targets inflation than if it targets another aggregate. However, it is also possible that other factors may influence the link between inflation and trust, such as the degree of independence of the central bank or the responsibility for inflation that citizens attribute to the government. This could therefore diminish the impact of the monetary policy framework on the link between inflation and trust in the central bank. Since the literature focuses on advanced economies whose monetary policy frameworks are largely based on inflation targeting, such assumptions could not be tested empirically.

In EMDEs, a negative correlation between inflation and trust in the central bank is more pronounced for inflation-targeting regimes

Data from the World Bank Country Surveys are a valuable source for addressing the lack of surveys tracking trust in the central bank in EMDEs and for analysing the link between trust in the central bank, inflation and the monetary policy framework. Collected by the World Bank in the 133 countries in which it operates, these data record the perceptions of its clients and partners, including, since 2019, their degree of trust in the central bank. To the best of our knowledge, this is the only public database containing such information in a large number of EMDEs: it therefore seems to be a particularly valuable tool for shedding light on the link between trust in the central bank, inflation and the monetary policy framework in these countries.

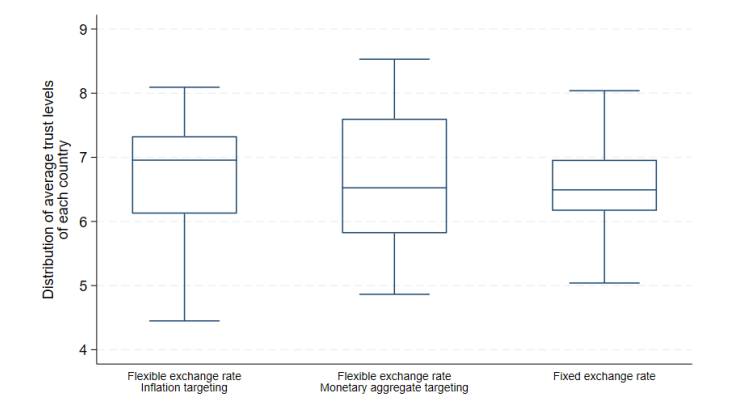

To study this link, we compile data from 140 annual surveys conducted between 2019 and 2023, covering 37,119 individuals in 100 countries. For each of them, we identify the degree of trust in the central bank, which can range from 1 (no trust at all) to 10 (complete trust). Overall, the median level of trust reported in the sample is 7, with a first quartile of 5 and a third quartile of 8. Despite a wide dispersion in the trust levels reported by respondents, trust is slightly higher when the central bank operates under a floating exchange rate regime and inflation targeting, and this difference is statistically significant (Chart 2).

Chart 2: Distribution of average trust expressed in the central bank

Note: Among countries with floating exchange rates and inflation targeting, the median average level of trust in the central bank is 7, the first quartile is around 6, and the last quartile is around 7.5

We then regress these individual data on the level of inflation and the country's stated monetary policy framework during the survey year, distinguishing between economies with fixed exchange rates and those with floating exchange rates, and, among the latter, those with inflation targeting and those with monetary aggregate targeting.

We control for various factors that may be correlated with interest rate variables, both at the individual level (gender, sector of activity, reported trust in government) and at the country level (level and growth rate of GDP per capita, unemployment rate, central bank independence, type of political regime, quality of governance). We also control for the survey year, in particular to capture the effects of global shocks common to all countries.

This analytical framework is subject to various limitations inherent in the quality of survey data. Firstly, the individuals surveyed are not representative of the population of their countries, as half of them are public servants. However, by controlling for respondents' sector of activity and their trust in the government, we can reduce the potential bias associated with this lack of representativeness. Secondly, the survey does not explain the reasons behind the trust score given by the individual, nor how they interpret the term “trust”. Lastly, given that trust is likely to have an impact on inflation, this analytical framework alone is not sufficient to conclude that there is a causal link between inflation and trust in the central bank. Nevertheless, thanks to the wealth of data available, we can carry out an initial systematic analysis of the link between inflation, monetary policy framework and trust in the central bank.

The results of this analysis suggest that, on average across the sample, higher inflation significantly reduces trust in the central bank (Chart 1). Although many other factors account for the level of trust, a one percentage point (pp) increase in average annual inflation reduces the trust score calculated for the same year by approximately 0.025 unit. This impact is significantly greater for inflation-targeting central banks: in this case, a 1 pp increase in inflation reduces the trust score by 0.035 unit.

Within EMDEs, higher inflation therefore appears to be associated with lower trust in the central bank, with a more pronounced effect for inflation-targeting central banks. This finding suggests, more broadly, that citizens' trust in the central bank depends on its ability to meet the objectives set out in its monetary policy framework.

The introduction of surveys covering the widest possible geographical area (EMDEs and advanced economies) and measuring both reported trust in the central bank and individuals' inflation expectations would increase the robustness of the analysis and, ultimately, broaden its scope.

Download the full publication

Updated on the 11th of December 2025