The 1992-3 crisis in the European Monetary System was a decisive event in Europe’s monetary history. It underscored the fragility of pegged exchange rates between national currencies and, in so doing, reinforced the commitment of members of the European Union to complete the transition to monetary union.

But there is a decided lack of consensus, even now, three decades after the event, about the causes of the crisis and consequently its implications. A first class of explanation, points to problems of economic policy and performance in countries whose currencies were attacked. Sterling was overvalued at the parity at which it entered the Exchange Rate Mechanism (ERM). Italian debts and deficits were too large. Banking systems were insolvent in the Scandinavian countries that shadowed the system.

A second explanation emphasizes the fragility of exchange rate pegs in an environment of high capital mobility. A capital outflow, whatever its causes, can produce the problems of economic policy and performance that cause a currency to come under attack, leading its defense to be abandoned. For example, when Denmark rejected the Maastricht Treaty in a referendum on June 2, 1992, casting doubt on the prospects for monetary union, capital flowed out of other ERM members. In response, Britain was forced to raise interest rates, weakening its housing market and competitiveness. Interest rate rises increased Italy’s debt-service costs and weakened the budget. They aggravated Scandinavia’s banking crises. The outflow, even if its causes were incidental, increased the costs of maintaining ERM parities, leading governments to throw in the towel.

German interest rates figure in both of these stories. Starting with reunification in 1990, the Federal Republic ran large budget deficits, supplementing the incomes of former East Germans and upgrading infrastructure in the region. The Bundesbank, concerned that those deficits would fuel inflation, raised policy rates in response. This drew funds toward Germany and away from its EMS partners, in turn requiring higher interest rates of the latter to stem the outflow.

By comparison, economists and historians have paid less attention to a third class of explanation that we highlight here. This is that ERM parities were destabilized by events outside Europe. Dollar weakness was associated with flows from the greenback to the Deutschmark, the closest substitute for the U.S. currency as it was offering Europe’s largest and most liquid securities market at the time (Giavazzi and Giovannini 1989). The Deutschmark therefore rose against other ERM currencies, placing the latter at risk of breaching their bilateral divergence margins. This phenomenon of a weak dollar leading to a strong Deutschmark and intra-ERM tensions was noticed prior to the crisis; it was known as “dollar-Deutschmark polarization.” The implication was that the EMS crisis was imported, at least in part, not home grown.

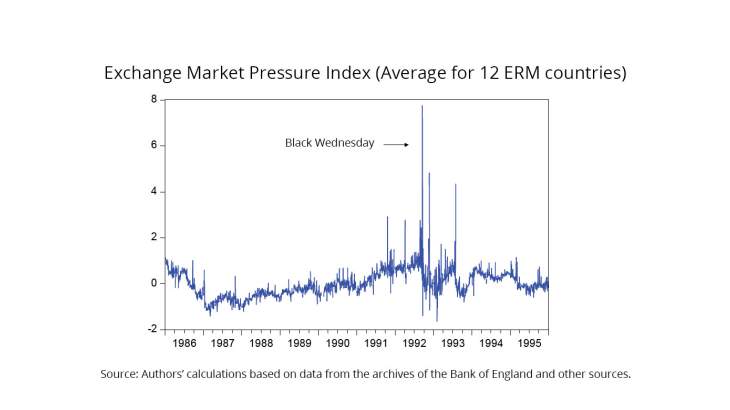

We use new archival evidence on foreign exchange market intervention recently declassified by the Bank of England and available in its archive. We collect daily data from 14 European countries, summing up to more than 500,000 daily observations spanning the period 1986-1995. While our data offers intervention in various currencies, we mainly focus on interventions in Deutschmark. We use those intervention data, together with exchange rates and interest rates, to construct a daily measure of exchange market pressure, shown above. That series allows us to pinpoint when and where the 1992-3 crisis was most intense. It shows that pressure on EMS currencies started building well before the Danish referendum, usually presented as the starting point of the crisis. It points to a fateful interview by Bundesbank President Schlesinger prior to the September 1992 French referendum on the Maastricht Treaty as the event triggering the most acute phase of the crisis.