1 Use of cash continues to decline as people turn to cards and mobile payments

The European Central Bank’s (ECB) SPACE 2024 survey on the payment attitudes of households in the euro area follows the same model as its three previous surveys.

The market share of online payments has increased again

In 2024, POS transactions accounted for less than 73% of the total number of transactions, with their share continuing to diminish from 84% five years ago. This decline was reflected in an increase in online payments (to a 25% share, up 5 percentage points in two years). The share of private transactions between individuals (P2P) was stable at 3%.

French consumers make more payments online (25% in 2024) than their counterparts in the euro area as a whole (21% on average), while growth in the share of online payments in France and the euro area has been identical since 2019, with a 14 percentage point increase.

This trend, which was amplified by the Covid-19 crisis, shows that lockdowns and travel restrictions permanently changed the payment habits of French consumers. In 2024, purchases of food, clothing and other household durables accounted for almost half of total online

purchases, meaning that some of the purchases that would have been made at points of sale have structurally shifted to online retailers (see Chart 2).

The growth in online payments is also contributing to the decline in the use of cash. Indeed, non-cash payments have now captured almost all of this market: in 2024, as in 2022, cards remained the most common payment instrument for online transactions with a 53% share, but online payment solutions (electronic wallets such as PayPal and other applications) recorded the strongest increase over the two-year period (up 6 percentage points). In 2024, online payment solutions accounted for almost one third (27%) of the payment methods used for online purchases. This figure includes the PayPal digital wallet, which alone accounted for almost 18%.

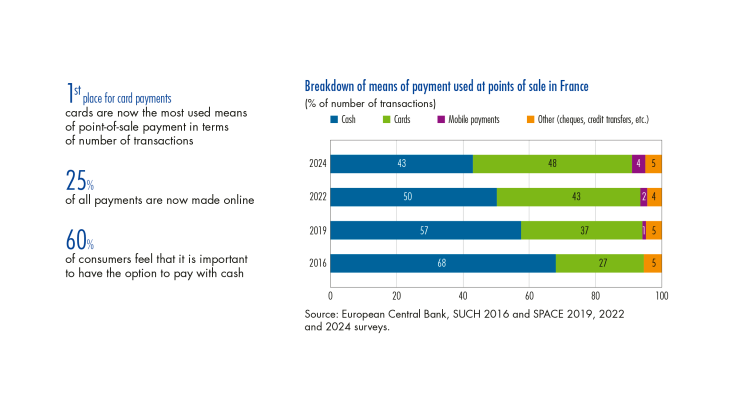

Card use exceeded cash use in shops for the first time in France

In France, the share of cash in POS payments contracted by 25 percentage points between 2016 and 2024, dropping to 43% of the total number of transactions. …