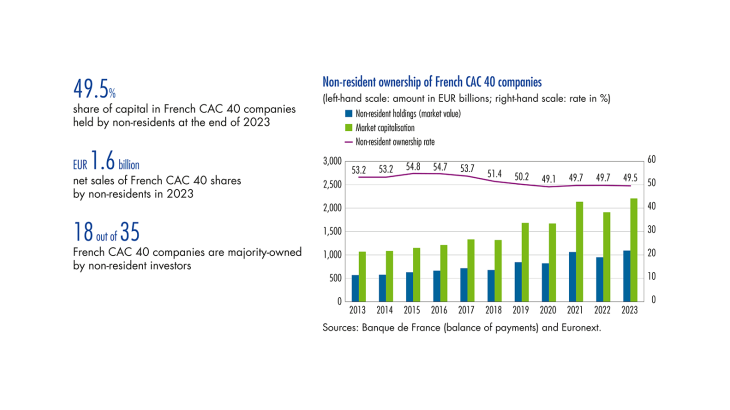

1 Non residents held nearly 50% of French CAC 40 shares in 2023

Non residents’ French equity holdings are mainly concentrated in CAC 40 companies

At the end of 2023, non residents held 49.5% of the capital of the 35 French resident companies listed in the CAC 40. The proportion was stable compared with the end of 2022 (see Chart 1).

Non resident holdings were mainly portfolio investments (92.6%), with direct investments accounting for only 7.4% of the total. The proportion of direct investments has remained almost unchanged over the past decade (see Chart 2).

Non resident holdings in French listed firms were valued at EUR 1,280 billion at the end of 2023, with CAC 40 firms accounting for the vast majority of this (EUR 1,093 billion or 85%). Outside the CAC 40, non resident ownership of French listed firms has hovered at around 30% since 2017. Consequently, the rate of non resident ownership of all French shares listed on Euronext was 45.7% in 2023 (see Chart 3).

Half of French CAC 40 companies are majority owned by non residents

As at 31 December 2023, 18 of the 35 French companies listed in the CAC 40 were more than 50% owned by non residents, 11 were 30 50% owned by non residents, and 6 were less than 30% owned by non residents. Seven French firms had at least one foreign direct investor (i.e. with a stake of over 10%; see Table 1). This breakdown has changed very little over the past few years.

Moreover, the dispersion of non resident ownership rates for French CAC 40 stocks remained stable in 2023 (see Chart 4). The average ownership rate for companies with the smallest foreign held stake was 24%, while for those with the biggest foreign held stake it was 78%.

Healthcare and utility firms have the largest foreign held stakes

In 2023, non residents reduced their overall stake in the consumer goods and services, healthcare and utilities sectors by 0.9 percentage point, and increased their stake in industry and energy by 1.7 percentage points, from 56.5% to 58.2%. Holdings in all other sectors were stable or declined very slightly. Non residents continued to hold a majority stake in healthcare and utility firms, while their smallest stake was in consumer goods and services firms (see Chart 5). …