- Home

- Publications and statistics

- Publications

- French exports in 2020: aerodependence

Post n°227. The pandemic has hit certain economies harder than others as a result of their particular sectoral specialisation. France’s specialisation in aeronautics, for example, explains nearly two-thirds of the decline in its global export market shares in the second half of 2020, and a third of the 8 percentage-point decline over the full year.

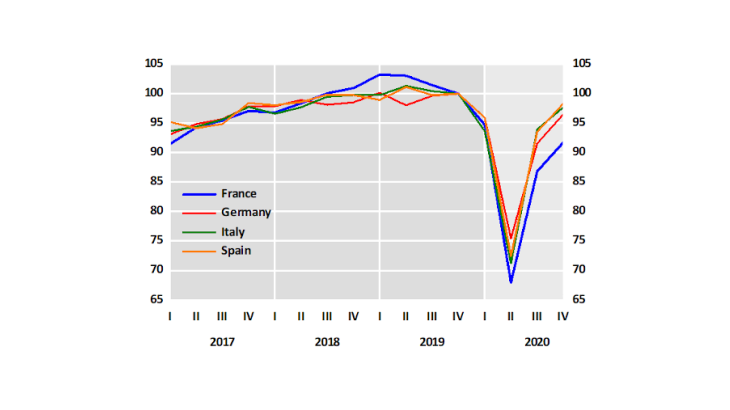

Source: Quarterly national accounts, data adjusted for seasonal and working-day variations.

A marked underperformance in French exports in 2020

Goods exports in all major euro area countries plummeted at the height of the public health crisis, in the second quarter of 2020, and then rebounded sharply as of the third quarter of that year (Chart 1). However, the dynamic varied across countries, with France in particular standing out from its main euro area trading partners. Compared with these countries, France’s exports fell more steeply and remained more persistently weak. In the second quarter of 2020, exports of French goods were around 34% lower in value terms than in the fourth quarter of 2019 (Germany: –25%; Italy: –28%; Spain: –28%). In the fourth quarter of 2020, they were still nearly 10% lower than in the fourth quarter of 2019, whereas in the three other economies they had almost returned to pre-crisis levels.

An unfavourable sectoral specialisation in the context of the public health crisis

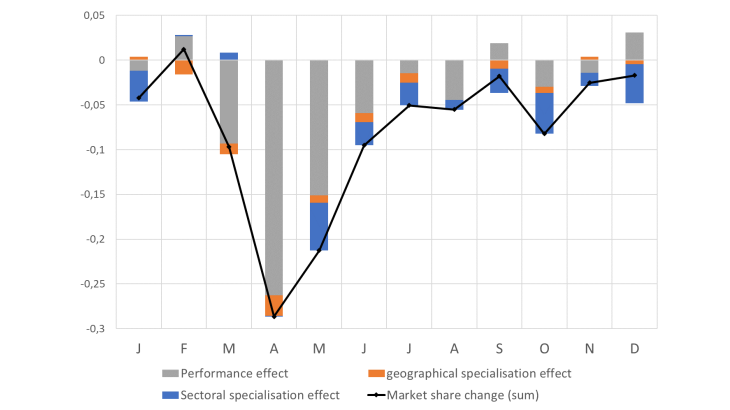

A detailed analysis of international trade by exporting country, importing country and product (Berthou and Gaulier, 2021) makes it possible to identify the contribution of sectoral and geographical specialisation effects to the change in France’s export market shares and those of its main euro area trading partners. The residual contribution to the change can be interpreted as a “performance” effect, after controlling for sectoral and geographical specialisation effects.

During the first lockdown that began in March 2020, the decline in France’s global market share in April 2020 is mainly explained by an unfavourable “performance” effect (which reduced France’s global market share by 23%), and not by sectoral or geographical specialisation (Chart 2). This poor export performance can primarily be attributed to the imposition of a stricter lockdown in France in April compared with: (i) other countries that are geographically close and experienced a simultaneous wave of the epidemic but introduced less restrictions or were quicker to adapt (for example Germany); (ii) other countries with a similar level of economic development but which were hit at a later stage by the epidemic (for example the United States); or (iii) emerging economies that experienced waves at a different stage (such as China and India). The effect of geographical specialisation appears to be unfavourable for France in April 2020 (and reduces its export market share by 2%), which can be explained by the intensity of epidemic wave at that time in those countries geographically closest to it. France’s sectoral specialisation effect is neutral in April, which is when all sectors were feeling the impact of the shutdown in activity.

From May and June 2020 onwards, as trade flows gradually began to return to pre-crisis levels (in France and our partner countries), French exports continued to be weighed down by a sectoral specialisation effect. In June 2020, this explains nearly a third of the year-on-year decline in France’s global export market share. In December, when the “performance” effect turned positive again, signalling a recovery in our exports, this was completely offset by a negative sectoral specialisation effect.

Over the full year 2020, France’s share of world goods exports fell by 8% in value terms. This is in part explained by negative sectoral and geographical specialisation effects (–2.3% and

–0.7% respectively). “Performance” effects, excluding sectoral and geographical specialisation, made a larger negative contribution over the full year, of –5%. In the second half, France’s sectoral specialisation explains around 68% of the loss in market share.

Source: Berthou and Gaulier (2021). Trade Data Monitor data (in USD) and authors’ shift-share decomposition of export market shares.

Note: annual change in log points in France’s market share of world goods exports, by value. In April, France’s market share of world goods exports fell by 0.28 log points or 25%.

The shock to the aeronautics sector is proving more persistent than for other sectors

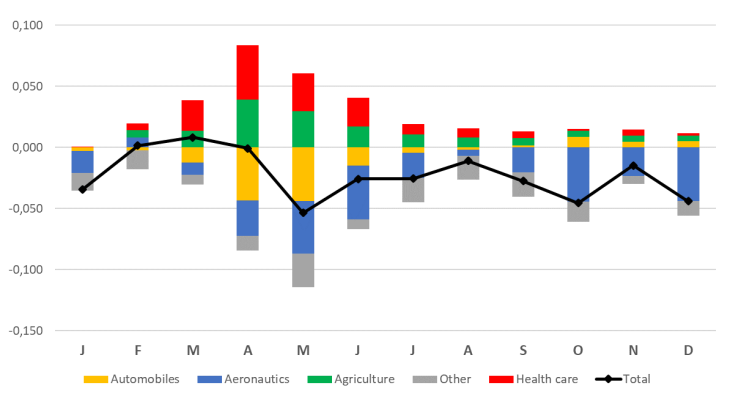

A breakdown of France’s sectoral specialisation effect by sector highlights the weaknesses in the country’s export specialisation in the context of the public health crisis (Chart 3).

The aeronautics sector stands out in that it dragged on French exports right from the start of the pandemic in 2020, and continued to have a negative impact, including in the second half of the year. The specific weakness in global demand for aeronautical products stems from the impact of the public health restrictions, which have significantly reduced global air traffic and passenger numbers, and led to the postponement or cancellation of aircraft deliveries to airlines.

Other sectors, such as the automobile industry, were badly hit by the Covid-19 crisis in the first months of the pandemic, but began to recover as of the autumn of 2020 and contributed to the rebound in French exports – albeit to a far lesser extent than in countries that are more specialised in cars, such as Germany. Global demand for healthcare and agri-food products helped to buoy French exports, including at the height of the first wave in the spring of 2020, but this positive effect faded somewhat in the second half of the year.

Source: Berthou and Gaulier (2021). Trade Data Monitor data (in USD) and authors’ shift-share decomposition of export market shares.

Note: x-axis: month in 2020; y-axis: contribution of products, annual change in log points. ‘Total’ corresponds to the blue bars in Chart 2, i.e. the sectoral specialisation effect.

France’s export sector has become “aerodependent”

In the 2000s, France’s sectoral specialisation increased (see Camatte and Gaulier, 2018), largely as a result of the successes of its aeronautics sector. However, these successes coincided with a trend of deindustrialisation in France and with the offshoring of goods production in other sectors traditionally regarded as French strongholds (such as automobiles). As a result, it led to a greater concentration of our exports. In 2019, before the public health crisis, aeronautics accounted for 39% of France’s total surpluses (18 product categories showing a surplus in the CEPII’s CHELEM database, out of a breakdown of 72 products). If we include France’s other three stronghold sectors, (cosmetics, beverages and pharmaceuticals), these four goods categories alone accounted for 79% of France’s total surpluses, compared with 38% for Germany’s four main stronghold sectors (cars, specialised machinery, pharmaceuticals, engines, out of a total of 42 positive balances).

This “aerodependence” proved very unfavourable in 2020. The uncertainties over the short and medium term (new epidemic waves and maintenance of restrictions on travel, airline bankruptcies), and more lasting challenges (such as the replacement of business trips with teleconferences, problems linked to the carbon footprint of air travel), raise legitimate questions over whether the aeronautics industry, and other stronghold sectors such as tourism, can once again become the main engines of France’s export industry.

Updated on the 25th of July 2024