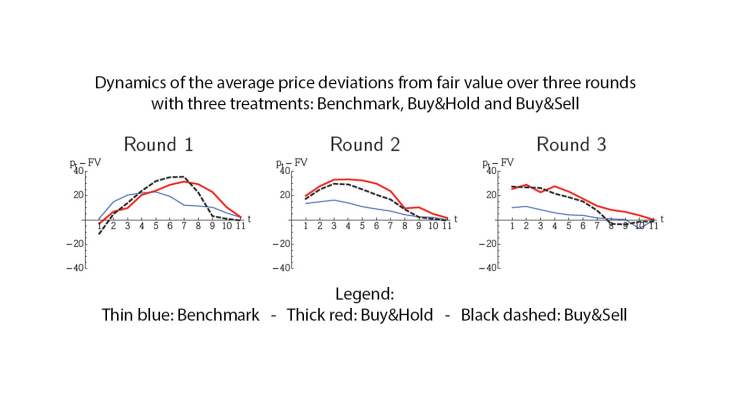

Working Paper Series no. 684. In this paper Adrian Penalver, Nobuyuki Hanaki, Eizo Akiyama, Yukihiko Funaki and Ryuichiro Ishikawa report the results of a repeated experiment in which a central bank buys bonds for cash in a quantitative easing (QE) operation in an otherwise standard asset market setting. The experiment is designed so that bonds have a constant fundamental value which is not affected by QE under rational expectations. By repeating the same experience three times, they investigate whether participants learn that prices should not rise above the fundamental price in the presence of QE (as found in (Penalver et al., 2017)). They find that some groups do learn this but most do not, instead becoming more convinced that QE boosts bond prices. These claims are based on significantly different behaviour of two treatment groups relative to a control group that doesn't have QE.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche