Export growth has been a key factor in achieving sustainable development for many emerging and developing countries, notably in South and Eastern Asia. Such long-run effects are predicated on the growth of a strong export sector and product portfolio, which ensures successful integration in international trade. Export growth itself may bring about economic specialization and structural change in the non-export growth sector, with indirect and sectoral feedback effects at the root of economic emergence. A key issue in export-led growth strategies, competitiveness is a multi-faceted objective, which entail both product-specific productive efficiency, pricing choices and wider structural components, such as business climate or the quality of macroeconomic management.

For small open economies in Africa, competiveness represents a major challenge in so far as the combination of a weaker business, imperfect competition or failures for instance in logistics and labor market may challenge export capacity. African countries also rely on intermediary goods for up to 60% of export values and may be subject to high transaction costs. In low income countries with weaker and less competitive transport and logistics infrastructure, such costs may rise to 15-20% of the cost of an imported container. Aligning production costs to those of foreign competitors is also paramount for countries with limited ability to influence prices on international primary or manufactured products markets.

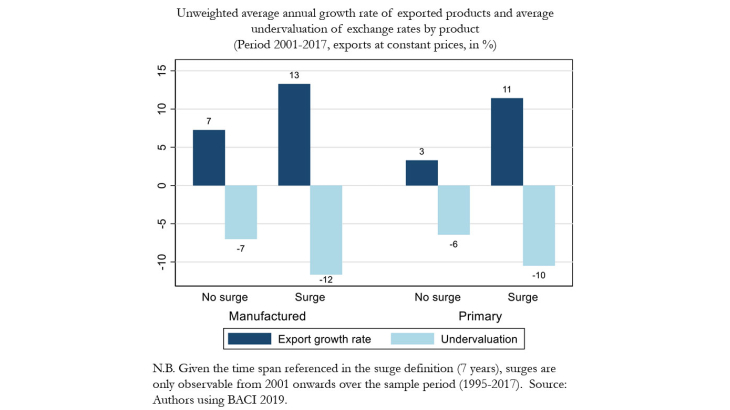

Recent literature has shown exchange rate undervaluation to be a driving force of economic performance either at the aggregated level for GDP acceleration, or at the sectoral level for exports. In this context, one important question pertains to the determinants of African export “surges”, that is episodes during which exports of a given country has outpaced past trends and translated in gains in world market share. To our knowledge, research on the relation of export product surges and by product exchange rate misalignment has not been explored so far. Such export surges may be particularly important for overall export, and GDP growth, if they are sustained over time. They are more susceptible to bring about structural change than temporary export performance and variations of markets share driven by the business cycle or international market price changes.

While empirical research has already highlighted the relationship between export growth and exchange rate misalignments, we focus on how this particular determinant of product competitiveness may affect export surges and whether such effects are sustained beyond the take-off phase. Using a panel of 41 African countries and a basket of 149 primary and manufactured exported goods (4-digit HS code), we identify 96 export surge episodes with a 7-year time span over the period 1995-2017. The empirical analysis is based on the complementary log-log (cloglog) model for a binary dependent variable. It differs from the logit and probit models by its non-symmetric transformation allowing an appropriate treatment of rare events. It shows that exchange rate undervaluation may be an influential determinant for triggering and maintaining export surges in Africa.