The classical writings of Hyman Minsky and Charles P. Kindleberger popularized the Financial Instability Hypothesis (FIH), which emphasizes the vulnerability of financial markets to boom-bust cycles – specifically, robust expansions that eventually lead to asset price collapses and economic contractions. Their analysis identifies a cyclical pattern where periods of prosperity and unfounded optimism fuel excessive risk-taking, particularly through leveraged investments. As optimism drives higher borrowing, even minor asset price declines can trigger “fire sales”, leading to a severe market downturn accompanied by economic contraction. This research formally evaluates the FIH within a standard macroeconomic framework that incorporates constraints on leveraged investment and non-rational extrapolative expectations.

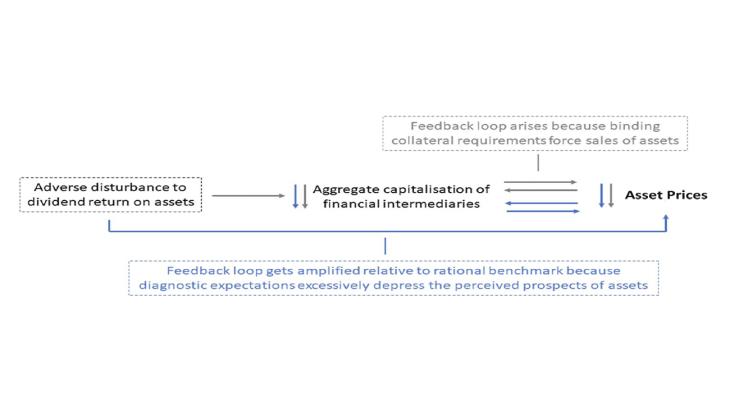

To evaluate the FIH appropriately, the analysis includes three critical components. First, credit markets are subject to collateral constraints, which lead to episodes of "fire sales" that amplify the effects of economic shocks (Figure 1). Second, the model includes non-rational, extrapolative expectations, which can cause significant deviations in asset valuations from economic fundamentals. Finally, the framework allows for the allocation of resources to productive technologies with different risk-return profiles. These elements provide a basis for understanding how the interplay between financial frictions and non-rational expectations generates financial instability and economic fluctuations.

The study's first key finding is that diagnostic (or extrapolative) expectations - whereby economic agents form (incorrect) expectations about future economic conditions based on recent movements in asset prices and macroeconomic outcomes- exacerbate financial instability relative to a benchmark economy in which agents form rational expectations that are consistent with economic fundamentals. This result rests on the interaction between the allocation of resources across productive technologies and extrapolative expectations. Consider a financial cycle that begins with a sequence of favorable economic shocks. These increase financiers’ wealth and borrowing capacity but also lead to excessive optimism regarding asset returns, encouraging risk taking and driving up asset prices. At the peak of the financial cycle, the economy becomes fragile to minor disturbances, which trigger a sharp correction of the appreciation of economic fundamentals. This event sets up a loop of asset price declines, tightening borrowing constraints and reallocation of assets to less productive but less risky technologies. During the bust, the effects of extrapolative beliefs on asset price adjustments are milder, because aggregate risk decreases. This asymmetric effect of diagnostic beliefs along the financial cycle leads to overall higher financial instability, thereby destabilizing both the financial system and the real economy, consistent with the FIH.

The study argues that financial regulation plays a critical role in limiting these risks. Specifically, the analysis emphasizes that restrictions on financial leverage and risk-taking are socially desirable, regardless of the regulator's expectations. However, the cyclical nature of these measures depends on the expectation process of the policymaker. A benevolent policymaker, whose expectations align with those of private agents, would impose leverage restrictions during post-crisis recoveries to support the restoration of balance sheets and the orderly recapitalization of the financial sector. By contrast, a paternalistic planner, with rational expectations in a world of private agents holding diagnostic expectations, would prefer to act pre-emptively, imposing leverage restrictions, like a countercyclical capital buffer, during expansions to reduce vulnerability to future financial downturns and fire sales episodes. Overall, the results underscore the importance of macroprudential policy throughout the financial cycle, with the design of measures shaped by the expectations of both market participants and regulators.

Keywords: Non-Rational Expectations, Financial Stability and Regulation

Codes JEL : E44, E71, G01