- Home

- Publications et statistiques

- Publications

- Euro area portfolio flows in 2020: the i...

Euro area portfolio flows in 2020: the impact of the Covid-19 crisis

Post n°218. Since the onset of the pandemic in 2020, euro area residents have sharply adjusted their international portfolio investments. Significant sales of foreign assets in March 2020 were followed by large purchases of foreign securities. At the same time, non-residents have purchased euro area debt securities, especially short-term debt.

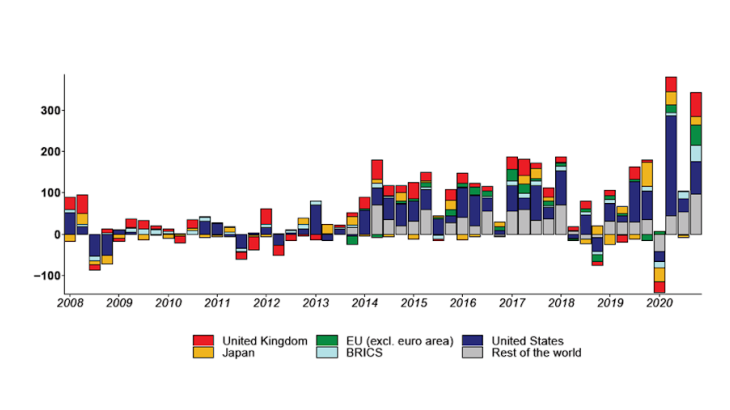

Source: European Central Bank.

Note: Quarterly net portfolio investment flows (equity and debt securities) of euro area residents, EUR billion. A positive (negative) number implies net purchases (sales) of foreign securities by euro area residents.

Large sales of foreign securities by euro area residents during the first wave of March 2020

The shock of the pandemic in March 2020 led euro area residents to unwind their investments in foreign securities, with net sales reaching EUR 134 billion in the first quarter of 2020. This is the highest amount of sales since the great financial crisis, which saw EUR 165 billion of net sales in the third quarter of 2008.

From a geographical perspective, these sales mainly concerned securities issued in Japan, the United Kingdom and the United States. These countries accounted for 25%, 18% and 17%, respectively, of total net sales in the first quarter of 2020. Sales of Japanese securities (EUR -25.3 billion) were mainly made up of equities, while sales of US securities (EUR -24.0 billion) were essentially composed of debt securities. Comparing the amounts sold with the euro area’s total holdings vis-à-vis these countries, it appears that the euro area sold 7% of its stock of Japanese securities, compared with 0.6% for US securities.

The onset of the coronavirus crisis led to a repatriation of funds through the sale of foreign securities, consistent with a preference for domestic securities (home bias) generally observed during crises. Indeed, the repatriation of funds in times of crisis may be motivated by informational advantages, a better relative status of domestic investors in case of default or the need to reduce exchange rate risks. These dynamics went along with strong selling pressures on international capital markets as well as a reduction in leveraged investment positions.

After the first wave, the euro area invested in foreign equities, especially US equities

Central bank interventions resulted in an abundance of liquidity which may have affected euro area residents' investments. Following the sales recorded in the first quarter of 2020 and as markets recovered, euro area investors invested abroad again in the second and fourth quarters of 2020, setting new records for purchases, at EUR 383 and 342 billion respectively. Overall, outflows from the euro area amounted to EUR 685 billion in 2020, compared with EUR 442 billion in 2019.

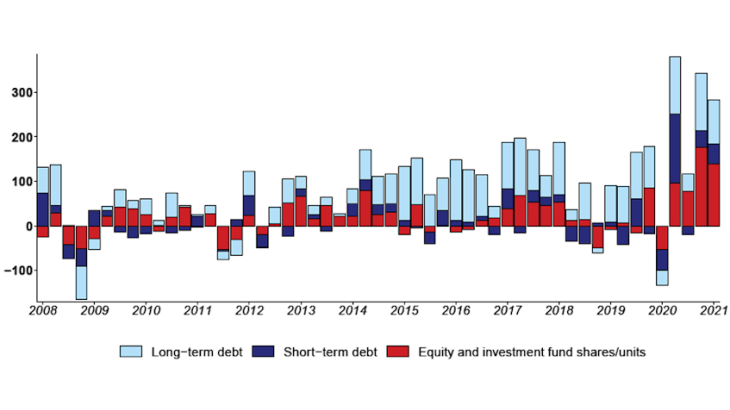

During 2020, euro area residents’ investment in foreign stock markets showed a dramatic increase. Non-resident equity purchases by domestic investors reached EUR 288 billion, which is a record. The share of equities in euro area outflows thus stood at 42% in 2020, compared with an average of 22% between 2017 and 2019. In terms of the relative share of the euro area securities portfolio, the weight of foreign equity rose in 2020. Euro area residents invested EUR 207 billion in US equities in 2020 (72% of the total), compared with only EUR 50 billion in 2019. This can be explained in particular by the speed of the recovery in US markets in 2020 (Carvalho and Schmitz, 2021).

Source: European Central Bank.

Note: Portfolio investment flows, equities, in EUR billion. A positive (negative) figure means net purchases (sales) of equities by euro area residents.

The purchase of foreign equities is in line with the optimism that characterised financial markets at the end of 2020. The announcement of the discovery of vaccines, the recovery in commodity prices, the election of J. Biden in the United States and the free trade agreement between the United Kingdom and the European Union contributed to the rise of stock prices. This optimism was also underpinned by central banks’ commitment to keep interest rates at low levels. In search for yield, investors also increased their equity positions in emerging markets.

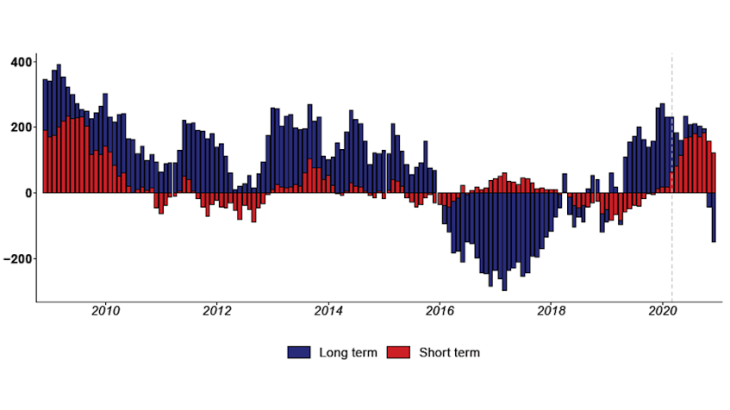

On the liabilities side, the crisis has boosted purchases of short-term debt issued by the euro area

Looking at euro area liabilities, i.e. the flows of purchases or sales of resident securities by non-residents, foreign investors considerably upped their purchases of short-term debt in 2020, especially government debt, which reached the historical highs observed in 2008. In contrast, net purchases of euro area equities by non-residents reached, on average, the lowest point in the decade after 2011 (EUR 8 billion) , notably due to the shock in March 2020, during which sales of euro area equities reached EUR 134 billion.

Source: European Central Bank.

Note: Euro area debt securities purchases (positive) and sales (negative) by non-residents, 12-month rolling sum, EUR billion.

There are three main reasons for these developments. First, in the context of financial stress that appeared in early 2020, investors preferred liquid assets such as short-term government debt securities, especially those issued by core euro area countries (Moench et al., 2021). Their status as high-quality assets, especially those with short maturities, was particularly appreciated by investors, as shown by the compression of the spread between German Bund rates and overnight indexed swap (OIS) rates, a risk-free interest rate, during the financial market tensions in March 2020.

Second, the large issuance of government debt in the euro area, driven by governments' immediate liquidity needs, led to an increased supply of short-term securities for investors. On average, net short-term issuance by euro area governments amounted to 2.4% of GDP in 2020, compared to -0.2% in each of the previous three years (the public sector cut back its stock of short-term debt during this period). These issues were particularly significant in France (4.4% of GDP) and the Netherlands (3.6% of GDP) and may have helped ease strong demand pressures for safe assets.

Lastly, the increased pace of ECB purchases of government debt securities resulted in a larger absorption of long-term government debt (Sirello, 2020). This contributed to lowering yields on long-term debt securities, making them less attractive to international investors.

In conclusion, international purchases by euro area investors in 2020 were interrupted by the financial shock of March 2020, before immediately picking up in the second half of the year thanks, amongst other things, to central bank interventions. At the same time, non-residents showed less appetite for euro area long-term debt, in a manner very similar to what had already been observed with the launch of the asset purchase programme at the end of 2014 (Coeuré, 2017).

Updated on the 25th of July 2024