Billet de blog 432. Between Q1 2023 and Q3 2025, European ESG funds recorded a resilient performance despite increased volatility in inflows. This trend is also in evidence among French-labelled funds, which are adapting to the requirements of the new SRI label. ESG funds therefore remain an attractive investment despite the prevailing headwinds.

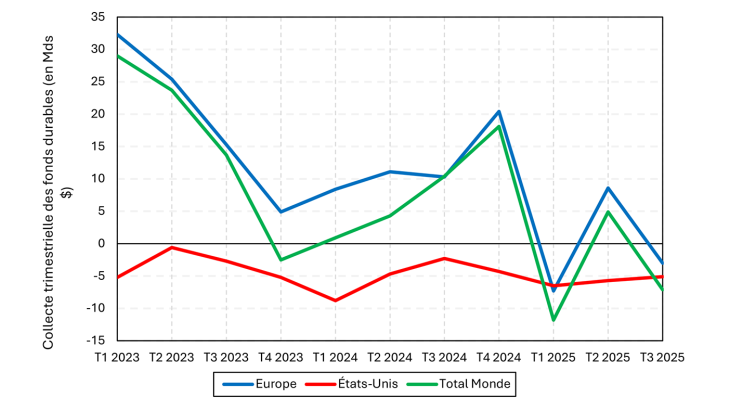

Chart 1 – Net quarterly flows into ESG funds (USD billions; Q1 2023 - Q3 2025) – Morningstar

A less favourable environment for ESG investing?

Investments that meet environmental, social and governance (ESG) criteria are facing headwinds on a number of fronts. First, the early measures taken by the Trump administration are encouraging American companies and fund managers to shun ESG investments ("ESG Backlash", Financial Times, 2025). This is compounded by regulatory instability (the overhaul of the Sustainable Finance Disclosure Regulation, new guidelines on fund naming and the reform of certain labels) that could blur the clarity of products.

Indeed, over the past few years, the underperformance of certain “green” segments, coupled with a major comeback witnessed in more “traditional” sectors, has choked off flows to these investment strategies. Since 2022, the sharp rise in long-term rates has increased the cost of capital, penalising certain capital intensive “green” stocks. Between 2022 and 2024, the MSCI Global Alternative Energy Index fell by an annual average of 21%, while ‘traditional’ sectors such as fossil fuels outperformed the market (MSCI World Energy: +17% per annum). The write-downs taken by Ørsted – the world's largest developer of offshore wind power – illustrate the effect of high interest rates on capital-intensive renewable projects (Financial Times, 2024). Its share price fell by 26% per year over the same period.

Our analysis is based on two separate data sources. For sustainable funds, data published quarterly by Morningstar. For French-labelled funds (SRI, Greenfin, CIES, Relance and Finansol), the quarterly listing of labelled collective investment undertakings (CIUs) was combined with investment fund collection data (Banque de France).

Morningstar sustainable funds are based on a benchmark that only includes CIUs whose regulatory documentation places extra-financial criteria at the heart of portfolio development (specific objectives and/or binding ESG criteria). Moreover, to guarantee the integrity of the definition of sustainability, exclusion rules forbid certain investment vehicles (funds of funds, ETFs with only basic ESG screening). This qualification is not limited to sector-based exclusions. It requires a genuine willingness, reflected in concrete strategies: selection of the best players, proactive shareholder engagement or measurable impact objectives.

For their part, each French sustainable finance label imposes its own specifications on CIUs. Greenfin excludes fossil fuels, ISR uses a reinforced ESG framework, Relance requires support for French SMEs and mid-caps combined with ESG commitments, and Finansol factors in social and solidarity impact. The CIES label borrows certain principles from the ISR label while adding in specific social and solidarity requirements.

Moderate outflows from ESG funds in Europe

According to global Morningstar fund data, ESG funds recorded net outflows of USD 55.1 billion in Q3 2025, a largely technical movement, reflecting the transfer of USD 48 billion worth of assets from four open-ended funds to private mandates handled by the same management company. These assets have not left the sustainable investment universe, they have simply been removed from the scope of Morningstar's data, which only cover open-ended funds (Morningstar, 2025).

Excluding the scope effect, global net outflows totalled USD 7.1 billion in Q3 2025 (compared with net inflows of USD 6.2 billion in the previous quarter), driven by the United States (USD -5.1 billion) and Europe (USD -3.1 billion), although the rest of the world continued to record net inflows (USD +1.1 billion). While the United States posted its twelfth consecutive quarter of net outflows, Europe witnessed a slowdown in 2025, suffering its first quarter of net outflows in Q1 after 28 quarters of positive growth (Morningstar, 2025). However, Europe remains the driving force underpinning inflows. Between early 2023 and the third quarter of 2025, it posted average inflows of USD 11.5 billion per quarter, compared with USD 7.6 billion globally, offsetting structural outflows from the United States (USD -4.6 billion) (Chart 1).

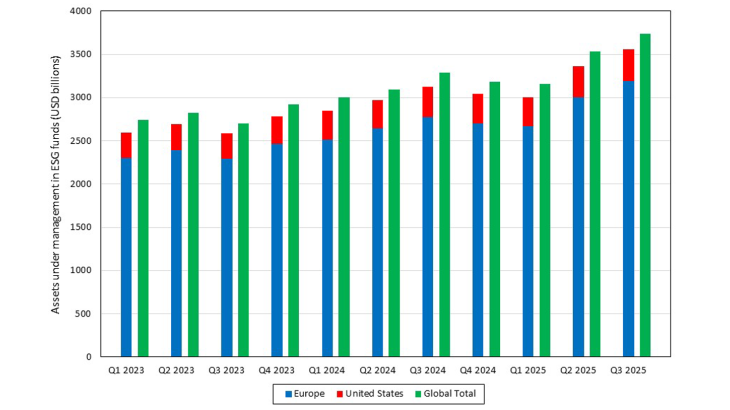

Outflows in Q3 2025 remained moderate in terms of global outstandings (approximately 0.2% of assets), especially as total assets under management continued to grow, despite reduced inflows. Global assets under management grew from USD 2.74 trillion at the end of March 2023, to USD 3.735 trillion at the end of September 2025 (Chart 2). Europe, which contributes 85% of this total, accounted for USD 3,187 billion, compared with USD 2,300 billion in March 2023 (+38.6%). In the United States, assets under management increased by USD 367 billion (+24%), despite structurally negative inflows.

The value of outstanding assets continued to grow as funds were marked to market. The resilience of European assets under management since the beginning of the year (+18%), was partly due to the appreciation of the euro against the dollar (+12.5% over the same period), which automatically inflated valuations, in addition to strong market performance. In the United States, tech stocks in particular, which comply with ESG criteria due to their structurally low carbon intensity, have sustained valuations and offset net withdrawals. At the same time, the recent outperformance of the MSCI Global Alternative Energy Index (+42.8% in 2025) has boosted the value of sustainable funds with the highest exposure to renewable energies. This bounce suggests that the current downturn in this segment may be coming to an end, on the back of massive energy demand from data centers, which is reviving interest in long-term green electricity purchase agreements (Bloomberg, 2025).

Chart 2 – Quarterly assets under management in ESG funds (USD billions; Q1 2023 - Q3 2025) – Morningstar

For French labelled funds, excluding scope effects, assets under management remain stable

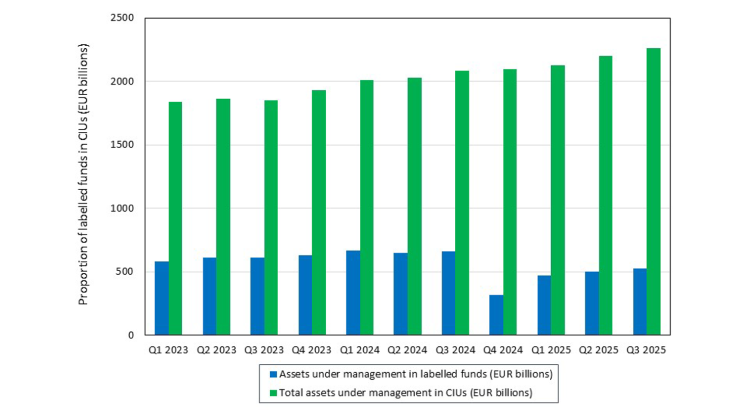

In France, assets under management in labelled funds (SRI, CIES, Relance, Greenfin, Finansol) grew steadily from EUR 581 billion in Q1 2023 to peak at EUR 662 billion in the third quarter of 2024 (Chart 3). The drop observed in Q4 2024 (-52%, to EUR 317 billion) was mainly due to the reform of the SRI label, the largest French label, accounting for nearly 90% of total outstandings. The recovery in SRI funds since then has obviously driven an increase in labelled assets under management in the first three quarters of 2025, from EUR 317 billion to EUR 528 billion.

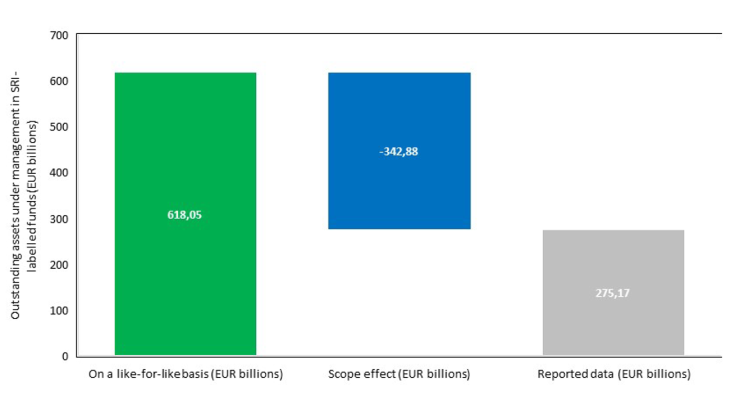

The 2024 reform of the SRI label, which bolsters its ESG criteria, led to de-labelling and a decline in the number of funds between the third and fourth quarters of 2024, from 1 342 to 939 (–30 %, or EUR -343 billion). Assets under management in SRI funds totalled EUR 618 billion on a like-for-like basis, virtually unchanged from Q3 2024 (EUR 627 billion).

Chart 3 - Quarterly assets under management in labelled funds (EUR billions; Q1 2023 - Q3 2025)

Given the weight of SRI funds within the labelled investment universe, the gradual adaptation to the new criteria has been the main driver of the bounce reported since then. After the fourth quarter of 2024, assets under management in SRI funds rose from EUR 275 billion to EUR 441 billion in Q1 2025 (+60.1%), then to EUR 471 billion in Q2 (+6.9%) and EUR 501 billion in Q3 (+6.4%).

Chart 4 – SRI funds: scope effect (EUR billions) of the reform on assets under management (Q4 2024)

Key: The scope effect reflects (de)labelling between Q3 and Q4 2024. To exclude the scope effect, we freeze the SRI fund investment universe in Q3 2024, allocating total assets under management in Q4 2024.

Download the full publication

Updated on the 23rd of February 2026