Note 1: Deviations correspond to the difference between the December 2020 projection and a pre-crisis trend projection.

Note 2: The "public demand" shock factors in the impact of public service closures in 2020 and therefore does not only reflect the effect of fiscal policy.

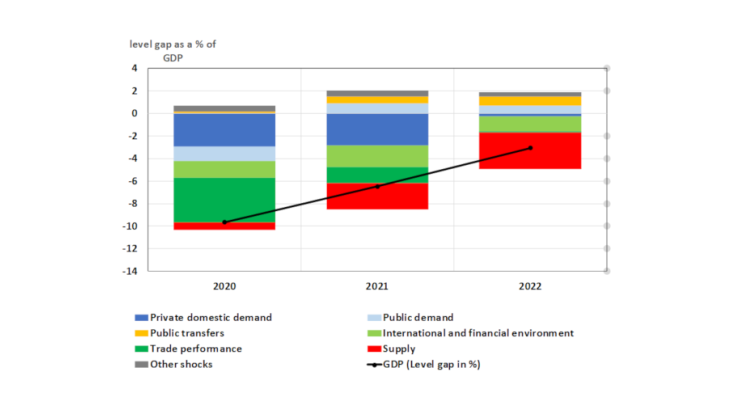

According to the macroeconomic projections published by the Banque de France in December 2020 (on the basis of health assumptions fixed at the beginning of December), GDP is expected to fall by 9% in 2020 and to pick up by 5% in each of the following two years 2021 and 2022. At this horizon, the path of the economy should remain below that which could be expected before the crisis. In this post, we put forward a breakdown of the shocks explaining the deviation from the pre-crisis path using the FR-BDF projection model.

This model is made up of equations (consumption, investment, employment...) describing agents’ behaviour. Shocks, normally of small magnitude, can cause the economy to deviate from the path forecasted by these usual behaviours. During the Covid-19 crisis, these shocks have been of an unusual magnitude. For example, the fall in household consumption is unrelated to its usual determinants, in particular income, since it is mainly the result of administrative restrictions.

While these specific shocks temporarily complicate the use of models, they may be used for a more in-depth analysis than simply interpreting changes in demand, by going back to the source of these changes. For example, a shock to investment does not correspond to the entire decline in investment but only to the part of the decline that goes beyond the usual link between investment and activity.

Shocks are broken down into seven main categories:

- Shocks to private domestic demand are related to consumption, investment and inventory changes. These shocks include, in particular, temporary shocks related to administrative restrictions.

- Shocks to public demand concern public consumption and investment.

- Shocks to public transfers describe the impact of government expenditure and revenue.

- The international and financial environment includes the demand addressed to France by its partners; as well as financing conditions, the exchange rate and oil.

- Trade performance concerns the relative ability of French companies to meet external and domestic demand compared with their competitors in a given international and financial environment.

- "Supply shocks" include the mechanisms whereby the crisis lastingly affects the productive system, such as the decline in the long-term trend in labour productivity or rigidities in the price adjustment mechanism.

- "Other shocks" include all variables that do not come under these six categories, but whose impact remains relatively small.

We carry out this breakdown work as a deviation from the projection we made before the outbreak of the health crisis. This breakdown must be interpreted with caution, in particular because the "private domestic demand" shocks are not pure demand shocks (as they result from a rationing of supply); moreover, "public demand" shocks include the fall in production of certain non-market services during their closure in 2020, and therefore does not only reflect the effect of fiscal policy.

In 2020, the crisis caused shocks to private domestic demand and to trade performance

The sharp decline in GDP in 2020 relative to a trend path (see Chart 1) can be explained by the combination of several shocks. The fall in private domestic demand accounts for almost a third of this decline. Public demand also plays a significant role due to the marked drop in government activity during the first lockdown. In the first half of the year, the recessive effect of the closures of public services – close to the contribution of the decline in public consumption during the first lockdown to the loss of GDP (1 point of annual GDP) – in fact more than offsets the public support linked to healthcare spending and emergency measures (short-time work, income support for individual entrepreneurs, etc.).

The international environment accounts for a fairly small share of the decline in GDP (one fifth of the total), in connection with the fall in global demand addressed to France. Conversely, the deterioration in France’s trade performance in both exports and imports explains more than a third of the fall in activity in 2020. France's sectoral specialisation, focused in particular on aeronautics and tourism, has weighed on exports, which have also been impacted by tighter restrictions in France than in its trading partners. At the same time, imports, for example of goods needed to combat the epidemic, have held up relatively well.

In the medium term, supply shocks are expected to slow the return to activity levels expected before the crisis

According to Banque de France projections, the recovery in activity in 2021 shall be driven by two main factors. On the one hand, the public sphere supports activity through public demand and income support expenditure under the recovery plan. On the other, the underperformance in exports, while remaining significant, should diminish. However, the shock to private domestic demand is still expected to be present, notably because consumption should remain limited due to the circulation of the virus.

In 2022, the private demand shock is expected to dissipate and activity should continue to be buoyed by public expenditure and favourable financing conditions. However, the gradual build-up of a supply shock is expected to maintain activity lastingly below its pre-crisis trend level. This supply shock stems both from a lasting negative shock to long-term productivity, due in particular to a lower capital stock, and to a larger extent (about two-thirds of the supply shock) from inertia in companies’ price adjustment behaviour, comparable to a mark-up shock. Without this inertia, prices would fall even further.

The shocks of the first two lockdowns each have specific features

This shock breakdown also makes it possible to examine certain macroeconomic characteristics specific to both the 2020 spring and year-end lockdowns. The steeper fall in activity in the first lockdown was caused by the sharp decline in trade performance, but also by a shock to private domestic demand and a shock to public demand in a context of partial public service closures. The economic impact of the second lockdown is probably weaker and mainly related to the private domestic demand shock, as social distancing mainly affects trade and services to households, thus curbing their consumption.