A substantial share of Governing Council’ communication takes place between meetings

When we think about central banks moving markets, we usually think of official monetary policy decisions. And indeed, when the European Central Bank’s Governing Council (ECBGC) meets to set policy, markets listen closely. But there is more to the story.

Between meetings, Governing Council members — including the ECB President, the other five ECB Executive Board members, and Governors of the euro area national central banks speak in public regularly. This inter-meeting communication (IMC) does not involve formal decisions but can still move markets by shaping expectations about future policy. To understand the importance of these different forms of communication, we built a new dataset: the Euro Area Communication Event-Study Database (EA-CED, see Istrefi, Odendahl and Sestieri (2025)). The EA-CED covers nearly 5,100 public communication events (mostly speeches and interviews) and 304 ECB Governing Council monetary policy meetings from 1999 to early 2024. For each of these events, we track how 47 financial market instruments moved in the minutes and hours following the remarks relative to their value shortly beforehand. Event studies of this sort assume that no other market moving information comes out during this window so that the changes in prices can be attributed entirely to the event studied. Crucially, by conditioning our analysis on the market volatility before each event, we filter our database by keeping only the events that had a significant market impact. Roughly 60% of the events in the database contain news that impacted markets significantly. We have made the EA-CED publicly available.

Speeches do not just fill headlines — they move markets

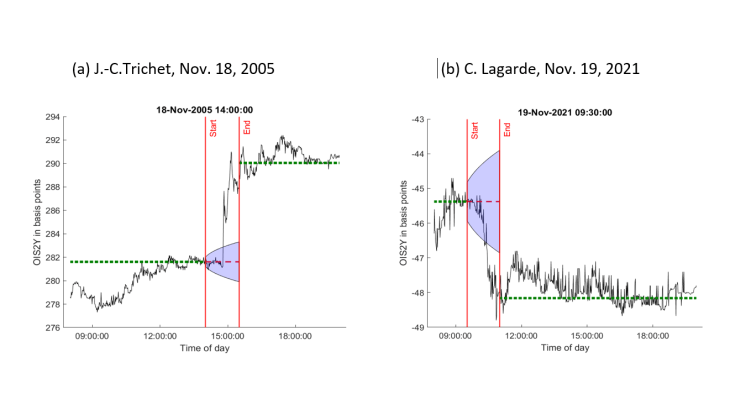

Chart 1 shows two examples of ECB president speeches that moved markets significantly. On 18 November 2005, the Eonia swap or Overnight Indexed Swap rate, a measure of the risk-free rate in the euro area, with a two-year maturity (OIS2Y) jumped during the speech of ECB President Jean-Claude Trichet. The New York Times (2005) noted that the: "ECB made it clear it will raise rates. [...] “We will remove some of the accommodation which is in the present monetary policy stance,” Trichet said [...]". Conversely, the OIS2Y fell during the speech by ECB President Lagarde on 21 November 2021. CNBC (2021) wrote: "European Central Bank President Christine Lagarde reiterated on Friday that the ‘conditions to raise rates are very unlikely to be satisfied next year.’ The euro fell following Lagarde’s comments, dropping to $1.1301 against the dollar. Banking stocks also dipped by around 2%.".

Overall, Istrefi, Odendahl et Sestieri (2025)show that ECB communication between meetings has a real and measurable impact on financial markets — and often one that is just as large as, or even larger than the reaction to official ECB policy announcements. This is especially true for medium- and long-term interest rates, suggesting that IMC provide information about future ECB policy or how GC members view the path of the economy. And this impact is not limited to speeches by the ECB President but extends to other members of the Governing Council.

Interestingly, we find that inter-meeting communication often sends early signals about what the ECB is likely to do in its next policy meeting. For example, before rate hikes, markets tend to react to hints dropped in advance by ECB officials, with risk-free rates and sovereign bond yields increasing well ahead of the official decision. The information to which markets react in inter-meeting communication is multidimensional: when Governing Council members speak, they often reveal different types of signals, such as signals about current interest rates (knows as “Target”) and about future rates (known as “Forward Guidance” or “Path”), or news about asset purchase programmes (labelled “Quantitative Easing”). These three types of information explain around 90% of how markets move in response to IMC events. This tells us that financial markets are highly attuned not just to policy decisions, but also to messages delivered between meetings.

The EA-CED dataset helps identify the impact of monetary policy on the economy

Beyond market reactions, we use a well-established macroeconomic model — a Bayesian Vector Autoregression, BVAR, with sign and narrative restrictions — to trace the effects of monetary policy on the euro area economy. We impose minimal sign restrictions to identify monetary policy shocks, namely that a monetary tightening pushes up the 2-year OIS rate and lowers stock prices, at least for a few periods. We then incorporate information from key communication events — “narrative restrictions” — i.e. events that gave important monetary policy signals (Target and Path shocks) observed during both regular ECB meetings and inter-meeting communication. These shocks serve as the basis for our narrative restrictions: we constrain the sign of the monetary policy shock in specific months where interest rates moved notably in response to these key communication events. In our sample, half of the largest values (in absolute terms) of these two shocks come from IMC events. For example, one IMC event used as narrative restriction is Trichet’s speech in November 2005 illustrated in Chart 1.

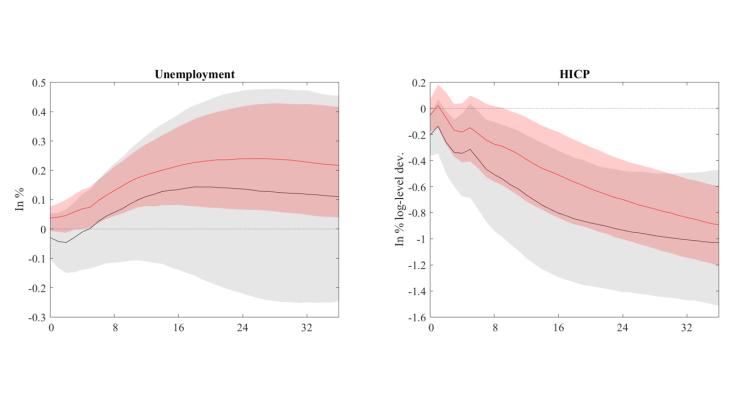

Chart 2 compares the effect of a monetary tightening shock that raises the 2-year OIS rate by 25 basis points. Responses to the shock identified using narratives based on IMC events are depicted with the red line and those based on narratives from ECBGC announcements with the black line. In both cases, the median responses show a decline in inflation (HICP) and an increase in unemployment following a tightening shock, consistent with theoretical expectations. However, although the point estimates are very similar, the credible bands reflected by the shaded area are considerably tighter for the model using IMC narrative restrictions. In contrast, the response of the unemployment rate is insignificant in the model using only ECBGC narrative restrictions.

Chart 2. The effects of monetary policy shocks on the macroeconomy