This paper examines market reactions to both ECB Governing Council (ECBGC) meetings and inter-meeting communication (IMC) events, offering a comprehensive analysis of how inter-meeting communication influences financial markets and the transmission of monetary policy in the euro area.

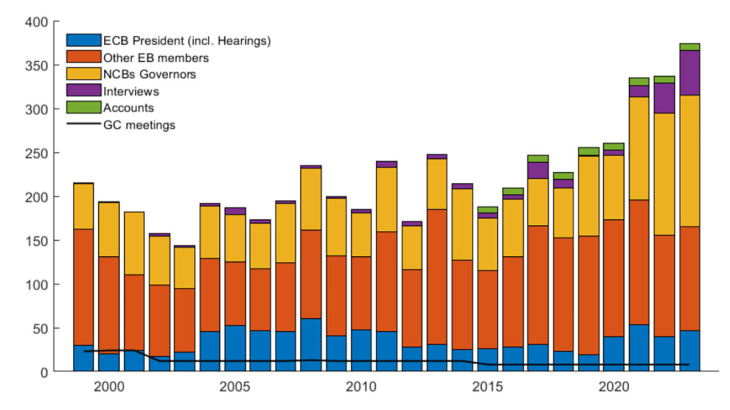

We first construct the Euro Area Communication Event-Study Database (EA-CED), which consists of 304 ECBGC meetings and approximately 5,100 IMC events from Governing Council members and the respective intraday changes of 47 euro area financial variables around these events, from January 1999 to February 2024. IMC events include speeches and interviews given by ECB Presidents, members of the ECB Executive Board, the Governors of the French, German, Italian, and Spanish national central banks, as well as the publication of the ECB Monetary Policy Accounts. Importantly, in the EA-CED we differentiate between events that do and do not move markets significantly, based on their impact computed relative to the market volatility prior to the event. Overall, there are about 2,600 IMC events and 280 ECBGC policy meetings that we classified to carry significant news - about 60% of the total events in the EA-CED. We made this database publicly available for researchers.

As a second contribution, we document that Eurosystem inter-meeting communication has a considerable impact on euro area financial assets, often of similar or larger magnitude than ECB policy announcements, particularly for medium- and long-term interest rates. The significant impact is not limited to communication from the ECB President; other GC members also significantly influence markets. The relevance of IMC is further supported by the evidence that IMC events ahead of monetary policy decisions contain policy signals that move risk-free rates and sovereign yields in the direction of the forthcoming decision (especially ahead of tightening decisions). Moreover, information in IMC is multidimensional in the sense that three structurally identified factors, known in the literature as Target, Forward Guidance (FG) and Quantitative Easing, explain around 90% of the yield curve movements around IMC events.

As a third contribution, we show how the EA-CED - specifically, IMC surprises - can be used to identify the effect of monetary policy shocks on macroeconomic variables in the euro area. We estimate a Bayesian Vector Autoregression (BVAR), where the identification approach of a monetary shock in the euro area is guided by sign and narrative restrictions that are informed by specific IMC events. We find that this approach leads to estimated responses of real GDP and consumer prices that are both significant and do not exhibit the prize puzzle, underscoring the informational value in inter-meeting communication.

Keywords: Monetary Policy, ECB, Communication, Financial Markets, Euro Area

JEL classification: E03, E50, E61