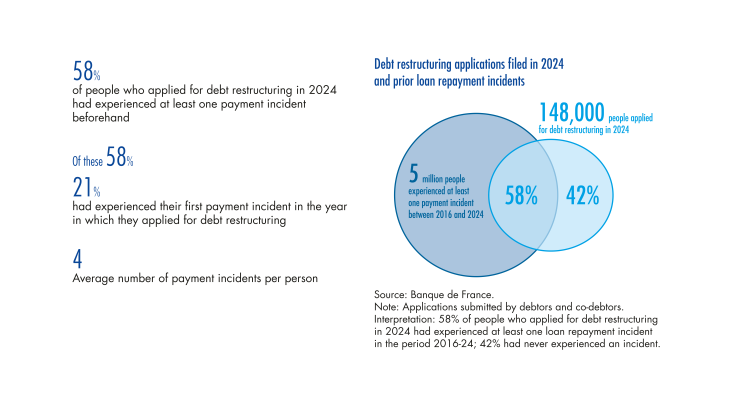

1 A link between FICP entries and applications for debt restructuring

FICP entries are an indicator of households’ financial health

The Fichier national des incidents de remboursement des crédits aux particuliers (FICP – National Register of Household Credit Repayment Incidents) records all late payments reported by banks on non-business overdrafts and loans, as well as individuals who have begun debt restructuring proceedings (see appendix). The register is used by banks to assess borrowers’ creditworthiness. Being listed on the FICP may lead a bank to refuse a loan application, but it is not in itself a legal obstacle to obtaining a loan. In addition to helping measure credit risk, the FICP is designed to prevent households from getting into excessive debt. Entries in the register are published monthly in the Baromètre de l’inclusion financière (Financial Inclusion Barometer, Banque de France, 2019 et seq.) and provide insight into the difficulties individuals encounter in repaying bank loans.

After slowing during the Covid-19 pandemic, payment incidents began to rise as of 2022, fuelled by issues with consumer credit and overdrafts (see box). This mainly reflects the impact on households of the energy crisis of 2022-23: the rise in consumer goods prices (especially food and energy) affected poorer households disproportionately (Abdouni et al., 2024), leaving them less able to repay debts and, in some cases, forcing them to take out new loans to cover their day-to-day expenses (OIB, 2024).

The rise in debt restructuring applications from 2023 followed on from the increase in payment incidents

The rise in debt restructuring applications over the past two years follows a period of decline that began with the adoption of the Lagarde Law in 2014, which tightened conditions for providing consumer credit (Banque de France, 2020). The decline accelerated further during the Covid-19 crisis, due to the difficulty of physically submitting applications during lockdown and the government’s decision to provide substantial aid for households (Antipa, Jean and Nivat, 2021).

According to a survey of online debt restructuring applicants conducted by the Banque de France since 2023, 41% of respondents cite a worsening of their financial situation as the main reason for applying. A third of respondents say these difficulties date back less than 12 months, while a third say they have lasted for between one and two years, and another third say they have lasted for over two years.